``We can chart our future clearly and wisely only when we know the path which has led to the present." - Adlai E. Stevenson (1835-1914)

When we talk about financial globalization, we talk about greater accessibility to financing, a deepening of capital markets, a broader scope of risk-sharing capabilities, a wider base of asset ownership, more array or selections of financial instruments, and increasing profile of financial markets, participants and institutions. And these have been unfolding right before our very eyes.

Just to give you a short clue, market participants today includes the emergence of the “sovereign funds” class or public institutions assigned by national governments to allocate sections of their excess reserves into the global asset markets. In other words, public funds have now morphed into quasi-hedge funds which now compete with private funds for the same purpose, to generate “ALPHA” returns.

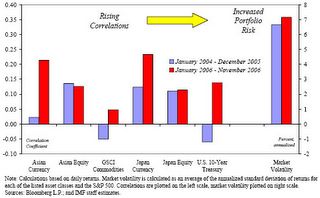

I have shown you how closely correlated the movements of our markets have evolved with that of our neighbors or with global benchmarks. And in such context, as much as the benefits accrue, the risks have been increasingly interrelated or shared.

To quote IMF’s Managing Director, Rodrigo de Rato in his recent speech (emphasis mine), ``In the last decade, the global integration of capital markets has become even deeper. As a result, both the benefits of free trade and free capital flows and the risks associated with volatile capital movements have increased....We have learned that shocks in the financial sector can spread quickly to other sectors, and that the interlinkages between sectors must be taken into account.”

In today’s world where capital markets greatly overwhelm the exchange of goods and services, it is of no doubt the principal role played by the financial sector.

And it is on similar grounds, where as an Asian bull, I believe trends towards the “financial globalization” theme will drive the region’s assets (including the Philippines) over the LONG RUN to unprecedented heights;

>mounting trade surpluses which represent the wealth shift phenomenon,

>outsourcing and offshoring signifies a shift of the manufacturing capacity or increasing trends of industrialization,

>per capita convergence or the rising middle class,

>intensifying regionalization trends or lesser dependence on a single market or source of finance,

>growing consumer class,

>beneficiary of the science and technology revolution,

>favorable demographic trends,

>faster growth rates

>growing supply of skilled labor and

>rising productivity

Yet, in the face of these substantial auspicious circumstances, the Asian economies have not been adequately supported by its financial markets which are largely fragmented, underdeveloped and over reliant on the traditional banking sector as source for financing as shown in Figure 1.

.bmp) Figure 1: IMF: Asia Underdeveloped Markets

Figure 1: IMF: Asia Underdeveloped MarketsThe 2006 outperformance of the Philippine Phisix (+42.29% in local currency) and Indonesia’s JKSE (+55.3% in local currency) could be due to the extremely low levels of Market Capitalization relative to GDP, which in 2004 represented 34 and 30% respectively.

And this is one of the reasons why the present global structural imbalances thrive; Asia’s surpluses continue to be recycled into US assets, which tacitly supports the highly indebted US consumers as manifested by the exploding trade deficits, simply because its capital markets do not have the depth and sophistication to absorb all these excesses surpluses. And this will nonetheless change.

According to IMF’s Agnès Belaisch and Alessandro Zanello (emphasis mine) ``In the future, trends in regional trade and abundant liquidity are likely to serve as catalysts for stronger financial linkages throughout the region... A strengthening of regional demand and trade growth will independently stimulate Asian asset markets and tighten regional interconnections. Better-linked regional financial systems could provide funding and hedging instruments to support the region's trade activities. Overall, Asia's growing intraregional trade will catalyze greater financial integration and, in turn, be stimulated by it.”

In short, the trends towards further capital markets deepening and integration looks like a monumental and possibly “irreversible” force to reckon with. Such is the reason why I am bullish with non-bank finance services which I think should benefit significantly from this seismic transformation, aside from of course, the general asset classes of Asia.

In today’s globalized financial environment where money moves “freely” in search of yields real time, let me show you why foreign money should continue to pour into Asian assets. In the eyes of the widely followed BCA Research, real yields matter (or bond yields deflated by inflation indices)...

.bmp) Figure 2: BCA Research: Searching for Yields

Figure 2: BCA Research: Searching for Yields``The Chart compares real bond yields and the basic balance for key emerging markets. Countries with high real yields and strong external positions (emphasis mine) offer the best risk/reward profile for investors in domestic bonds—that is, those in the upper right area.” wrote BCA Research.

As you can see in Figure 2, the Philippines alongside its ASEAN contemporaries have been labeled as good value in real bonds yields (domestic currency), with mature East Asian bonds in somewhat the lesser attractive class. Meanwhile, US and Australian bonds have been shown as the least attractive.

Now relative to RISKS I believe, the housing recession in the United States has been the biggest mystifying factor whose effects could undo yet all the present gains seen in the liquidity driven global financial markets.

.bmp) Figure 3: Northern Trust: % changes of New and Existing Homes

Figure 3: Northern Trust: % changes of New and Existing HomesMainstream analysts have recently adduced to several positive data in the housing industry as signs of a bottom. I am highly skeptical of this.

Bottoms or tops, or major cyclical inflection points do not come without capitulation from either bulls or bears. Because markets are psychological in nature, they tend to shoot beyond the norm; that is why you have such phenomenon as Mania, Panics and Crashes. As the Wall Street axiom goes, Markets climb a wall of worry, and decline on a ladder of hope.

