Last Sunday I wrote about how domestic stock market operators have been incessantly attempting to manage index levels

Moreover, the recent rebound amidst swooning volume comes in the visage of support from undefined or unidentified stock market operator/s. These faceless entities appear to have been responsible for most of the rallies over the past two consecutive weeks…Nonetheless, the common trait in the massaging the index, either via intraday “pump” or “marking the close” have been to massively push up prices of at least 3 issues with combined market cap weighting of 15-20%. In panic buying episodes, (September 24 and October 16), the kernel of these activities transpire after lunch break.

Again I’ve got to hand it to the bulls for their tenacity for the reckless use of (whoever’s) money to "make" or "draw" the charts.

Today’s massaging of the Phisix has been an incredible combo of panic buying (on select issues) and ‘marking the close’.

The left window from technistock.net exhibits the relatively low P 7.37 billion from today’s pump. The official volume was at Php 7.62 billion inclusive of special block sales

The right window from colfinancial illustrates the after lunch break “pump” until the session end, which climaxed with the “marking the close”. The ‘marking the close’ gains contributed to about a substantial 35% of the session’s 1.1% gains.

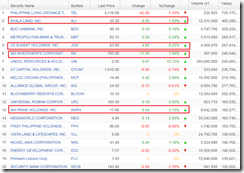

From the surface, it has largely been a two sector pump due to the extraordinary gains, namely Holding firms (+2.21%) and Property (1.77%) as shown by the table from the PSE

In reality, three sectors had been involved. The lesser visible of the two had been the industrials (right most window) which sprang back to the positive at the close from early losses.

Today’s combo package of ‘afternoon delight’ buying panic PLUS ‘marking the close’ that has pumped 3 sectors has mainly been channeled through a 6-company push.

From the Holding sector, JGS (+8.23%), AC (+1.27%), and SM (+1.49%).

While the 3 manifested the afternoon delight, JGS’ (left window) marking the close was the most pronounced.

The supporting sectors has been the property and industrials mainly through Ayala Land (+1.53%), SMPH (+3.15%) and JFC (+1.41%)

These 3 had a more elaborate exhibition of the afternoon pump that culminated with a dazzling marking the close.

Looking at how these 6 companies performed today, would give the impression that these issues are bound to SOAR by a huge margin tomorrow if not in the very immediate future. Why the pump?

Of the 6 issue pump only 4 made it to the top 20 most active. Such implies that the invisible operators made headway with JFC and AC in a less conspicuous manner.

And the market combined weighting of the 6 issues was at 34% as of the session’s end.

Everything that I have described last Sunday had been showcased today.

These operators have hardly been concerned about valuations or instability risks but about maintaining threshold levels (for political symbolism?).

The index manipulations has also been evident last Monday, October 27th where about all 18-20 points of the day's losses had been wiped out by the same last minute scheme. Monday's session was closed unchanged.

Some bulls represented by the stealth stock market operators have become so desperate as to massage price index so frequently if not with wanton regularity.

Yet they fail to heed the BSP chief’s fresh warnings that “keeping rates low for too long could result in mis-appreciation of risks in certain segments of the market, including the real estate sector and the stock market as markets search for yield” as well as “in a period of low volatility such as what we have been experiencing, practice the discipline of setting limits. This discipline will not only help you to avoid the pitfalls of “chasing the market”

And hardly has these entities come to realize that history’s lessons reveals that the obverse side of every mania (add to this market manipulation) is a crash.

No comments:

Post a Comment