As you probably know by now, the Philippine Peso surged to its highest level since June 2003 or a 2½ year high to Php 53.42 against the US dollar for an amazing gain of 1.36% over the week, essentially validating my contrarian forecast about a year ago.

Naturally, we have mainstream news accounts and their corresponding analysts piling over the reportage on what seems to be the stating the obvious....exploding overseas remittances. However, your prudent investor analyst who adopts the maxim of the illustrious economic journalist Frédéric Bastiat who declares “There is what is seen and the unseen”, which basically means an act or event as having been seen as the immediate cause to an effect but is not duly the underlying cause, in Bastiat’s words, ``When a man is impressed by the effect that is seen and has not yet learned to discern the effects that are not seen, he indulges in deplorable habits, not only through natural inclination, but deliberately.” In the context behavioral finance, Bastiat’s adage translates to what is usually deemed as ‘rationalization’ or an oversimplified explanation usually attributable to current events.

Figure 1, US Dollar/Philippine Peso Chart

In our Oct 17 to 21 edition, see US Tightening Affecting Global Financial Markets II, I wrote ``The chart above of the Philippine peso shows of the domestic currency appreciating after two rate hikes; on September 22nd (red arrow) the Peso was at 56.24 while prior to Thursday’s rate hike the Peso was last traded at 55.71.” In short, the incipience of the peso’s appreciation was marked by a series of interest rates increases adopted by our own version of Central Bank, the Bangko Sentral ng Pilipinas, as shown in Figure 1.

Of course, this is NOT to discount the remittance factors which coincidentally accelerated during the period as promptly reported by Manila Times’ Maricel E. Burgonio last November 16th, ``OFW remittances that month rose 28 percent to $941 million from a year ago. This led to a 28-percent growth in nine-month inflows to $7.9 billion from the $6.204 billion sent home in the same period last year.”

At the magnitude of today’s firming of our local currency, it would probably require remittances to grow by about 40-50% to drive the Peso to its current levels. Nonetheless, we should not forget that the remittances have been growing all year round yet the Peso hovered within the 56 to a US dollar levels in about 27% of the year! Particularly in July to September which was largely ascribed to political instability concerns arising from the Garci wiretapping scandal.

My bullish case for the Peso has mainly been predicated in the context of macro developments, particularly of surplus global liquidity, expanding trade, financial marketplace and economic integration. In short, the globalization of the economic and financial spheres has expedited the gradual leveling off in the purchasing power differentials underpinning today’s macro evolution.

If you think that the Philippine Peso’s 1.36% advance was enough to make this week’s cynosure, then you must be apprised that it was

Let us take it from the report of Bloomberg’s Christina Soon (emphasis mine), ``The rupiah surged 3 percent this week to 9,700 against the dollar, the biggest weekly gain since the period ended July 19, 2002. The currency yesterday climbed as high as 9,615, its strongest since June 20...The rupiah yesterday climbed to the strongest since June 20 after the central bank this week raised its benchmark interest rate for the sixth time in four months to slow inflation. Higher rates boost returns investors get for holding Indonesian assets. A new cabinet that was put into place this week also fueled expectations the government can attract more investment.”

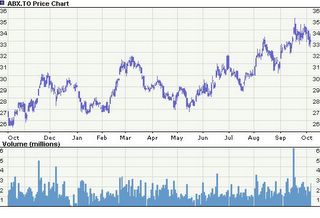

Figure 2

It has not been different from

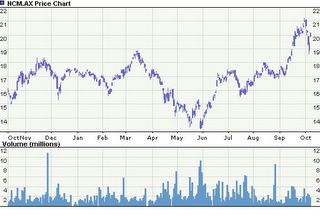

Figure 3

The Korean Won also a victim to the 1997 Asian Crisis presently shows of a steady and robust rebound (see Figure 3) in the wake of the downside overshoot. Again, perceived interest rate premiums have been spurring its present currency gains!

Ms. Soon notes of the gains of the other regional currencies such as Thai Baht (+.3%) to 41.28,

Aside from remittances Ms. Soon also notes of the other currency analysts views of growing spread differentials for the Philippine currency responsible for its current gains, ``The currency yesterday extended gains to a 29-month high after a report this week showed inflation rose at the fastest pace in three months in November, stoking speculation of an interest-rate increase next week....The consumer price index advanced 7.1 percent from a year earlier, up from 7 percent in the previous two months, the National Statistics Office said on Dec. 6. The currency added 1.4 percent through the end of October after Bangko Sentral ng Pilipinas lifted its key interest rate on Oct. 20 to curb inflation from higher fuel prices. The bank on Nov. 17 kept its key interest rate at 7.5 percent.”

What am I driving at? The US dollar’s sterling gains this year relative to its major trading partners has been primarily prompted by the view of better returns relative to currency yield spreads as a result of the 12 ‘measured’ increases by the US Federal Reserves on its interbank lending rate from 1% to 4.0% with another rate increase anticipated this Tuesday, December 13th. To quote the IMF’s December 2005 Financial Market Update (emphasis mine), ``The U.S. dollar appreciated as growth and interest rate differentials remained in favor of the United States and outweighed concerns over structural weaknesses, leading to robust investment inflows. Foreign demand for U.S. dollar financial assets, particularly bonds, remained in excess of amounts needed to finance the country’s current account deficit...Emerging market bond spreads tightened to record low levels on improving fundamentals and the search for yield.”