What gives the bulls the ammo for their continued exuberance is the absence of credit-related crisis or fallout from risky exotic mortgages or derivatives yet. However, it is too premature to discount such possibilities, as signs of incipient raptures could have emerged, from Bloomberg’s Caroline Baum, ``A few sub-prime lenders have gone belly up. Signs of additional distress are just starting to show up in larger home- loan companies. Last week, IndyMac Bancorp Inc., the second- biggest independent mortgage lender, said its fourth-quarter earnings would miss forecasts because of deteriorating credit quality in the home-loan market.”

This view appears to have been shared by the illustrious Yale Professor Robert Shiller of the Irrational Exuberance fame in his latest interview in Bloomberg (emphasis mine), ``Why hasn’t the weak the housing market affected retail sales? Or why hasn’t consumer confidence fallen’ more? Well the easy answer to that is it hasn’t really started falling yet. It’ s the rate of increase that’s been going down for two years now, and its just starting to fall....I mean cities are down 1-2%, its not happened yet, so I am interested in what’s gonna happen next year.”

This means mainstream analysts have been looking at the rate of change instead nominal figures in determining the scope of the retrenchment of the housing industry.

Despite the declining rate of change, as shown in Figure 3, the nominal price levels suggests that housing levels remains on the high side, ergo, the effects of the fallout has not yet been visible. In other words, market participants have been in a state of denial and have not capitulated, so the likelihood is that while there may be interim recoveries, the bottom in the housing industry in the US has yet to be found.

In addition, Mr. Shiller implies that as nominal price levels decline, things can get rather interesting or possibly, the ramifications would be more evident. And we must not forget that since markets functions as discounting mechanisms, where if such effects would be more apparent by next year, stressed or not, the market’s price signals should soon be reflective of these.

Further, as I have repeatedly mentioned, Derivatives, “Financial Weapons of Mass Destruction” to Warren Buffett, which have provided for expanded leverage and added liquidity in the markets, have now caught the attention of policymakers as potential catalyst to a major market crisis.

This is one of the major issues taken up in the Davos Switzerland, where Zhu Min, the Bank of China's executive vice-president warned (emphasis mine), ``There is money everywhere. You can get liquidity from the market every second for anything. Derivatives are eight times global GDP and much of the money is flowing to Asia, where people have no idea what risks they are taking."

.bmp) Figure 4: Lazlo Birinyi/ Trend Investor: S&P’s Record Run

Figure 4: Lazlo Birinyi/ Trend Investor: S&P’s Record RunAs I have been saying along, despite fundamental risks, global markets appear to be getting ahead of themselves. In spite of Friday’s 3% decline, which shadowed the activities in Wall Street, the Phisix has still been up 6.04% year to date! And by virtue of being overextended, the market could simply tumble out of sheer profit-taking.

This observation from Steven Lord of the Trend Investor (emphasis mine), ``In a nutshell, this is the current situation in U.S. equity markets. Although I am not bearish on the market per se, the current bull market is elderly by historical standards at 51 months, while the S&P has now booked the 928 consecutive days without a one-day, 2% correction. It is the longest such streak since before the Depression, or, more correctly, for as far back as we can get daily prices. It is an ominous fact, since most things on Wall Street eventually revert to trend. With earnings and the economy decelerating, the Fed unlikely to be much help unless things dramatically change for the worse, and markets perched at record levels on the back of one of the longest bull markets on record, we’re calling the chances for a good, old-fashioned correction as better than good.”

.bmp) Figure 5: Stockcharts.com: Emerging Market dissonance

Figure 5: Stockcharts.com: Emerging Market dissonanceIn figure 5, one can see that emerging market debts (lower panel) appear to have “peaked out” and could be in the process of correcting, [via manifestations of lower highs and lower lows] while Emerging market bourses seems to continue with its upside momentum. However, the Morgan Stanley Emerging Market Index has yet to break the 925 hurdle to confirm its uptrend. Failure to do so could translate to a weakening momentum or a possible reversal.

Let me repeat, aside from all the negatives I’ve cited since (growing divergences, unfavorable market actions, fundamental, technical and sentiment risks), I think that our cost of capital have risen far more than the potential returns that can be gained from investing today, making the present day theme least attractive.

Say if one of the analyst is right on his prediction that the Phisix will gain 10% in 2007, with the Phisix already up 6%, this means your upside is now limited to 4% until the end of the year! But how about your downside risks? This is what I mean as the risk prospect has far outgrown your return potentials.

Of course, there will be selective opportunities within the market. We are after all in a long term bullmarket faced short-term risks.

Further, with eroding seasonal strengths, the manifestation of overconfidence through the bidding up of third tier issues signifies the accelerating speculative fervor. As such, it looks as if there are more fools or suckers out there than money to be made, which gives us another reason to be extremely cautious.

Yet, the market can still go higher predicated on a budding mania at work. As I have said to a favorite foreign client, acting on one’s portfolio reminds me of the Serenity Prayer which goes...

God grant me the serenity

to accept the things I cannot change;

courage to change the things I can;

and wisdom to know the difference.

There are things that we cannot change and things that we can act upon to effect changes for as long as we know our goals.

.bmp)