Warren Buffett’s father Howard (an anti-New Deal and anti-interventionist Congressman) wrote to Murray Rothbard in 1962 about sending some of Murray’s books to his son. Judging from Warren’s recent comments, it seems the books were lost in the mail. So Mark Thornton has sent this care package to the billionaire investor.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, March 14, 2013

Dad Howard Buffet’s Wish for Son Warren Buffett Delivered

Tuesday, November 27, 2012

Why Warren Buffett Loves to Tax the Rich

As Americans for Limited Government President Bill Wilson notes, the company openly admits that it owes back taxes since as long ago as 2002.“We anticipate that we will resolve all adjustments proposed by the US Internal Revenue Service (“IRS”) for the 2002 through 2004 tax years ... within the next 12 months,” the firm’s annual report says.It also cites outstanding tax issues for 2005 through 2009.

But on closer examination, one realizes that Mr Buffett never mentions doing anything to eliminate the tax-avoidance strategies that he uses most aggressively. In particular:1. His company Berkshire Hathaway never pays a dividend but instead retains all earnings. So the return on this investment is entirely in the form of capital gains. By not paying dividends, he saves his investors (including himself) from having to immediately pay income tax on this income.2. Mr Buffett is a long-term investor, so he rarely sells and realizes a capital gain. His unrealized capital gains are untaxed.3. He is giving away much of his wealth to charity. He gets a deduction at the full market value of the stock he donates, most of which is unrealized (and therefore untaxed) capital gains.4. When he dies, his heirs will get a stepped-up basis. The income tax will never collect any revenue from the substantial unrealized capital gains he has been accumulating.

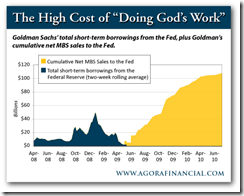

During the depths of the 2008 Credit Crisis and stock market selloff, “Wall Street was of fire,” recalls Peter Schweizer in his expose, Throw Them All Out. “[But] Buffett was running toward the flames…with the expectation that the fire department (that is, the federal government) was right behind him with buckets of bailout money…Indeed, Buffett needed the bailout…Beyond Goldman Sachs, Buffett was heavily invested in several other banks that were at risk and in need of federal cash. He began immediately to campaign for the $700 billion TARP rescue plan that was being hammered together in Washington.”“As the political debates surrounding the proposed $700 billion Troubled Asset Relief Program (TARP) bailout bill heated up,” recalls blogger, Pat Dollard, “Buffett maintained an appearance of naiveté, an ‘aw shucks’ shtick that deferred to the judgment of politicians. ‘I’m not brave enough to try to influence the Congress,’ Buffett told the New York Times.“Behind closed doors, however, Buffett had become a shrewd political entrepreneur,” Dollard continues. “The billionaire exerted his considerable political influence in a private conference call with then-Speaker of the House Nancy Pelosi and House Democrats. During the meeting, Buffett strongly urged Democratic members to pass the $700 billion TARP bill to avert what he warned would otherwise be ‘the biggest financial meltdown in American history.’”“If the bailout went through,” Schweizer correctly observes, “it would be a windfall for Goldman. If it failed, it would be disastrous for Berkshire Hathaway.”Buffett’s “hard work” paid off.“In all, Berkshire Hathaway firms received $95 billion in bailout cash from the Troubled Asset Relief Program (TARP). Berkshire held stock in the Wells Fargo, Bank of America, American Express, and Goldman Sachs, which received not only TARP money but also $130 billion in FDIC backing for their debt. All told, TARP-assisted companies constituted a whopping 30% of its entire company disclosed stock portfolio.”But these billions of dollars represented only the most visible portions of the bailout funds that flowed to Berkshire’s companies. Wells Fargo, for example, received “only” $25 billion of TARP funding, but it also received another $45 billion at the same time from the Federal Reserve’s Term Auction Facility (TAF).Incredibly, Wells Fargo’s borrowings paled alongside those of Goldman Sachs. Throughout the crisis, Goldman gorged itself at every available government trough. The morally challenged investment bank borrowed only $10 billion from the TARP. But at the same time Goldman was griping about “being forced” to take the $10 billion TARP loan, the company was borrowing tens of billions of dollars more from obscure government lending programs with acronyms like: CPFF, PDCF and TSLF.And that’s not all!Amidst much fanfare and self-congratulatory press releases, Goldman repaid its TARP loan in June 2009, but only after securing $25 billion of government capital at a different trough. As we observed in a December 15, 2010 edition of The Daily Reckoning:On June 17, 2009…thanks to some timely, undisclosed assistance from the Federal Reserve, Goldman repaid its $10 billion TARP loan. But just six days before this announcement, Goldman sold $11 billion of mortgage-backed securities (MBS) to the Fed. In other words, Goldman “repaid” the Treasury by secretly selling illiquid assets to the Fed.One month later, Goldman’s CEO Lloyd Blankfein beamed, “We are grateful for the government efforts and are pleased that [the monies we repaid] can be used by the government to revitalize the economy, a priority in which we all have a common stake.”As it turns out, the government continued to “revitalize” that small sliver of the economy known as Goldman Sachs. During the three months following Goldman’s re-payment of its $10 billion TARP loan, the Fed purchased $27 billion of MBS from Goldman. In all, the Fed would purchase more than $100 billion of MBS from Goldman during the 12 months that followed Goldman’s TARP re-payment.Is it any wonder that Buffett’s $5 billion “investment” in Goldman Sachs succeeded so nicely?“Later, astonishingly,” recalls Peter Schweizer, “Buffett would publicly complain about the bailouts in his annual letter to Berkshire investors, claiming that government subsidies put Berkshire at a disadvantage…”

