When I wrote about the Philippine casino bubble in April 2013, I noted of the potential impact from the deterioration of the Chinese economy to Philippine and regional casino industry: “And the loses suffered by Singapore casino operators from unscrupulous bettors are just signs from the periphery, particularly the vulnerable Chinese economy, of the possible things to come.”

Add the current economic stagnation to the political persecution of the opposition by the incumbent administration (operating under the slogan of “anti-corruption”), and to the financial repression in the context of the ongoing interdiction of capital flight, (Yesterday the Chinese government reportedly imposed reserve requirement on financial institutions trading in foreign-exchange forwards), the outcome has been a perfect trifecta (economic, financial and political) storm: Macau’s casino dependent industry tailspinned in the 2Q!

From Bloomberg:

Macau’s economy dipped to its lowest since 2011 as high-end gamblers avoided the world’s largest casino market amid a widening crackdown on graft in China.The city where gambling accounts for four-fifths of economic output saw GDP tumble 26.4 percent in the last quarter, according to government data released Monday. The drop worsened from 24.5 percent in the first quarter.

That’s the statistical economy on a freefall to its “weakest since early 2011”!

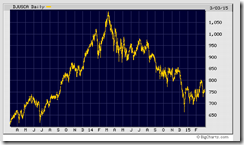

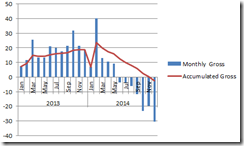

And Macau’s predicament has hardly abated. Casino revenues this August remains mired in deep losses.

The above signifies a wonderful depiction of the boom-bust cycle in motion as exhibited by casino earnings

Moreover, Macau’s junctures have begun to spillover to the political economy, as Macau’s government surpluses shrinks

While its economy fared worse than crisis and debt-laden Greece in recent months, Macau’s unemployment rate has held steady below 2 percent and its government maintained a surplus.Still, the fiscal surplus of 8.63 billion patacas ($1.1 billion) in the second quarter has almost halved from a quarter earlier amid falling gaming taxes. Beijing-backed Chief Executive Fernando Chui had said he would cut some government spending if the casino downturn worsens.

Cut government spending? If this happened in the West, Macau’s administrator would be pilloried for mouthing a politically incorrect stance—austerity!

This also means that a prolonged economic rut will lead to deficits that would increase Macau's debt and magnify risks to its vulnerable economy and to financial instability.

Yet how has the industry been coping with the slump?

Macau’s casino operators have been trying to spark a revival with a series of new resorts aimed at drawing mainland Chinese tourists, heeding Beijing’s call for the city to reduce its dependence on gambling. Those numbers haven’t yet been forthcoming.Package group tours from mainland China fell 19 percent in July from a year ago, even as the number of hotel rooms in the former Portuguese enclave increased 7.2 percent to 30,000, according to official data Monday.

Such slowdown hasn't been limited tot Macau, Hong Kong’s retail sales, according to Nasdaq, fell by a faster-than-expected 2.8% in July from a year earlier, dragged by a further slow down in inbound tourism and partly by the impact of the stock market's correction on consumer sentiment, the Census and Statistics Department said Monday.

The above are manifestations of the deepening stagnation of mainland China’s economy.

Macau’s woes have predominantly been framed as an outcome of political actions. Instead of hunkering down, Macau’s operators will shift its business model paradigm by ADDING to current supply of hotels, shopping malls and other leisure based investments.

As noted above, Macau’s dilemma have emanated from a combination of the growing slack in demand AND excess capacity.

And if expansion plans by the operators will be fulfilled, then this will only compound on the region’s excess capacity in the hotel-shopping mall-resort industry. And the bad news is that this implies of the spreading of financial losses, not limited to Macau, but to the region.

And China’s yuan depreciation will only exacerbate the region’s current conditions.

Meanwhile, there exists a feedback mechanism between economic downturn and debt. In Macau, this has hardly been apparent yet in her financial system. However, its social costs have emerged—a surge in kidnapping!

From Time.com:

Macau’s glitzy hotels and casinos are taking out insurance policies to protect themselves against a new threat to the house — the abduction of wealthy guests over unpaid gambling debts.The risk of kidnapping has increased significantly in recent months as fewer numbers flock to the Chinese Special Administrative Region that also serves as the world’s largest gambling hub, reports the South China Morning Post.This partly due to China’s slowing economy, meaning falling revenues for moneylenders that rely heavily on tourists from the mainland. As Beijing limits the amount of cash visitors can legally take to Macau, many high-stakes gamblers use local loan sharks for ready cash, which can be perilous if the cards and dice prove unfriendly.As most kidnappings occur in guests’ rooms, hotels could face lawsuits from victims and their families. The insurance policies mitigate this risk with coverage for legal liability and crisis responders.The Macau government reports that as many as 170 people were held against their will during the first six months of this year — more than double the figure for the same period of 2014. However, these are only the cases the authorities know about, with experts saying the true total is likely much higher.

Increase in the incidences of crimes and even possibly heightened risks on social instability will likely characterize an environment plagued by a deepening economic slump and or a financial crisis.

Macau represents just one of the many proverbial canary in the coal mine.

Finally, here are updated stock market price charts from Macau’s casino majors.

MGM China Holdings (HK:2282)

Galaxy Entertainment Group (HK:27)

Sands China Ltd. (HK: 1928)

Wynn Macau Ltd. (HK: 1128)

SJM Holdings Ltd. (HK:880) owner of Grand Lisboa

Early August, much of these stocks mounted had ferocious 10-20% rallies. Some mistakenly thought that it was the beginning of a turnaround.

It turned out that such rally signified a “bull trap”.

The resumption of losses has virtually erased all short term gains. Or, presently, these stocks have been drifting lower than the level when the August rally commenced.

It’s a great example of bear markets “descending on a ladder of hope”.

By the way, Macau’s crashing stocks have also spread to affect its US based parent firms….

…thus contributing the swoon of the Dow Jones Gaming Index. That’s aside from US economy dynamics.

On a personal note: I am not an ivory tower expert who talks the world without personally seeing them. So I went on the ground (one of Philippine casinos) last weekend to see for myself. And what I saw seems much aligned with what I have been writing about.

.png)

.png)

.png)