Water now flows uphill.

From Bloomberg:

The European Central Bank’s imminent bond-buying plan has left $1.9 trillion of the euro region’s government securities with negative yields.Germany sold five-year notes at an average yield of minus 0.08 percent on Wednesday, a euro-area record, meaning investors buying the securities will get less back than they paid when the debt matures in April 2020.By the next day, German notes with a maturity out to seven years had sub-zero yields, while rates on seven other euro-area nations’ debt were also negative. While some bonds had such yields as far back as 2012, the phenomenon has gathered pace since the ECB’s decision to cut its deposit rate to below zero last year.Even when investors extend maturities, and move away from the region’s core markets, returns are becoming increasingly meager. Ireland’s 10-year yield slid below 1 percent for the first time this week, Portugal’s dropped below 2 percent, while Spanish and Italian rates also tumbled to records….Eighty-eight of the 346 securities in the Bloomberg Eurozone Sovereign Bond Index have negative yields, data compiled by Bloomberg show. Euro-area bonds make up about 80 percent of the $2.35 trillion of negative-yielding assets in the Bloomberg Global Developed Sovereign Bond Index, the data show.

Traditionally borrowers pay creditors and savers interests (positive yields). Negative yields means that this relationship has been overturned, borrowers are now paid by savers and creditors to borrow.

The reason for this; because of the promise to buy government securities, bond punters have been front-running the ECB to drive rates at subzero levels.

This chart is from February 2 when negative yields constituted $1.7 trillion. This means an 11.7% increase of bonds with negative yields since.

With ECB’s promise to monetize a significant number of debt which Zero Hedge estimates as possibly 100%, bond market liquidity will likely shrink and thus risking an upsurge of volatility.

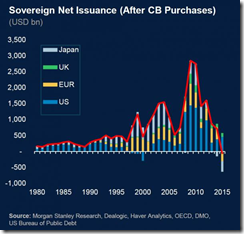

One may have the impression that perhaps immaculate balance sheets may have prompted the public to pay government to borrow. But as shown above, except for Germany, the Bloomberg’s debt chart reveals that debt from European countries has materially been inflating even from a one year basis.

Negative yields implies that credit risks has almost been totally eliminated!

See water flows uphill now.

The ECB has provided colossal subsidies (or resource transfer) to the banking system, bond holders and the government.

Financial analyst David Stockman at his website the Contra Corner has an incisive treatise on this.

Here is an excerpt: (bold mine)

That investors anywhere in this age of fiscal profligacy would pay to own the notes and bonds of sovereign states is a testament to the financial deformations of modern central banking. But the fact that nearly $2 trillion of debt issued by European governments is currently trading at negative yields——now that’s a flat-out derangement. After all, the aging, sclerotic economies of the EU have been making a bee line toward fiscal insolvency for most of the last decade.So it goes without saying that this giant agglomeration of pay-to-own government debt is not reflective of an outbreak of fiscal rectitude or any other rational economic development. It’s purely an artificial trading result stemming from central bank destruction of every semblance of honest price discovery. In this case, the impending ECB purchase of $70 billion of government debt and other securities per month for the next two years has transformed the financial casinos of Europe and elsewhere into a front runner’s paradise.As today’s Bloomberg piece tracking Europe’s $2 trillion of exuberant irrationality makes clear, sovereign bond prices are soaring because traders are accumulating, not selling, in anticipation of the ECB’s big fat bid hitting the market in the weeks ahead:“It is something that many would not have pictured a year ago,” said Jan von Gerich, chief strategist at Nordea Bank AB in Helsinki. “It sounds very awkward in a sense, but if you look at it more, the central bank has a deposit rate in negative territory, and there’s a huge bond-buying program coming. People are holding on to these bonds and so you don’t have many willing sellers.”Needless to say, this is the opposite of at-risk price discovery; it amounts to shooting fish in a barrel. Never before have speculators been gifted with such stupendous, easily harvested windfalls. And these adjectives are not excessive. The hedge fund buyers who came to the game early after Draghi’s “anything it takes”ukase have enjoyed massive price appreciation, but have needed to post only tiny slivers of their own capital, financing the balance at essentially zero cost in the repo and other wholesale funding venues.Indeed, the more risk, the bigger the windfall. German yields have now been driven below the zero bound on all maturities through seven years, emboldening speculators to move out on the risk curve. So doing, they have gorged on peripheral nation debt and have been generously rewarded. In the case of the 10-year bond of Ireland—-a state which was on the edge of bankruptcy only a few years ago—-leveraged speculator gains are now deep into three figures.

Continue with the rest of the article here

The obverse side of every money manipulation stoked financial asset mania is a crash.

No comments:

Post a Comment