[As a side note, maybe the Occupy Wall Street movement should consider occupying Berkshire Hathaway too]

Saturday, May 19, 2012

Warren Buffett and the Austrian Business Cycle Theory

Warren Buffett’s dad the prominent libertarian Howard Buffett in a letter to Murray Rothbard wanted to share the latter’s book, “The Panic of 1819”, to his son, perhaps to introduce the Austrian Business Cycle Theory (ABCT).

from the Lew Rockwell Blog

Excerpted from the second to the last paragraph… (hat tip Bob Wenzel)

Somewhere I had read that you wrote a book on the "Panic of 1819". If this is correct, I would like to know where I can buy a copy of it. I have a son who is a particularly avid reader of books about panics and similar phenomenon. I would like to present him with the book referred to.

It’s interesting to know that Warren Buffett’s adapted philosophy has been in the opposite dimension relative to his Dad, especially amplified today...Warren’s twilight years.

Ironically, son Warren has even furiously assailed on the essence of what his Dad believed in.

The sad part is that Warren Buffett evolved from being a model value investor and deigned himself into a major crony for the Obama administration, where the son Warren may have sold out Dad’s principles for convenience, status and wealth.

This reminds me of Jedi master Yoda who warned apprentice Jedi Anakin Skywalker in the final episode of the prequel Star Wars Episode III: Revenge of the Sith

The fear of loss is a path to the dark side.

I am inclined to think that the prospect of the loss of the above privileges could have been a key influence behind the son’s embrace of the state…and the dark side.

Friday, February 10, 2012

Warren Buffett versus his Dad Howard Buffett on Gold

Warren Buffett has long been averse to gold as an investment (and as part of his political philosophy), focusing on the polemics that gold does not account for a productive asset.

In a recent Fortune article he continues with this line of rant. (bold emphasis mine)

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As "bandwagon" investors join any party, they create their own truth -- for a while…

Whether the currency a century from now is based on gold, seashells, shark teeth, or a piece of paper (as today), people will be willing to exchange a couple of minutes of their daily labor for a Coca-Cola or some See's peanut brittle. In the future the U.S. population will move more goods, consume more food, and require more living space than it does now. People will forever exchange what they produce for what others produce.

