``There is nothing like losing all you have in the world for teaching you what not to do. And when you know what not to do in order not to lose money, you begin to learn what to do in order to win. Did you get that? You begin to learn!”- Edward Lefèvre, Reminiscences of A Stock Operator

I have been requested by some to help improve on their portfolio returns, something which I have been attempting to do through this newsletter since 2002. Let me reword, the reason for this newsletter is to help you identify and act on investment themes or trends with an objective to attain returns greater than what is offered by the respective benchmarks in the marketplace. Unless you obtain the services of a portfolio manager, which I highly recommend for the purposes of specialization, the task to improve on your portfolio essentially falls on you, as the investor/prospective investor.

However, as stated in numerous occasions investing is fundamentally or most importantly psychological more than anything else, in contrary to what is commonly known or assumed. In the words of author Edward Lefèvre in his investment classic (said to have written on the account of the legendary trader, Jesse Livermore), Reminiscences of A Stock Operator (emphasis mine), ``But not even a world war can keep the stock market from being a bull market when conditions are bullish or bear market when conditions are bearish. And all a man needs to know to make money is to appraise conditions.” If you have noticed, appraising psychological conditions that constitute the cycles have been the focal point of this outlook since I began this lowly information crusade. All other concerns have remained subordinate. And this applies not only to the stock market but to all aspects of the financial markets as well.

Moreover, investment forecasting is NOT a practice thaumaturgy (performance of magic or miracles). In alot of instances I found it intensely difficult and even frustrating to preach about absolute returns, when expectations of me are usually predicated on short term moves. I found a passage from Mr. Lefèvre’s book applicable to my plight (emphasis mine)...

``I NEVER hesitate to tell a man that I am bullish or bearish. But I do not tell people to buy or sell any particular stock. In a bear market all stocks go down and in a bull market they all go up...I speak in a general sense. But the average man doesn’t wish to be told that it is a bull market or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn’t even wish to think. It is too much bother to have to count the money that he picks up from the ground.”

Essentially this is what the public fails, if not refuses, to understand; that cycles caused by psychological shifts by the investing community underpin the marketplace. While there maybe sizeable accounts of randomness or “noise” on its daily activities, fundamentally, markets, like any aspect of our corporeal life operates under cycles.

And accordingly, as stated above, in most instances, similar to the narrative of Mr. Lefèvre, I find that the average investors indeed want something for nothing, such that in most cases, I am often expected to deliver short term winning formulas or a nostrum which essentially is a deliverance from one’s “gamblers’ ticks”.

And this is where the stock touts as seen in most conventional brokers and their coterie of analysts thrive, by mostly advancing PAST information and projecting them into the future. By deluging you with stock particulars, they induce you to trade frequently, which basically go against the goal of achieving above average returns, in the treasured words of the Oracle of Omaha, Mr. Warren Buffett, ``For investors as a whole, returns decrease as motion increases.” These stock touts often cannot distinguish the proverbial ‘forest from the trees’ simply because it is not their interest to do so. Their revenues models are not derived from bolstering your returns but from churning transactions.

Further, by pounding on you with past financial details aggravated by the “implied effects” of current events, they foster upon the public the fundamental foibles of the average investors; the mental short cuts or “heuristics”, namely the survivalship bias, overconfidence, anchoring, Loss Aversion/prospect theory, framing, mental accounting/rationalization, Regret theory and the comfort of the crowd/fallacy of the typicality (see August 18 to 22, 2003, Stock Market 101 on Cycles, Investor Psychology and Behavioral Finance). For instance, journalists from the mainstream media are wont to paint the picture (“framing”) abetted by the experts, during days when the markets traded lower as oil prices coincidentally goes up, of a causality based on oil price movements on the market. Sounds familiar no?

Figure 1 Dow Jones World Stock Index (black line) and the WTIC Crude benchmark (red line)

Say it isn’t so! The Picture is a fact as Ludwig Wittgenstein, Austrian-British philosopher once wrote; the three year chart of Crude Oil West Texas Intermediate (WTIC) and the Dow Jones Word Index certainly disproves such assertion so far. Yet, as mentioned above, you would hear commentaries flooding allover mainstream media from the so called experts to the lay persons of the highly touted “inverse correlation”. Such is an example of mental short cuts called as the fallacious “rationalization” of events to the markets. ``Either they're trying to con you or they're trying to con themselves.” observes Warren Buffett on financial analysts.

