Because of the Spratly’s brouhaha, many Filipinos seem to be searching the web for the odds of winnability for the Philippines, in case of a military escalation that could lead to a war with China.

I think these people, whom have not experienced the horror of wars, seem to desire it, perhaps in the doltish presumption that any war won’t get them involved or that wars function as some form of sporting event.

In wars, the losers have always been the people, as both combatants and non-combatants get slaughtered, aside from the economic hardship, physical dislocation and the psychic or mental trauma that arises from such hellish events.

Worst, people from opposing camps shoulder the burden of paying for such outrageous exercise.

Yet if there are any winners, they have always been the politicians, who see people fighting and dying in their behalf and paying for their reckless adventures in the false name of nationalism.

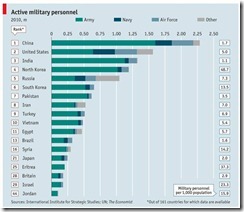

This graphic from the Economist.

The above graph only shows that a war with China is suicidal.

The better alternative is to engage them in more trading activities that should ease geopolitical pressures. Trade and not war is the answer.