This article from tucksonweekly delves on the several issues ignored or deliberately downplayed by the mainstream press for one reason or another, mostly political. Quoting the entire article...

Censored Stories

Project Censored presents the 10 stories the mainstream media ignored over the past year

By CAMILLE T. TAIARA

Just four days before the 2004 presidential election, a prestigious British medical journal published the results of a rigorous study by Dr. Les Roberts, a widely respected researcher. Roberts concluded that close to 100,000 people had died in the invasion and occupation of Iraq.

Most were noncombatant civilians. Many were children.

But that news didn't make the front pages of the major newspapers. It wasn't on the network news. So most voters knew little or nothing about the brutal civilian impact of President George W. Bush's war when they went to the polls.

That's just one of the big stories the mainstream news media ignored, blacked out or underreported during the past year, according to Project Censored, a media watchdog group based at California's Sonoma State University.

Every year, project researchers scour the media looking for news that never really made the news, publishing the results in a book, this year titled Censored 2006. Of course, as Project Censored staffers painstakingly explain every year, their "censored" stories aren't literally censored, per se. Most can be found on the Internet if you know where to look. And some have even received some ink in the mainstream press. "Censorship," explains project director Peter Phillips, "is any interference with the free flow of information in society." The stories highlighted by Project Censored simply haven't received the kind of attention they warrant, and therefore haven't made it into the greater public consciousness.

"If there were a real democratic press, these are the kind of stories they would do," says Sut Jhally, professor of communications at the University of Massachusetts and executive director of the Media Education Foundation.

The stories the researchers identify involve corporate misdeeds and governmental abuses that have been underreported if not altogether ignored, says Jhally, who helped judge Project Censored's top picks. For the most part, he adds, "stories that affect the powerful don't get reported by the corporate media."

Can a story really be "censored" in the Internet age, when information from millions of sources whips around the world in a matter of seconds? When a single obscure journal article can be distributed and discussed on hundreds of blogs and Web sites? When partisans from all sides dissect the mainstream media on the Web every day? Absolutely, says Jhally.

"The Internet is a great place to go if you already know that the mainstream media is heavily biased" and you actively search out sites on the outer limits of the Web, he notes. "Otherwise, it's just another place where they try to sell you stuff. The challenge for a democratic society is how to get vital information not only at the margins but at the center of our culture."

This list should not be taken as gospel; not every article or source Project Censored has cited over the years is completely credible; at least one this year is pretty shaky (see sidebar).

But most of the stories that made the project's Top 10 were published by more reliable sources and included only verifiable information. And Project Censored's overall findings provide valuable insights into the kinds of issues the mainstream media should be paying closer attention to.

1. Bush Administration Moves to Eliminate Open Government

While the Bush administration has expanded its ability to keep tabs on civilians, it's been working to make sure the public--and even Congress--can't find out what the government is doing.

One year ago, Rep. Henry A. Waxman, D-Calif., released an 81-page analysis of how the administration has administered the country's major open government laws. His report found that the feds consistently "narrowed the scope and application" of the Freedom of Information Act, the Presidential Records Act and other key public-information legislation, while expanding laws blocking access to certain records--even creating new categories of "protected" information and exempting entire departments from public scrutiny.

When those methods haven't been enough, the Bush administration has simply refused to release records--even when the requester was a congressional subcommittee or the Government Accountability Office, the study found. A few of the potentially incriminating documents Bush and co. have refused to hand over to their colleagues on Capitol Hill include records of contacts between large energy companies and Vice President Dick Cheney's energy task force; White House memos pertaining to Saddam Hussein's, shall we say, "elusive" weapons of mass destruction; and reports describing torture at Abu Ghraib

The report's findings were so dramatic as to indicate "an unprecedented assault on the laws that make our government open and accountable," Waxman said at a Sept. 14, 2004, press conference announcing the report's release.

Given the news media's intrinsic interest in safeguarding open-government laws, one would think it would be plenty motivated to publicize such findings far and wide. However, most Americans remain oblivious to just how much more secretive--and autocratic--our leaders in the White House have become.