This is not to suggest that such correlation will be perpetual. A correlation is a correlation until it is not. For me, the reasons why oil and global stock markets have shadowed each other are due to the following:

One, oil has not yet crossed the ‘threshold of pain’ as to drain liquidity away from the financial system.

Second, speaking of liquidity, inordinate amounts of money and credit has been flooding the global financial system, causing the purchasing power of fiat currencies to fall against assets or, as seen on a mirror viewpoint, excess money have been simply chasing for yields, driving a diverse range of asset prices higher...including oil.

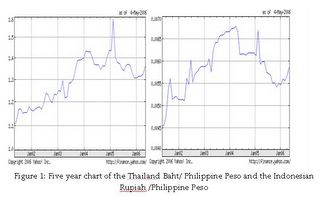

Figure 2: Gavekal Research: US and Japan Dumping Money in to the System

Figure 2 from Gavekal Research shows that the Japanese monetary base has been allowed to double in very short periods of time or in about three years, thrice since 1971. In fact, according to Gavekal Research, the Japanese Monetary base is currently even larger than the US! They are suggesting that the gradual reversal of the current monetary Quantitative Easing (QE) policy and the prospective lifting ZIRP (Zero Interest Policy) could lead to a possible meltdown in global bonds bolstering my case (see March 27 to 31 edition, Listen To Your Barber On Higher Rates and Commodity Prices!), as exported Japanese capital ($1.8 trillion!!!...or about 15% of US GDP or 3% of US assets) may find its way back home. But that is another story for our future outlook.

Lastly, the synchronized movements of oil prices and equity assets could be reflective of a global economy running on full throttles.

So essentially, it does not necessarily follow that high oil prices would lead to a lower market, as the causal association has rather been flimsy or outright tenuous, for the time being. In fact based on the historical data, as shown by Figure 1, it could be said of the reverse; particularly higher oil prices have led to higher markets values for equity assets or in a different plane, higher assets values for global equities have led to higher oil prices! Take your pick.

Going back to the main issue, it is also in the marketplace where such inferences (the act of deriving a logical conclusion from a premised believed to be true), assumptions (something accepted as true without proof) and cognitive illusions (illusion of knowing) are largely utilized by the average investors as basis for their decisions, the major attributes of investor losses. Unless one learns how to separate the “chaffs from the grains”, when the tide goes out one will learn who’s been swimming naked or who’s been surfing on plain ol’ Lady Luck.

You see, rising markets breeds many soi-disant geniuses. Rising markets will similarly lead to investor overconfidence. And since markets operate on cycles this means that many of the late comers and their attendant ‘genius’ experts will get burned arising from sheer imprudence or recklessness in the future as the cycle turns. Count that as a fact, it always does. Greed, Fear and Hope always dominates the market, as it has been, since time immemorial. As George Santayana wrote in The Life of Reason, ``Those who cannot remember the past are condemned to repeat it.”

I have dealt frequently with the unseen variables over the mostly macro facets and on some domestic economic and financial market issues. The information I have imparted to you have not been conventional, yet, they would appear to have validated my prognosis over time’s progression. I know it could have been outright serendipity or just plain luck. But at least, I am pleased to have been fortunate or blessed enough to have rightly called on the major turns or inflection points in the financial markets, be it the Phisix, the Peso, the Mining index/industry, the US dollar, Gold or commodities. Thank you, Lord.

Yet, all these could also have been a matter of visual processing, or the sequence of steps that information takes as it flows from visual sensors to cognitive processing (wikepedia.org), at the margins. The picture below (Figure 3) is a test of your visual processing, something which is commonly applied to investing.

Figure 3: Visual Processing Test, from Robert Ringer of Early to Rise

According to Mr. Ringer, If you are able to spot the object above then your visual processing is probably good. If you can’t get it, then try rotating the picture clockwise or look at it on a landscape format. If you are still having a hard time figuring it out, then probably it is an indication that you have probably some difficulty with your visual processing.

This isn’t an abstraction or illusion, it’s an actual picture. It’s actually a picture of a cow or of a cow’s face.

The point is, to quote Mr. Robert Ringer, ``we often look directly at things, yet still do not see them.”