This is an example of how experts use specific time frames to prove a point.

This from

Bespoke Invest,

(bold highlights mine)

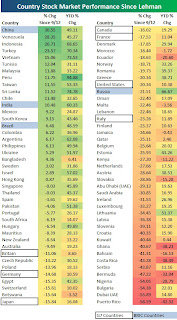

``The S&P 500 is

up 11.24% since July 10th, which is a significant move in such a short period of time. The recent gains also put the index up

nicely at 8.28% year to date. As shown below, the US has performed well relative to the rest of the world. Since July 10th, it

ranks 22nd out of 82 countries. Russia is up the most with a gain of 24.23%, followed by Hungary, Poland, Norway, Romania, and Germany. Middle and Eastern European countries have seen some of the biggest gains in recent weeks."

Adds Bespoke, ``While China has been the second best performing country (behind Peru) year to date, it is only

up 10.32% since July 10th. This is better than most countries, but it hasn't been the worldwide leader that

it was earlier in the year. Five of the G-7 countries have outperformed China, and

all seven G-7 countries are in the top 50% in terms of performance. This is a sign that

developed markets have been holding their own against emerging markets in recent weeks. Only ten out of 82 countries are down since July 10th, with Slovakia leading the way at -5.67%."

We are grateful to Bespoke for their wonderful graphics.

However, with China's year to date gains at a

mindboggling 88.66% and with the Shanghai benchmark at grossly overbought conditions, it would be a puzzle or an irony to expect a continuation of such torrid pace of advances or even make a worthwhile comparison. 88% versus 9% (year-to-date) is just a wide wide chasm.

As we earlier wrote in

Global Stock Market Performance Update: Rotational Effects and Tight Correlations``If global markets have been driven by liquidity or monetary forces or inflation dynamics then it is quite obvious that there

will be rotational effects and secondly, for the early movers

some tight correlation, as global liquidity transmission interlinks divergent markets."

Hence, our views seem to get validated where we appear to be indeed witnessing

rotational effects from inflationary policies as the

market leadership has temporarily switched from (leaders) emerging markets to the (laggards) developing markets.

Another, as Bespoke likewise observed, only 10 out of 82 since July 10th are down, or 17 out of 82 global benchmarks on a year-to-date basis-

signifies further proof of the "global liquidity transmission interlinks divergent markets", we earlier posited. Market gains seem to broadening on a worldwide basis, but not all.

Russia's RTS outperformance

appear to be a function of a typical bullmarket trend. As we commented in the same article, ``Russia's hefty decline exhibits overheating. The Russian benchmark is still the 5th best year to date performer IN SPITE of the recent (21%) downturn. It trails Peru, Sri Lanka, China and India."

Indeed, after a 50% fibonacci retracement since the March lows, Russia has used its recent reprieve and the opportune windows provide by developed markets as fulcrum to stage another gala rendition (even at the face of a mighty performance by developed economies.)

Bottom line: ``developed markets have been holding their own against

emerging markets" because of the

rotational effects and global liquidity transmission of the global inflation dynamics more than representative of idiosyncratic strength or traits.

At the end of the day, emerging markets has still patently outperformed its developed counterparts under present "ultra loose monetary" conditions.