In other words, today’s $1.9 trillion daily traded currency markets are obsessed with the chase for yields emanating from a glut of credit and money, prompting portfolio flows into currencies that maintains a prospective positive cash premium spread relative to comparable anchor currencies, such as the US Dollar, Euro or Japanese Yen. This spread arbitrage is widely known as the ‘Carry Trade’. Hence, the Philippine currency is NOT exempt from trading strategies assimilated by portfolio managers and thereby derives its strength LESS from the ‘seen’ remittance flows but mainly from the ‘unseen’ portfolio flows. Empirical evidence such as the declining peso denominated and dollar denominated sovereign bond yields suggests of indicators supportive of this view, i.e. being investor supported and so as with partial signs into the Phisix based on net foreign buying~ in spite of present consolidation.

This is NOT to say that the Peso’s recent climb would reverse under such scenario, but rather once the structural infirmities of the US dollar would come into full view, as in 2002-2004, what could be expected in the currency marketplace would be a refocus on the present state of underlying fundamentals moored on growing intra-region economic and financial ties and the individual performance of emerging market economies.

Figure 4, Emerging Market and Global Yield differential spreads courtesy of IMF/JP Morgan and Merrill Lynch

As the recent IMF Financial Market Review (see Figure 4) notes (emphasis mine), ``Despite the rise in short-term rates in the United States, emerging markets have proven remarkably resilient to a variety of shocks, with emerging market external bond spreads falling to all-time lows. This resilience has been fostered by significant improvements in fundamentals, with emerging market countries having significantly reduced public debt-to-GDP ratios since 2002 due to strong economic growth, appreciating currencies and, in many cases, strong primary fiscal surpluses. Furthermore, external financing requirements for emerging market sovereigns and corporates have continued to decline as commodity prices rise and global growth boosts remittances from overseas workers.”

In short, the US dollar bear market in 2002- 2004 helped boosted fundamentals of emerging market assets particularly relative to sovereign and corporate bonds and had been doing so despite the recent rally seen with the world’s anchor currency. The realignment towards the purview of fundamentals from the yield perspective could help propel the Peso to maintain its momentum for further MODERATE gains in the coming year/s.

One must be reminded that the PESO has LAGGED the region such that today’s outperformance could be construed as simply a classic case of cyclical recovery.

In the present global economic milieu, immense disparities of purchasing power between developed and emerging market economies have created substantial economic opportunities for trade, service, goods production/manufacturing and financial exchange arbitrage, largely fueled by the web enabled technological revolution in information and communication services. The offshoot of this phenomenon has been to facilitate wealth redistribution to emerging market economies. It is for this reason why global capital flows are expected to continue to take advantage of

For instance, the Philippines is ranked among the lowest in terms of Purchasing Power Parity (PPP) as measured by the Economist’s Big Mac Index as of June 9th (Peso at 54.95 or higher prior to the article’s composition). In US dollar terms a Big Mac cost $1.47 in the Philippines compared to $3.06 in the United States, $1.54 in Hong Kong, $2.34 in Japan, $1.53 in Indonesia, $2.17 in Singapore, $2.49 in South Korea, $2.41 in Taiwan and $1.48 in Thailand. Whereas the pegged currencies then of

Albeit I would caution you from adhering to some outlooks that give emphasis to simply technical dimensions in predicting the future directional values of the Peso. One must be reminded that economic construct of the

However, going back to fundamental potentials, Goldman Sachs which four years ago, predicted the rise of the “BRIC”, the

Bloomberg Asian analyst William Pesek quotes Mr. Jim O'Neill, London-based head of global economic research at Goldman Sachs, dubbing the next generation of potential BRIC’s as ``Next Eleven, the list includes Bangladesh, Egypt, Indonesia, Iran, South Korea, Mexico, Nigeria, Pakistan, the Philippines, Turkey and Vietnam” based from the criteria which includes “macroeconomic stability, political maturity, openness of trade and investment policies and quality of education.”

Of course, this sanguine outlook does not presume or gloss over risks or incidences without any road bumps. As mentioned in the past, the present macro risks includes the sharp unwinding of intrinsic imbalances such as a sharp slowdown in the Chinese economy, a real estate led consumer retrenchment in the US, a collapse in the value of the Japanese Yen, a US dollar crash, a trade war or wave of protectionism, surge of consumer price inflation...among the others that may lead to unnerving investors, a possible liquidity crunch or portfolio outflows and reverse the pervasively positive sentiment for the region and its asset classes.

The risks could also be insulated in nature with regards to the domestic arena, particularly political destabilization and possible governance or policy lapses that could derail the semblance of progress as evidenced by the positive gains evinced by domestic financial assets.