Source: "New Report Details Bush Administration Secrecy" press release, Karen Lightfoot, Government Reform Minority Office, posted on www.commondreams.org, Sept. 14, 2004.

2. Media Coverage Fails on Iraq: Fallujah and the Civilian Death Toll

Decades from now, the civilized world may well look back on the assaults on Fallujah in April and November 2004 and point to them as examples of the United States' and Britain's utter disregard for the most basic wartime rules of engagement.

Not long after the "coalition" had embarked on its second offensive, U.N. High Commissioner for Human Rights Louise Arbour called for an investigation into whether the Americans and their allies had engaged in "the deliberate targeting of civilians, indiscriminate and disproportionate attacks, the killing of injured persons, and the use of human shields," among other possible "grave breaches of the Geneva Conventions ... considered war crimes" under federal law.

More than 83 percent of Fallujah's 300,000 residents fled the city, Mary Trotochaud and Rick McDowell, staffers with the American Friends Service Committee, reported in AFSC's Peacework magazine. Men between the ages of 15 and 45 were refused safe passage, and all who remained--about 50,000--were treated as enemy combatants, according to the article.

Numerous sources reported that coalition forces cut off water and electricity, seized the main hospital, shot at anyone who ventured out into the open, executed families waving white flags while trying to swim across the Euphrates or otherwise flee the city, shot at ambulances, raided homes and killed people who didn't understand English, rolled over injured people with tanks, and allowed corpses to rot in the streets and be eaten by dogs.

Medical staff and others reported seeing people, dead and alive, with melted faces and limbs, injuries consistent with the use of phosphorous bombs.

But you wouldn't know any of this unless you'd come across a rare report by one of an even rarer number of independent journalists--or known which obscure Web site to log onto for real information.

Of course, the media blackout extends far beyond Fallujah.

The U.S. military's refusal to keep an Iraqi death count has been mirrored by the mainstream media, which systematically dodges the question of how many Iraqi civilians have been killed.

Les Roberts, an investigator with the John Hopkins Bloomberg School of Public Health, conducted a rigorous inquiry into pre- and post-invasion mortality in Iraq, sneaking into Iraq by lying flat on the bed of an SUV and training observers on the scene. The results were published in the Lancet, a prestigious peer-reviewed British medical journal, on Oct. 29, 2004--just four days prior to the U.S. presidential elections. Roberts and his team (including researchers from Columbia University and from Al-Mustansiriya University in Baghdad) concluded that "the death toll associated with the invasion and occupation of Iraq is probably about 100,000 people, and may be much higher."

The vast majority of those deaths resulted from violence--particularly aerial bombardments--and more than half of the fatalities were women or children, they found.

The State Department had relied heavily on studies by Roberts in the past. And when Roberts, using similar techniques, calculated in 2000 that about 1.7 million had died in the Congo as the result of almost two years of armed conflict, the news media picked up the story; the United Nations more than doubled its request for aid for the Congo, and the United States pledged an additional $10 million.

This time, silence--interrupted only by the occasional critique dismissing Roberts's report. The major television news shows, Project Censored found, never mentioned it.

Sources: "The Invasion of Fallujah: A Study in the Subversion of Truth," Mary Trotochaud and Rick McDowell, Peacework, Dec. 2004-Jan. 2005; "US Media Applauds Destruction of Fallujah," David Walsh, www.wsws.org (World Socialist Web site), Nov. 17, 2004; "Fallujah Refugees Tell of Life and Death in the Kill Zone," Dahr Jamail, New Standard, Dec. 3, 2004; "Mortality before and after the 2003 Invasion of Iraq," Les Roberts, Riyadh Lafta, Richard Garfield, Jamal Khudhairi and Gilbert Burnham, Lancet, Oct. 29, 2004; "The War in Iraq: Civilian Casualties, Political Responsibilities," Richard Horton, Lancet, Oct. 29, 2004; "Lost Count," Lila Guterman, Chronicle of Higher Education, Feb. 4, 2005; "CNN to Al Jazeera: Why Report Civilian Deaths?," Fairness and Accuracy in Reporting, April 15, 2004, and Asheville Global Report, April 22-28, 2004.