Our country's businesses will continue to efficiently deliver goods and services wanted by our citizens. Metaphorically, these commercial "cows" will live for centuries and give ever greater quantities of "milk" to boot. Their value will be determined not by the medium of exchange but rather by their capacity to deliver milk. Proceeds from the sale of the milk will compound for the owners of the cows, just as they did during the 20th century when the Dow increased from 66 to 11,497 (and paid loads of dividends as well).

It’s bizarre to see Mr. Buffett argue about the non-productive role of gold yet imply of gold’s potential as a currency or as money.

Mr. Buffett ignores that, money, to quote the great Murray N. Rothbard, forges the connecting link between all economic activities. This only means that any massive debasement of the currency, which again is used as link to all economic activities, will undermine the division of labor which thereby erodes the productive capacity of an economy (and specifically Mr. Buffett’s or anyone’s investments or ‘capacity to deliver milk’).

In short, it would be a serious gaffe to think that economic activities can be isolated from the ever changing conditions of money. Thus, his objection that gold represents a non-productive asset is essentially a non-sequitur.

And obviously Mr. Buffett admits to such spurious reasoning through some of his actions in his flagship Berkshire Hathaway: (bold emphasis added)

Under today's conditions, therefore, I do not like currency-based investments. Even so, Berkshire holds significant amounts of them, primarily of the short-term variety. At Berkshire the need for ample liquidity occupies center stage and will never be slighted, however inadequate rates may be.

So Mr. Buffett holds non-gold currency based investments in spite of his reluctance to incorporate them as part of his portfolio. So Mr. Buffett practices a deny but apply strategy.

And finally, here is another blatant inconsistency in his letter

Berkshire's goal will be to increase its ownership of first-class businesses. Our first choice will be to own them in their entirety -- but we will also be owners by way of holding sizable amounts of marketable stocks

The folksy Mr. Buffett is not being candid at all.

Today, his investments have not been about taking on first-class ‘efficiently deliver goods and services wanted by our citizens’ but rather on businesses that heavily relies on government’s support. For instance Mr. Buffett has profited from Obama’s anti-competition energy policies such as the Keystone pipeline controversy, and earlier, Mr. Buffett also profited immensely by participating in the various bailouts conducted by the US government in the US financial system.

In short, Mr. Buffett has morphed from value investor to a political entrepreneur or a crony. This hardly represents the ideals Mr. Buffett has been preaching about.

And importantly the sage of Omaha’s actions runs to the contrary against the virtues espoused by his venerable father Mr. Howard Buffett, the staunch ‘old right’ libertarian.

My guess is that Mr. Buffett’s antipathy towards gold has really nothing to do with economics (which he uses as a flimsy cover or camouflage) but could most likely represent a personal issue—specifically based on an implicit division with his father (for whatever reasons)

Here is an excerpt on Mr. Howard Buffett’s celebrated treatise on “Human Freedom Rests on Gold Redeemable Money”

Far away from Congress is the real forgotten man, the taxpayer who foots the bill. He is in a different spot from the tax-eater or the business that makes millions from spending schemes. He cannot afford to spend his time trying to oppose Federal expenditures. He has to earn his own living and carry the burden of taxes as well.

But for most beneficiaries a Federal paycheck soon becomes vital in his life. He usually will spend his full energies if necessary to hang onto this income.

The taxpayer is completely outmatched in such an unequal contest. Always heretofore he possessed an equalizer. If government finances weren't run according to his idea of soundness he had an individual right to protect himself by obtaining gold.

With a restoration of the gold standard, Congress would have to again resist handouts. That would work this way. If Congress seemed receptive to reckless spending schemes, depositors' demands over the country for gold would soon become serious. That alarm in turn would quickly be reflected in the halls of Congress. The legislators would learn from the banks back home and from the Treasury officials that confidence in the Treasury was endangered.

