``All man's troubles come from not knowing how to sit still in one room.” Blaise Pascal

While I remain bullish over the long term with the Phisix (10,000 Phisix...conservatively) as well as with the Peso and would not discount a potential mania to top out the present cycle, I am inclined to think that there could be a significant correction over the interim, possibly anywhere 10-25%; remember the Phisix is an illiquid market by global standards and illiquid markets translates to above par volatility (high beta), and that the Philippine markets could possibly stage a strong rebound during the latter half of the year.

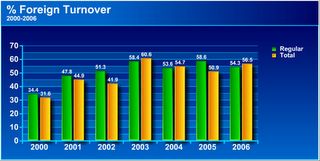

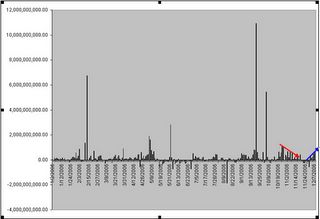

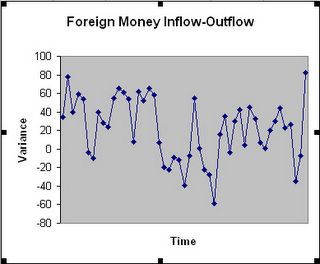

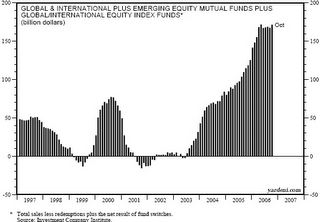

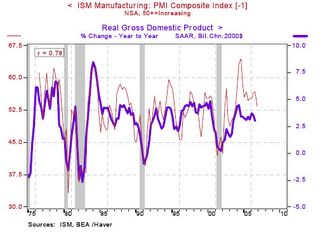

All this will essentially depend on the developments in the US dollar [I know the Euro will surpass the US dollar as the most circulated currency] as a fundamental driver as well as, the US financial markets which has, in my view, been the focal point of cross-border capital flows, and the inspirational paradigm to the world equity markets during the last quarter of 2006.

I do not foresee present day decoupling by Asia vis-à-vis US (see November 20 to 24 Asia’s Soaring Markets: A Matter of Decoupling from the

The Phisix could possibly end the year on the negative or trade sideways where gains or losses would unlikely top 5%.

I have been right with gold having reached the $600-650 level (closed at $604.9) which I forecasted early this year see Jan 02 to 06 2006 (2005 Recap and Blemishes: 2006 Still For Mines and Oil) and forecasts the potential of gold to decouple soon with its industrial metal siblings. Gold’s latest decline has been attributed to diminishing “inflation” concerns and to a surging US dollar.

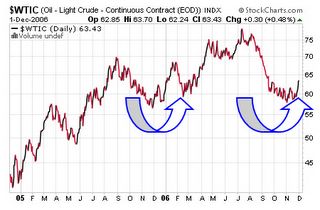

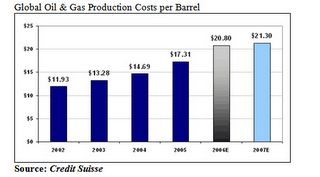

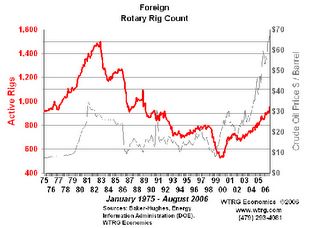

If the market savants such as the world’s Bond King Bill Gross are right to predict that the US Federal Reserve will cut rates from 5.25% to 4.25%, I can see gold topping the $700 at the close of 2007, alongside another key commodity, crude oil possibly in the $60 to $70 mark, this despite a worldwide slowdown on possibilities of greater than expected “peaking out” of maturing fields (for as long as the world does not enter into a depression-where all bets are off).

Meanwhile the US dollar index would possibly close lower for the year but at a much subdued loss than in 2006 possibly at 5% or less.

Because the PSE made substantial adjustments to the composition of the Phisix subsectors which took effect last January 2, 2006, I based the yearend returns on the first day from which the changes were adopted.

The mining sector which I predicted as the best performer for 2006 came in a very close second with gains of 65.2% to trail the Holdings at 66.67%. The other sectors came in the following order, Property 51.12%, Service 45.71%, All index 45.13% Banking 35.07% and CI 19.34%.

Unlike other mainstream analysts whose fungible views are dependent on the present activities of the market which they use to project into future, I remain steadfast in my projection that the juvenile mining sector has the potentials to draw even more investments, considering the “nationalization” efforts undertaken by several resource rich nations (Bolivia, Russia, Venezuela, Mongolia & etc..) which in essence reduces potential supplies on stream, and makes the country even more a compelling supply chain participant.

Of course, our projections are based on the sustenance of a “mining friendly” climate, that should be able to draw on foreign investments and generate more corporate stories and activities that would drive local investors into the mines.

And this should include the power and energy sector which has undergone years of intensive underinvestment, aside, from the much neglected agriculture based investment themes-arising from declining supplies of arable land due to growing desertification trends, a looming water crisis in various parts of the world, growing industrialization in emerging markets, demographic and urban migration trends as well as demand for agriculture products which used to be solely for food is now in competition as feedstock for alternative energy and most importantly, the growing consumption trends by rapidly developing emerging markets economy.

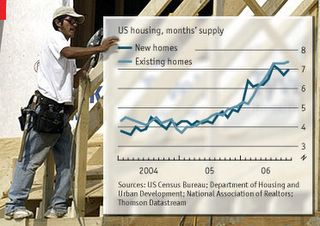

Furthermore, while many world markets have seen a boom in real estate, the

Another compelling investment theme would be the rapidly growing “sunshine” Business Process Outsourcing industry (BPOs), a beneficiary of today’s supply chaining trends in globalization. A global economic growth slowdown should benefit BPOs more as companies attempt to reduce costs and outsource more of their non-sensitive business processes. Also watch for companies that would benefit from various outsourcing/offshoring patterns, as well as beneficiaries from growing trends to integrate financial markets.

Finally, it is never good to discount that the Philippines sits on a wealth of potential high value tourism spots given its 7,100 islands, rich historical background and diverse culture. As