3. Another Year of Distorted Election Coverage

Last year, Project Censored foretold the potential for electoral wrongdoing in the 2004 presidential campaign: The "sale of electoral politics" made No. 6 in the list of 2003-04's most underreported stories. The mainstream media had largely ignored the evidence that electronic voting machines were susceptible to tampering, as well as political alliances between the machines' manufacturers and the Republican Party.

Then came Nov. 2, 2004.

Bush prevailed by 3 million votes--despite exit polls that clearly projected John Kerry winning by a margin of 5 million.

"Exit polls are highly accurate," Steve Freeman, professor at the University of Pennsylvania's Center for Organizational Dynamics, and Temple University statistician Josh Mitteldorf wrote in In These Times. "They remove most of the sources of potential polling error by identifying actual voters and asking them immediately afterward who they had voted for."

The 8-million-vote discrepancy was well beyond the poll's recognized, less-than-1-percent margin of error. And when Freeman and Mitteldorf analyzed the data collected by the two companies that conducted the polls, they found concrete evidence of potential fraud in the official count.

"Only in precincts that used old-fashioned, hand-counted paper ballots did the official count and the exit polls fall within the normal sampling margin of error," they wrote. And "the discrepancy between the exit polls and the official count was considerably greater in the critical swing states."

Inconsistencies were so much more marked in African-American communities as to renew calls for racial equity in our voting system. "It is now time to make counting that vote a right, not just casting it, before Jim Crow rides again in the next election," wrote Rev. Jesse Jackson and Greg Palast in the Seattle Post-Intelligencer.

Sources: "A Corrupt Election," Steve Freeman and Josh Mitteldorf, In These Times, Feb. 15, 2005; "Jim Crow Returns to the Voting Booth, Greg Palast and Rev. Jesse Jackson, Seattle Post-Intelligencer, Jan. 26, 2005; "How a Republican Election Supervisor Manipulated the 2004 Central Ohio Vote," Bob Fitrakis and Harvey Wasserman, www.freepress.org, Nov. 23, 2004.

4. Surveillance Society Quietly Moves In

It's a well-known dirty trick in the halls of government: If you want to pass unpopular legislation that you know won't stand up to scrutiny, just wait until the public isn't looking. That's precisely what the Bush administration did Dec. 13, 2003, the day American troops captured Saddam Hussein.

Bush celebrated the occasion by privately signing into law the Intelligence Authorization Act--a controversial expansion of the PATRIOT Act that included items culled from the "Domestic Security Enhancement Act of 2003," a draft proposal that had been shelved due to a public outcry after being leaked.

Specifically, the IAA allows the government to obtain an individual's financial records without a court order. The law also makes it illegal for institutions to inform anyone that the government has requested those records, or that information has been shared with the authorities.

"The law also broadens the definition of 'financial institution' to include insurance companies, travel and real estate agencies, stockbrokers, the U.S. Postal Service, jewelry stores, casinos, airlines, car dealerships, and any other business 'whose cash transactions have a high degree of usefulness in criminal, tax or regulatory matters'" warned Nikki Swartz in the Information Management Journal. According to Swartz, the definition is now so broad that it could plausibly be used to access even school transcripts or medical records.

"In one fell swoop, this act has decimated our rights to privacy, due process, and freedom of speech," wrote Anna Samson Miranda in an article for LiP magazine titled "Grave New World" that documented the ways in which the government already employs high tech, private industry, and everyday citizens as part of a vast web of surveillance.

Miranda warned, "If we are too busy, distracted, or apathetic to fight government and corporate surveillance and data collection, we will find ourselves unable to go anywhere--whether down the street for a cup of coffee or across the country for a protest--without being watched."

Sources: "PATRIOT Act's Reach Expanded Despite Part Being Struck Down," Nikki Swartz, Information Management Journal, March/April 2004; "Grave New World," Anna Samson Miranda, LiP, Winter 2004; "Where Big Brother Snoops on Americans 24/7," Teresa Hampton and Doug Thompson, www.capitolhillblue.com, June 7, 2004.

