``The best investment opportunities come from an asset class where those who know it best, love it least, because they have been disappointed most.” Donald Coxe, BMO Financial Group

I smell sweet absolute vindication. Since my Rip Van Winkle in Gold series in 2003, I have fulfilled partial projections (such as Philex “A” a mere 15 cents away from its 1987 high of 3.30), I predicted that all, if not most, previous highs of publicly listed mining issues would be topped and that the Mining index would surpass its 1987 high (see October 11 to 14, 2004 Philippine Mining Index: The March to 9,000-levels)!

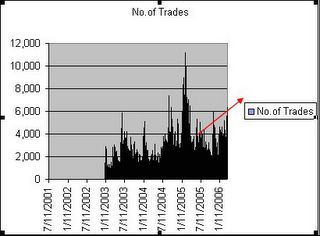

Today, since the euphoria brought about by the Supreme Court’s ratification of the Mining Act in 2004, it appears that the mining index has gotten its second wind with an industry-wide charge lifting the mining index close to its 2005 high.

My conviction is that the Mining/extractives industry (including oil) would generate the best returns simply stems from the following premises:

One, it has been a global trend. The measures of the industry are on a macro aggregate basis and not on a localized scale.

Second, the industry comes from a very low base. The mining industry has been depressed by over a decade. The huge surge in commodity prices worldwide represents imbalances in the demand-supply equation that necessitates our resources to be tapped or brought on stream to meet existing deficiencies. According to an industry official, of the 9 million mineral rich hectares only 1.4% of the potential mining sites have been covered by permits! In short, risks have been basically limited relative to the commodious upside potentials.

Third, the investment cycle for the industry has just turned in to its favor or the commodity cycle is at its pristine state yet.

Aside from demand growth emanating from the rapidly expanding emerging market economies at the margin, increasing investment and speculative activity has exacerbated the present cycle, according to analyst Martin Spring, ``One indication of this is that investment in commodity index funds has risen from less than $30 billion to an estimated $80 billion currently, and is forecast to reach $140-150 billion by the end of next year.”

Moreover, there is the supply side underscored by plunging inventories, according to Donald Coxe of BMO Financial Group who writes in his Basic Points, ``The next years of this bull market will be driven by the Supply Side.”

Infrastructure bottlenecks highlighted by the shortage of manpower (mining engineers, geologists and etc.), and materials (tires, rigs, et. al), rising costs (wages, cost of materials and interest rates!), reserves coming from politically risky zones (To quote Mr. Coxe, ``As for those billions of tons of ore in potential greenfield projects, they are scattered across the globe, mostly in Third World locations, and mostly in politically risky Third World locations, such as the Congo.”), severe undercapitalization or lack of investments (According to Mr. Coxe, ``The industry is consolidating rapidly, not growing rapidly”~ which means mining and oil companies have been tethered by the ‘rear view mirror’ syndrome or the fear that “good times may not last”), environmental restrictions and political interference. What took a new mining project to open or operate in 5 years has now been extended by about 8 years. So the good times are about to continue rolling. Again quoting Donald Coxe (emphasis mine), ``At current consumption growth rates, the world is going to need major new supplies of copper, zinc, lead, tin, aluminum, and nickel by the end of this decade.”

Finally and most importantly is that the industry has the CRITICAL MASS to attract foreign investments and contribute to the development of the domestic economy. According to analyst Doug Casey, the country is ranked second in gold reserves, third in copper and sixth in chromite.

Figure 1 Philippine Mining Index and the CBOE GOX index

I got scoffed at, laughed at and ridiculed when I preached this contrarian investment theme about 3 years ago. Such denials came from some clients and friends until even last year especially after the initial bout of euphoria failed to sustain its rise. To quote IBM founder Thomas J. Watson, Jr. ``There's a fine line between eccentrics and geniuses. If you're a little ahead of your time, you're an eccentric, and if you're too late, you're a failure, but if you hit it right on the head, you're a genius." It certainly proved difficult to be seen as an eccentric, when the public’s inclination is to assume of the short term perspective.

Albeit, I understand how investment mavens Jim Rogers and Dr. Marc Faber felt, having preached the same theme earlier or since the late 90s (Warren Buffett bought his 130 million ounces of silver in 1998!). Now it looks as if it is payback time, as the commodity theme gets conspicuously diffused into the public psyche!

Figure 2: From Denial to Gradual Acceptance?

I have been saying that the financial markets are fundamentally psychological more than anything else, such that investment themes permeate through the public via several stages. The boom bust stage cycle as defined by billionaire philanthropist George Soros as 1) The unrecognized trend, 2) The beginning of a self-reinforcing process, 3) The successful test, 4) The growing conviction, resulting in a widening divergence between reality and expectations, 5) The flaw in perceptions, 6) The climax and finally 7) A self-reinforcing process in the opposite direction.

With indicators such as business headlines ``Stocks at Par with Gold price trend”, faddish analysts taking up the Bullish outright “buy” calls from previously “speculative” buy calls on mining issues and local buying amidst foreign selling yet propping up price levels to 1987 highs (particularly in Philex Mining), it appears that we are in at the stage 2 “The beginning of a self-reinforcing process” gradating into the stage 3 “The successful test” of the Soros cycle. In short, from the fringe our investment theme has slowly evolved to the social convention or is, in other words, turning mainstream! From one the songs of the late Karen Carpenter, We’ve only just begun!

Figure 2 shows of the recent major or deep corrections in the mining index (blue arrows) have signified the massive denials by the public on the recrudescence of the once downtrodden industry. Yet despite such rabid denials your prudent analyst/investor remained steadfast, as British author Aldous Huxley once wrote, “Facts do not cease to exist because they are ignored.”

Today, the technical picture manifests of a gradual improvement in the investing public psyche as exhibited by our favorite pattern the “J.LO” bottom (named after actress Jennifer Lopez). Moreover, corrections or counter trend moves has been to a lesser degree compared to the previous.

Figure 3: The Big Picture! Massive JLOs!

Figure 3 shows of the Mining index since 1958. The highest the Mining index has reached was in 1987, which paradoxically was counter to the rapidly declining prices of commodities then. Today, the rise of the mining index has coincided with the spectacular jump in commodity prices see Figure 4, meaning that the global investing dynamics has filtered into the pricing of domestic mining stocks in anticipation of its renascence.

And since commodities operate under an investment cycle like any other industries, its record high prices driven by asymmetries in the marketplace are bound to remain in place for sometime; possibly a decade or more, although NOT in a straight line.

Some market participants or prospective participants deem analysts ‘can read the future’ or the ‘investing public’s mind’. Conventionally, they ask for a specific date or time frame, normally a short time at that, when considering to jump into the marketplace. Let it be known that we (analysts) do not control the market and are not clairvoyant nor are we psychic; we operate on the realm of probabilities and possibilities.

Figure 4: courtesy of Martin Weiss, Money and Markets

While I remain bullish on the industry over the long term, there would be a better time to accumulate at much attractive prices than today. BMO’s Donald Coxe makes a worthwhile recommendation to the public (emphasis mine), ``The longer-lived the reserves, the more a company is worth. A deep value investor should not price these stocks primarily on their current p/e ratios, but on the values deep in the ground that will be realized over coming years—and coming generations.”