``With so much complacency around and with such a high propensity to speculate in just about everything among all classes of investors, a nice crash should not entirely be ruled out.”- Dr. Marc Faber

I know, to some I may have sounded like an alarmist predicting a financial storm ahead. Yet despite my interim morose outlook, the financial markets in particular, the global equity markets continue to react antithetically against these premises.

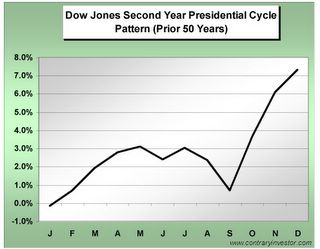

Yet evidences continue to mount in support of my concerns. Recently, I have assigned the weaknesses seen in the broad spectrum of energy prices to dampening demand in the US. Paul Kasriel, Chief economist of Northern Trust, points to the declining trend of US Petroleum imports in quantity as shown in Figure 1, as probable signs of demand contraction.

Figure 1: Northern Trust: Declining Energy Related Imports

Writes Mr. Kasriel, ``So, there would appear to be more evidence supporting the demand-side explanation for the recent decline in oil prices than the supply-side explanation. If it is weaker demand that is explaining lower oil prices, then do not look for a rapid re-acceleration in consumer spending or domestic spending of any sort. To be sure, a decline in energy prices will lead to stronger consumer spending than otherwise would be the case. But this would be a second-order effect if the decline in oil prices is the result of a restrictive monetary policy.”

The same cannot be said of China whose crude oil imports jumped 35% in August according to Xiao Yu of Bloomberg. I’d like to remind you that during the horrific “risk aversion” selling last May, Crude Oil despite the much touted speculative funds or “terror premium” factor largely attributed to its runup, was largely unaffected by the cross asset class selloff. In short, it is unlikely that today’s actions in the energy sector have been due to merely reallocation by the speculation money.

Figure 2: Fullermoney.com Oil’s Countertrend risk since 2001

Or could it be that the present softening of oil’s prices as merely a technical hiccup over its long term trend as had been the case since 2001, (see Figure 2)?

Analyst Barry Ritholtz echoes a similar view on the apparent corrosion of consumer demand (emphasis mine), ``In the past 16 Federal Reserve tightening cycles, there has been one true soft landing in 1994. I continue to look at that not as impossible, but as a low probability event.... My largest present concern is oil and other commodity prices. It's no coincidence that gas, oil, gold, aluminum and copper all have dropped at the same time. I read that as signs of a global slowing in demand.”

At the same time, we likewise hear parallel sentiments and warnings from the head honchos of the multilateral agency the IMF as Mr. Rodrigo Rato (Managing Director) and Mr. Raghuram Rajan (chief economist).

I watched Mr. Rajan’s interview at Bloomberg where he commented that the world economies have been growing strongly supported by emerging domestic demand. As an example, private demand has made up the bulk of Japan’s economic turnaround as shown in Figure 3 following a decade long slump.

Figure 3: JETRO: Domestic Demand leads Japan’s Recovery

However, Mr. Rajan thinks that while there could be some impact on the world economy by an economic downturn in the US, he is uncertain as to the degree or the magnitude of such impact.

Where the marked deceleration in the US real estate industry had been carried over by mainstream media accompanied by much heralded warnings, such swing in sentiment could have probably prompted markets to react in a diametric fashion, hence, the continued buoyancy (climbing a wall of worry?).

Yet when we talk about sentiments, it is noteworthy to point out that the global equity markets have shown extreme complacency as measured by the VIX chart (see my August 28 to September 1, edition, Market Dissonance: Bull or Bear Amidst A Slowdown?).

Moreover, if one takes a look at how credit spreads are presently behaving in the bond markets, as another measure of sentiment; we see similarly the same pattern.

Figure 4 Yardeni.com: Moody’s Corporate spreads

The spread between the yields of corporate bonds and sovereign debt instruments reflects investor sentiment. When investors are wary over the prospects of the economy, lenders naturally become hesitant to tidy over money to corporations resulting to higher yield differentials. Today, despite the pronounced “moderation”, US corporate bond spreads remain at very low levels signifying a high degree of complacency see Figure 4 courtesy of yardeni.com (Thank you James!).

Figure 5: Bank of International Settlements: Default rates and CDS markets

In addition, the lax environment can be seen in default rates and forecasts as shown in Figure 5, seen through the eyes of the Credit Default Swap markets.

Credit Default Swaps (CDS) are derivative instruments that swap or transfer the risks of credit exposure of fixed income products between parties.

