``But there are many others who are not bashful about using government power to do "good." They truly believe they can make the economy fair through a redistributive tax and spending system; make the people moral by regulating personal behavior and choices; and remake the world in our image using armies. They argue that the use of force to achieve good is legitimate and proper for government - always speaking of the noble goals while ignoring the inevitable failures and evils caused by coercion. Not only do they justify government force, they believe they have a moral obligation to do so.”-Congressman Ron Paul of

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, July 16, 2006

Politics, Flawed Policies and the Road to Hell

Friday, July 14, 2006

Crude Oil hits Fresh Record at $78 per barrel amidst Media's stoicism

Anyway, what media papers over is what we deal with. According to Bloomberg (you may click on the link for the entire article),

Hezbollah militants fired rockets from Lebanon into Israel's third-biggest city after Israeli forces bombed Beirut international airport and other targets. A Nigerian newspaper yesterday reported that rebels had attacked pipelines, later denied by the owner of the facility, Italy's Eni SpA.

``There's real disruption to supplies in Nigeria, potential disruptions in Iran, and now you've got what's happening in Israel,'' said Tobin Gorey, commodity analyst at Commonwealth Bank of Australia Ltd. in Sydney. ``Who wants to sell in this environment?''

Crude oil for August delivery rose as much as $1.70, or 2.2 percent, to $78.40 a barrel in after-hours electronic trading on the New York Mercantile Exchange. It was at $77.95 at 7:45 a.m. in Singapore, 35 percent higher than a year ago.

Monday, July 10, 2006

Phisix, Peso Driven by Fedwatch Plays; The Gallery Experience

Figure 4: Phisix (candlestick) and the USD/PESO (blue line)

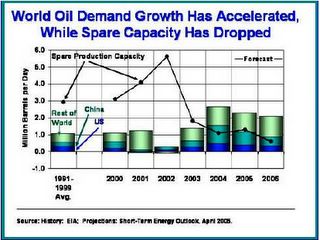

Record High Oil Prices and Interventionist Policies

``Since

Figure 1: stockcharts.com: benchmark WTIC Crude oil at a trading range?

Figure 2: Chart of the day: Inflation adjusted Oil prices

If government’s directives have been efficient, why has there been a massive shortage of investments by both public institutions and the private companies? Why has the demand-supply imbalances remained unresolved, if not aggravated? Or simply, why have oil prices persists to remain at lofty levels? And again, who pays for such miscalculations or ineptitude? Obviously, the people/consumers/constituents who ironically had been the intended party to benefit from supposed control. Whereas in the free markets erroneous decisions lead to individual losses or bankruptcies, flawed government policies have been borne by the citizenry or constituents via increased taxations or loss of purchasing power which essentially leads to the deterioration of the standards of living.

Figure 3: Energy Letter: Global Rig Count (April)

Investment implication: the obvious trend is to search for junior explorers who could build up sizeable reserves and become likely acquisition targets by Oil Majors.

Monday, July 03, 2006

Bullish Gold Backed by Gold/Oil Ratio

Figure 5 Stockcharts.com: Holding WTIC Crude (candle) amidst financial market turmoil.

Figure 7 Dailywealth: Gold/Oil Ratio: Gold cheaper than Oil

Fed Dilemma: Too Much Pressure To Continue Hikes

Yes, I have raised such concern that the Fed may initiate a pause or even a succession of rate cuts on the premise of an adverse

Figure 3 Stockcharts.com: Rebound in Phisix (candle) and CRB Index (line chart)

Figure 4 Economagic: Looks like a 40-year trough-to-trough cycle for benchmark treasuries

EZ Money Addicts and Pavlov’s Drooling Dogs

Figure 2 Stockcharts.com: US Dollar (left chart) and benchmark US Treasury Yields (right chart-candlestick) breaks down, while JP Morgan Emerging Debt (line chart) Rallies

In other words, while the endemic systemic risks have been mounting worldwide for quite sometime now, global financial markets have been inured if not hardwired into believing of the constancy of advancement, irrespective of the enormous leverage latched into the system. That’s how rational the markets are. Add leverage in order to advance the financial markets, which should translate to economic growth.

Wednesday, June 28, 2006

Hans Sennholz: Price Controls on Labor

Mr. Sennholz enunciates from the theoretical standpoint why Price controls fails...

Price Controls on Labor

by Hans F. Sennholz

The official Federal minimum presently stands at $5.15 an hour; the actual minimum is much higher. No employer can overlook the mandated fringe benefits which he is forced to pay above the minimum. There are employer Social Security taxes, unemployment and workers' compensation levies, and paid holidays.

In some industries the workers' compensation levy alone may amount to more than one-half of the wages paid. And if the employer should carry his workers' health insurance costs, employment costs may be double the minimum rate. If eager members of Congress should be successful in raising the minimum by two or three dollars an hour, many young people may be condemned to permanent unemployment.

The rate of unemployment tends to be directly proportional to the excess of labor costs over productivity. In many European countries with official minimum wages of more than $10 an hour, the rate of unemployment is measured in double-digit rates although governments spend massive amounts on make-work projects.

Hans F. Sennholz,

Sunday, June 25, 2006

Entertainment Value in Stockmarket reporting

``One area that does show some significance correlation with accuracy, meanwhile, is the frequency of an expert's contact with the media. Unfortunately, that correlation is negative. You read that right: experts that tend to appear regularly on TV tend to make forecasts that are even less accurate, on average, than their camera-shy peers.”-Matt Stichnoth, Bankstocks.com

Has Gold Found its Bottom? Philippine Mining Index to Lead Phisix Anew?

``No government wants a hard currency which preserves purchasing power. They want a deceptively soft currency which inflates away debt and secures a competitive advantage for exports.”-David Fuller, Fullermoney.com

Figure 3: Stockcharts...Breakouts the US Dollar Index (black line) and US 10 Year Yields (candlestick)

Figure 4 Rising Metal Prices (blue line) and FED Fund Rate (red line)

Figure 5 Daily Wealth: Gold’s floor?

Figure 6: Stockcharts: rallying Gold (candle) MS Emerging Free Markets (line)

Figure 7: Phil Mining Index (candle) Phisix (green) and CBOE GOX (Blue)

Bernanke is No Bubble Buster, Little Visible Signals of Unwinding Yen Carry Trade

``Cycles in markets do exist, but it's impossible to pinpoint how long they will last with any precision. Much depends on the actions of government officials and the intelligence of the public. Each time is different. I recall commentators calling for a six-year gold cycle, or a 10-year real estate cycle. They are all ephemeral, because, as Shakespeare says, our actions are "not in the stars, but in ourselves."”-Mark Skousen Invest U

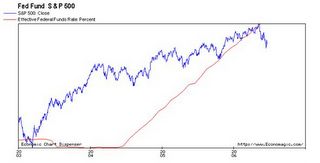

Figure 1: Economagic: Fed Fund and the US S & P 500 benchmark

Figure 2: ADB’s Asiabondsonline: JGB’s 2 and 10 Year yields climbing higher

Now the draining of US dollar based liquidity has its belated effects percolating into the

Thursday, June 22, 2006

Gold’s back....Phil Mining Index leads the Phisix?

The recent emergence of a global “risk aversion” led to convulsive liquidations in a majority of asset classes with commodities and emerging bourses suffering the most after delivering the best returns over the past 3 years.

The Phisix including its Mining Index component like its peers abroad endured the recent spate of shellacking. However, activities in the gold market appear to have driven the mining index higher despite the lackluster foreign driven selling performance of the Phisix (blue line chart below).