Congress would be forced to confront spending demands with firmness. The gold standard acted as a silent watchdog to prevent unlimited public spending.

I have only briefly outlined the inability of Congress to resist spending pressures during periods of prosperity. What Congress would do when a depression comes is a question I leave to your imagination.

I have not time to portray the end of the road of all paper money experiments.

It is worse than just the high prices that you have heard about. Monetary chaos was followed in Germany by a Hitler; in Russia by all-out Bolshevism; and in other nations by more or less tyranny. It can take a nation to communism without external influences. Suppose the frugal savings of the humble people of America continue to deteriorate in the next 10 years as they have in the past 10 years? Some day the people will almost certainly flock to "a man on horseback" who says he will stop inflation by price-fixing, wage-fixing, and rationing. When currency loses its exchange value the processes of production and distribution are demoralized.

For example, we still have rent-fixing and rental housing remains a desperate situation.

For a long time shrewd people have been quietly hoarding tangibles in one way or another. Eventually, this individual movement into tangibles will become a general stampede unless corrective action comes soon.

Mr. Warren Buffett is being exposed for his rhetorical sophistry. Besides, the markets will eventually expose on his equivocation, which apparently he has taken on some 'deny and apply' insurance. He should instead pay heed to his Dad's wisdom, if not at least follow his Dad's legacy of honesty.

Saturday, February 12, 2011

Warren Buffett: Embracing Crony Capitalism

Warren Buffett used to be the person I wanted to emulate. Not anymore.

This is because Warren Buffett’s investment approach has radically changed. He has undergone dramatic transformation from a Graham-Dodd modeled value investor to a political entrepreneur-crony capitalist.

The Huffington Post writes, (bold highlights mine)

No matter what the government does, taxpayer bailouts of the financial sector will sometimes be necessary, according to the nation's second richest man.

As markets crashed in the fall of 2008, government officials feared that if certain financial institutions failed, the entire financial system -- or perhaps even the entire economy -- would come down with them. In the months after the government extended a $700 billion bailout to the financial sector, lawmakers have striven to ensure that no institution poses such a systemic risk that it would be too big, or too interconnected, to be allowed to fail.

But famed investor Warren Buffett, whose own firm profited handsomely from the bailout, said bailouts are an inevitable feature of finance, Bloomberg reports.

Buffett, who is personally worth at least $45 billion, told the government panel charged with investigating the causes of the financial crisis that its work would not prevent the phenomenon of "too big to fail."

Reading last night’s very timely article at Mises.org, Frank Chodorov wrote of how some capitalists have contributed to the advancement of socialism.

Mr. Chodorov wrote, (bold highlights mine)

The task of producing goods and services for exchange was accepted as a necessity, but the summum bonum was the acquisition from the king of grants, patents and subsidies that would yield them monopoly profits, that is, profits over and above what might be garnered in a competitive market. Their aim was to live like nobles who rendered no service for the rents they collected from their tenants.

It appears that such “rent seeking paradigm” seems to be Mr. Buffett’s newfound specialty.

Warren Buffett’s perceived “bailout-as-a-necessity” is due to the fact that he or his company profits from these. Yet, what is beneficial for him comes at the expense of ordinary people. Bailouts are basically redistribution of wealth from the average Americans to Mr. Buffett, his company and shareholders.

Nonetheless bailouts are not inevitable. Eventually a political economic system that persists in doing so will only degenerate. And this will likewise affect his company’s profits overtime.

Besides, bailouts or political concessions depend on patronage. Once Mr. Buffett’s political network has gone out of the loop then such privilege goes out of the window as well.

So instead of looking for economic opportunities to exploit on, Mr. Buffett and his executives will be focusing on lobbying.

This only goes to show how Mr. Buffett’s the time horizon has substantially narrowed. Maybe it’s because of age.

But Mr. Buffett has certainly been a disappointment, unlike his libertarian father, a staunch defender of the “old right”, Howard Buffett.