5. U.S. Uses Tsunami to Military Advantage in Southeast Asia

The American people reacted to the tsunami that hit the Indian Ocean last December with an outpouring of compassion and private donations. Across the nation, neighbors got together to collect food, clothing, medicine and financial contributions. Schoolchildren completed class projects to help the cause.

Unfortunately, the U.S. government didn't reflect the same level of altruism.

President Bush initially offered an embarrassingly low $15 million in aid. More important, Project Censored found that the U.S. government exploited the catastrophe to its own strategic advantage.

Establishing a stronger military presence in the area could help the United States keep closer tabs on China--which, thanks to its burgeoning economic and military muscle, has emerged as one of this country's greatest potential rivals.

It could also fortify an important military launching ground and help consolidate control over potentially lucrative trade routes. The United States currently operates a base out of Diego Garcia--a former British mandate in the Chagos Archipelago (about halfway between Africa and Indonesia), but the lease runs out in 2016. The isle is also "remote and Washington is desperate for an alternative," wrote veteran Indian journalist Rahul Bedi.

"Consequently, in the name of relief, the U.S. revived the Utapao military base in Thailand it had used during the Vietnam War (and) reactivated its military cooperation agreements with Thailand and the Visiting Forces Agreement with the Philippines," Bedi reported.

Last February, the State Department mended broken ties with the notoriously vicious and corrupt Indonesian military--although human rights observers charged the military with withholding "food and other relief from civilians suspected of supporting the secessionist insurgency, the Free Aceh Movement," Jim Lobe reported for the Inter Press Service.

Sources: "US Turns Tsunami into Military Strategy," Jane's Foreign Report, Feb. 15, 2005; "US Has Used Tsunami to Boost Aims in Stricken Area," Rahul Bedi, Irish Times, Feb. 8, 2005; "Bush Uses Tsunami Aid to Regain Foothold in Indonesia," Jim Lobe, Inter Press Service, Jan. 18, 2005.

6. The Real Oil-for-Food Scam

Last year, right-wingers in Congress began kicking up a fuss about how the United Nations had allegedly allowed Saddam Hussein to rake in $10 billion in illegal cash through the Oil for Food program. Headlines screamed scandal. New York Times' columnist William Safire referred to the alleged U.N. con game as "the richest rip-off in world history."

But those who knew how the program had been set up and run--and under whose watch--were not swayed.

The initial accusations were based on a General Accounting Office report released in April 2004 and were later bolstered by a more detailed report commissioned by the CIA.

According to the GAO, Hussein smuggled $6 billion worth of oil out of Iraq--most of it through the Persian Gulf. Yet the U.N. fleet charged with intercepting any such smugglers was under direct command of American officers, and consisted overwhelmingly of U.S. Navy ships. In 2001, for example, 90 of its vessels belonged to the United States, while Britain contributed only four, Joy Gordon wrote in a December article for Harper's magazine.

Most of the oil that left Iraq by land did so through Jordan and Turkey--with the approval of the United States. The first Bush administration informally exempted Jordan from the ban on purchasing Iraqi oil--an arrangement that provided Hussein with $4.4 billion over 10 years, according to the CIA's own findings. The United States later allowed Iraq to leak another $710 million worth of oil through Turkey--"all while U.S. planes enforcing no-fly zones flew overhead," Gordon wrote.

Scott Ritter, a U.N. weapons inspector in Iraq during the first six years of economic sanctions against the country, unearthed yet another scam: The United States allegedly allowed an oil company run by Russian foreign minister Yevgeny Primakov's sister to purchase cheap oil from Iraq and resell it to U.S. companies at market value--purportedly earning Hussein "hundreds of millions" more.

"It has been estimated that 80 percent of the oil illegally smuggled out of Iraq under 'oil for food' ended up in the United States," Ritter wrote in the U.K. Independent.

