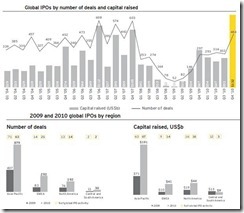

For me, the success of IPOs have mostly been sentiment based, where the direction of the general markets account for the success of specific issuance. In other words, bull markets prompt for fantastic returns which would draw in more issues to list. Hence ascending markets will lead to more IPOs.

Conversely, IPOs are usually nonevents during bear markets (the above chart I earlier posted here). Ergo, IPOs can function as indicators of the whereabouts of a bubble cycle.

I recently posted about signs of brewing bubble on internet stocks.

LinkedIn which has been already a hit in the secondary markets made a scintillating debut yesterday.

In the NYSE, LinkedIn prices more than doubled!

From the Marketwatch,

LinkedIn’s stock LNKD +108.58% soared at one point more than 140% to $108.25, before receding to $94.25 by the close of its first day of trading on the New York Stock Exchange.

Propelled by vigorous demand leading up to its initial public offering, LinkedIn’s IPO priced at $45 a share, at the top end of a recently raised range of $42 to $45 a share. Previously, the IPO pricing range had been $32 to $35 for shares in the professional-networking service.

Bespoke Invest notes of IPOs with best first day returns during this cycle.

LinkedIn topped two Chinese internet companies, Youku.com (video hosting service) and Qihoo 360 Technology (internet anti-virus and security products). Again the best returns have all been in the internet sectors.

This means listing of internet stocks have drawn in alot of speculative activities and will likely serve as precedent for more frenzies.

As Tech columnist Eric Savitz writing in Forbes writes, (emphasis added)

In other ways, the current situation looks nothing like the first Internet bubble. (For instance, there is no insane salary-inflating battle for journalists this time around. Sigh.) The most obvious difference is that until now, all of the action has been taking place in the venture capital market, or at least, in the newly emerging secondary market for venture investments. There have been just a handful of IPOs, aside from a flurry of Chinese Internet deals. But many of the key social networking players have been showing signs of inching toward the exits. Facebook hasn’t filed yet, and neither has Twitter, Zynga or Groupon. (Though Zynga and Yelp both threatened to abandon San Francisco unless the city exempted them from an onerous tax on employee stock options they could have otherwise faced going public while based in the city by the Bay.) Skype, after a year in registration, agreed to be acquired by Microsoft for $8.5 billion. Zillow has filed, though and so has Pandora. There’s still the makings here of a 1999-like IPO explosion...

The market’s hunger for LinkedIn shares is a demonstration of the kind of speculative fervor last seen in the recently popped bubble in the silver market. This isn’t really about what’s rational, it’s about dreams and imagination. The risks here are obvious; buying LinkedIn shares at 20, or 30 or 40x last year’s revenues is giant game of chicken that I would personally advise against. LinkedIn is not Pets.com; it is a real company, with impressive growth, and it operates in the black. But is the current valuation rational? I’m not convinced.

History may not repeat itself, as Mark Twain said, but they could rhyme.