Let’s hear it from the central bank of the world’s combined central banks, the Bank of International Settlement (emphasis mine), ``Major corporate spread indices stayed well above previous lows in the United States despite indicators of credit quality that showed few signs of deteriorating. Moody’s forecast for the 12-month trailing speculative grade default rate for January 2007 was revised down by August 2006 to 2% from over 3% six months earlier, continuing a pattern of downward-revised forecasts over the past few years (left-hand panel). Expected default frequencies, as calculated by Moody’s KMV based on balance sheet information and asset price volatility, were also stable at low levels for firms within rating categories (centre panel). The persistence of higher spreads in the face of a broadly unchanged outlook for credit quality is consistent with indicators showing that the appetite for credit risk never fully rebounded from the turmoil in corporate bond and CDS markets in the second quarter of 2005 (right-hand panel).”

While there have been some signs of turbulence as a result of the global shakeout in May, investors have basically assumed the present placid trends as the future’s trajectory, note the phrase “broadly unchanged outlook for credit quality”. That’s how smug the financial markets are relative to risks. Evidently, that’s also a product of an ocean of liquidity. Now again, we question this tranquil outlook in the face of economic growth “moderation” whose repercussions remain undetermined but whose markets has been obviously priced for “perfection”.

Figure 6: PSE and Dow Jones World Index

Figure 6 shows that the world markets have been, as I have pointing out ad nauseam, largely behaving in synchronicity. The sheer gargantuan size of the liquidity pool and its continued growth, in the global financial system has led investors to stretch for returns. Further, the digitization of money and credit plus the technology enabled integration of the financial markets has allowed capital markets to deepen, reduce barriers and domestic volatility, facilitate for a seamless flux of capital that has prompted for resonating movements of these benchmarks. For instance, the Phisix and the Dow Jones World Index has moved as one or has seen a stronger correlation over the past quarter relative to the previous period.

I have to admit though that the recent behavior of the Phisix had been that of an upside momentum following last Friday’s breakout. Volatility as measured by the Bollinger band seen in the upper window appears to signify continuity of such upside momentum, again in consonance with the activities of world markets, with particular emphasis to the US markets.

Of course for the time being, my fears could be misplaced considering that one, the financial environment remains unrestrictive which means contemporary avenues or channels of liquidity remains as potential fuel for any added upside moves. Besides, the loose lending standards may cushion whatever shortfall US consumers may yet face over the interim and may extend its heavily levered spending binges.

Eric Roseman, Investment Director of the Sovereign Society wrote (emphasis mine), ``When long-term U.S. interest rates are below 5%, it's probably not the time to get bearish on global economic growth and commodities. Keep in mind that previous economic recessions began with the Federal Funds rate closer to 7% and long-term rates at 6.5%, or higher. Global liquidity has eased somewhat since mid-May. But overall, bank lending is still very robust around the world and companies are still logging respectable earnings growth, though likely to be moderated over the next several months. Unless a geopolitical event happens that tips the global economy into recession, this bull market will still be alive and kicking.”

Second, lower energy prices and lower yields are both stimulative. Lastly there are signs of incremental increases in wages and accelerated capital spending that may yet cushion the decline in the US real estate industry and extend the spending binges of the overstretched consumers.

Yes, my fears may have yet to turn into reality but I am not throwing caution into the wind and withdrawing my cynicism towards the present market climate until we see more vivid signals from the financial markets that would merit increased exposure. Instead, I would rather take this opportunity to trade the market.

Finally, my suspicions on gold’s recent downdraft have been confirmed. According to this Reuter’s report, ``According to the weekly balance sheet issued by the European Central Bank, gold holdings fell 114 million euros in the week to September 8, the biggest drop in two months. The ECB said this was due to sales by two central banks, but did not name them. Separately, the Bank of Portugal announced that it had sold 20 tonnes of gold "in recent months", taking its total for the current year of the agreement to 45 tonnes.”

Governments will do anything as to achieve its short term goals usually with long term unintended consequences. When governments distort markets we know that the effect is likely to be short-term. Moreover, governments have had ignoble track records in the markets. One can just be reminded of Britain’s Exchequer Gordon Brown controversial gold sales in 1999 which incidentally was at the record low of around $250 per ounce. And to consider governments are suppose to know what’s best for you and me. Just imagine the losses to the British taxpayers borne out of this miscalculation. On this premise alone, I see a continuing bullish trend on the monetary metal even as it may be weighed down by short term volatility emanating from government interventions.