Sources: "The UN Is Us: Exposing Saddam Hussein's Silent Partner," Joy Gordon, Harper's, December 2004; "The Oil for Food 'Scandal' Is a Cynical Smokescreen," Scott Ritter, UK Independent, Dec. 12, 2004.

7. Journalists Face Unprecedented Dangers to Life and Livelihood

Last year was the deadliest year for reporters since the International Federation of Journalists began keeping tabs in 1984. A total of 129 media workers lost their lives, and 49 of them--more than a third--were killed in Iraq.

In short, nonembedded journalists have now become familiar victims of U.S. military actions abroad.

"As far as anyone has yet proved, no commanding officer ever ordered a subordinate to fire on journalists as such," wrote Steve Weissman in an update for Censored 2006. But what can be shown is a pattern of tacit complicity, side by side with a heavy-handed campaign to curb journalists' right to roam freely.

The Pentagon has refused to implement basic safeguards to protect journalists who aren't embedded with coalition forces, despite repeated requests by Reuters and media-advocacy organizations.

The U.S. military exonerated the Army of any wrongdoing in its now-infamous attack on the Palestine Hotel--which, as the Pentagon knew, functioned as headquarters for about 100 media workers--when coalition forces rolled into Baghdad on April 8, 2003.

To date, U.S. authorities have not disciplined a single officer or soldier involved in the killing of a journalist, according to Project Censored.

Meanwhile, the interim government the United States installed in Iraq raided and closed down Al-Jazeera's Baghdad offices almost as soon as it took power and banned the network from doing any reporting in the country. In November, the interim government ordered news organizations to "stick to the government line on the U.S.-led offensive in Fallujah or face legal action," in an official command sent out on interim prime minister Eyad Allawi's letterhead and quoted in a November report by independent reporter Dahr Jamail.

And both American and interim government forces detained numerous journalists in and around Fallujah that month, holding them for days.

Sources: "Dead Messengers: How the US Military Threatens Journalists," Steve Weissman, www.truthout.org, Feb. 28, 2005; "Media Repression in 'Liberated' Land," Dahr Jamail, Inter Press Service, Nov. 18, 2004.

8. Iraqi Farmers Threatened by Bremer's Mandates

Historians believe it was in the "fertile crescent" of Mesopotamia, where Iraq now lies, that humans first learned to farm. "It is here, in around 8500 or 8000 B.C., that mankind first domesticated wheat, here that agriculture was born," wrote Jeremy Smith in the Ecologist. This entire time, "Iraqi farmers have been naturally selecting wheat varieties that work best with their climate ... and cross-pollinated them with others with different strengths.

"The U.S., however, has decided that, despite 10,000 years practice, Iraqis don't know what wheat works best in their own conditions."

Smith was referring to Order 81, one of 100 directives penned by L. Paul Bremer III, the U.S. administrator in Iraq, and left as a legacy by the American government when it transferred operations to interim Iraqi authorities. The regulation sets criteria for the patenting of seeds that can only be met by multinational companies like Monsanto or Syngenta, and it grants the patent holder exclusive rights over every aspect of all plant products yielded by those seeds. Because of naturally occurring cross-pollination, the new scheme effectively launches a process whereby Iraqi farmers will soon have to purchase their seeds rather than using seeds saved from their own crops or bought at the local market.

Native varieties will be replaced by foreign--and genetically engineered--seeds, and Iraqi agriculture will become more vulnerable to disease as biological diversity is lost.

Texas A&M University, which brags that its agriculture program is a "world leader" in the use of biotechnology, has already embarked on a $107 million project to "re-educate" Iraqi farmers to grow industrial-sized harvests, for export, using American seeds. And anyone who's ever paid attention to how this has worked elsewhere in the global South knows what comes next: Farmers will lose their lands, and the country will lose its ability to feed itself, engendering poverty and dependency.

On TomPaine.com, Greg Palast identified Order 81 as one of several authored by Bremer that fit nicely into the outlines of a U.S. "Economy Plan," a 101-page blueprint for the economic makeover of Iraq, formulated with ample help from corporate lobbyists. Palast reported that someone inside the State Department leaked the plan to him a month prior to the invasion.

Smith put it simply: "The people whose forefathers first mastered the domestication of wheat will now have to pay for the privilege of growing it for someone else. And with that, the world's oldest farming heritage will become just another subsidiary link in the vast American supply chain."

Sources: "Iraq's New Patent Law: A Declaration of War Against Farmers," Focus on the Global South and Grain, Grain, October 2004; "Adventure Capitalism," Greg Palast, www.tompaine.com, Oct. 26, 2004; "US Seeking to Totally Re-Engineer Iraqi Traditional Farming System into a US Style Corporate Agribusiness," Jeremy Smith, Ecologist, Feb. 4, 2005.

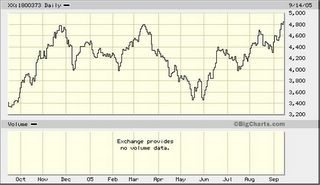

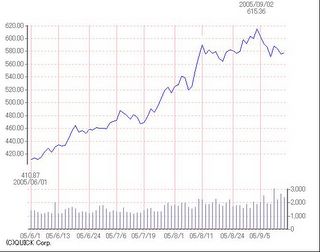

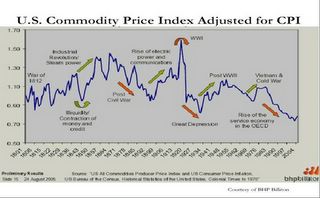

9. Iran's New Oil Trade System Challenges U.S. Currency

The Bush administration has been paying a lot more attention to Iran recently. Part of that interest is clearly in Iran's nuclear program--but there may be more to the story. One bit of news that hasn't received the public vetting it merits is Iran's declared intent to open an international oil exchange market, or "bourse."

Not only would the new entity compete against the New York Mercantile Exchange and London's International Petroleum Exchange (both owned by American corporations), but it would also ignite international oil trading in euros.

"A shift away from U.S. dollars to euros in the oil market would cause the demand for petrodollars to drop, perhaps causing the value of the dollar to plummet," Brian Miller and Celeste Vogler of Project Censored wrote in Censored 2006.

"Russia, Venezuela and some members of OPEC have expressed interest in moving towards a petroeuro system," he said. And it isn't entirely implausible that China, which is "the world's second largest holder of U.S. currency reserves," might eventually follow suit.

Although China, as a major exporter of goods to the United States, has a vested interest in helping shore up the American economy and has even linked its own currency, the yuan, to the dollar, it has also become increasingly dependent on Iranian oil and gas.

"Barring a U.S. attack, it appears imminent that Iran's euro-dominated oil bourse will open in March 2006," Miller and Vogler continued. "Logically, the most appropriate U.S. strategy is compromise with the EU and OPEC towards a dual-currency system for international oil trades."

But you won't hear any discussion of that alternative on the 6 o'clock news.

Source: "Iran Next US Target," William Clark, www.globalresearch.ca, Oct. 27, 2004.

10. Mountaintop Removal Threatens Ecosystem and Economy

On Aug. 15, environmental activists created a human blockade by locking themselves to drilling equipment, obstructing the National Coal Corp.'s access to a strip mine in the Appalachian Mountains 40 miles north of Knoxville, Tenn. It was just the latest in a protracted campaign that environmentalists say has national implications, but that's been ignored by the media outside the immediate area.

Under contention is a technique wherein entire mountaintops are removed using explosives to access the coal underneath--a practice that is nothing short of devastating for the local ecosystem, but which could become much more widespread.

As it stands, 93 new coal plants are in the works nationwide, according to Project Censored's findings. "Areas incredibly rich in biodiversity are being turned into the biological equivalent of parking lots," wrote John Conner of the Katúah branch of Earth First!--which has been throwing all its energies into direct action campaigns to block the project--in Censored 2006. "It is the final solution for 200-million-year-old mountains."

Source: "See You in the Mountains: Katúah Earth First! Confronts Mountaintop Removal," John Conner, Earth First!, November-December 2004.