The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, October 15, 2006

Phisix Supported by Local Buying Amidst A Rising Peso

US Trade Deficits: Be Careful of What You Wish For

US trade deficit for August leapt to a record $69.9 billion. This trade deficit borne out of the global vendor financing scheme trade structure has been a very important source of worldwide liquidity, as

Figure 8 Gavekal Research: US Current Account Deficits and Financial Crisis

Saturday, October 14, 2006

Reuters: Online brokerage account scams worry SEC

While online trading is still in an embryonic stage in the Philippine setting, the functional equivalent of “an ounce of prevention is worth a pound of cure” means recognizing risks posed by “Incursion scams” and taking the necessary security measures to prevent from falling victim to these predations. Here is an important excerpts from the Reuters,

Sunday, October 08, 2006

Are Equity Markets Defying Gravity?

The Dow Jones Industrial Index, one of the key yardsticks for US equities hit milestone record highs last week!

Figure 1: Chartoftheday.com: Record High but needs a Hurdle to clear

Figure 2: stockcharts.com: Phisix-DJIA Close Correlation

Since the

2. Lower Energy Prices are helping CONTAIN INFLATION.

3. Stock buybacks are DRIVING earnings.

4. Money from Housing and Energy or those from the sidelines will SHIFT to Equities.

Now as to the argument that lower energy prices help contain inflation is grounded on an equally flawed premise. Dr. Frank Shostak of MAN Financials, in his very insightful contributory article to the Mises Institute, “Will An Oil Price Fall Push Inflation Down?” explains why (emphasis mine)...

``If the stock of money rises while all other things remain intact, this must lead to more money being spent on the unchanged stock of goods — which means an increase in the average price of goods. (The term "average" is used here in conceptual form. We are well aware that such average cannot be computed).

Are the Financial Markets Fighting the FED?

These are hardly bullish factors for US assets going forward as about 78 million baby boomers (birth years: 1946-1964) enter into the retirement age in the coming years.

Election Season: Big Brother’s Hand “The Gorilla in the Room”?

This leads us back to the present fix, “Why are the markets rising amidst a mid-cycle slowdown?”

During the past month, as the seasonal strength favored rising gold prices, an abnormal degree of selling pressure sent gold prices plummeting. I initially suspected of government’s hand in trying to “manage our inflation expectations” by dumping on the gold market, and was proven right, apparently my suspicions have been confirmed by more sales by the European Central Bank according to their recent disclosures. This seems to have been timed as the calendar year for the European Central Gold Sales Agreement closed last September 26th, where they are allowed to unload 500 tonnes annually.

Bullish Momentum, Flexibility and Trading Advices

According to George Soros, ``One can never be sure whether it is the expectation that corresponds to the subsequent event or the subsequent event that conforms to expectation. The segregation between thoughts and events that prevails in natural science is simply missing.” In this context, I remain uncertain of my convictions over the interim simply because events have turned against them.

Yet as prudent investors we do not fight the tape. In the invaluable words of legendary trader Jesse Livermore ``There is only one side of the market, and it is not the Bull side or the Bear side, but the right side.” We have to remain flexible, in view of these circumstances.

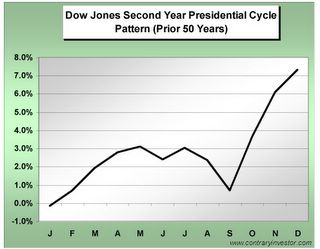

Figure 3: Contraryinvestors.com: Second Year Presidential Cycle Pattern

TailPieces

Thursday, October 05, 2006

The growing sophistication of Asian M&A

As an Asian bull, I noted that the ongoing financial integration will boost valuations aside from the activities in the regional corporate arena.

Go no further, the boom is yet unraveling.

Monday, September 25, 2006

Wisdom of Money:The Way You Think Dictates Your Spending Habits

Wisdom of Money imparts a very important message not just on spending but on investing habits, quoting them verbatim...

Wisdom of Money: The Way You Think Dictates Your Spending Habits

Prosperity thinking can be defined as a trusting attitude that things will work out. It is an optimistic state of mind, and an empowered orientation toward money. Prosperity thinking means aligning our beliefs, attitudes, expectations, goals and behaviors toward realistic levels of abundance, confidence and gain. It increases financial and personal self-esteem and assists in using our feelings and intuition to deal with money more successfully.

Poverty thinking, on the other hand, is a mistrustful state of mind that says things will not work out. It embodies pessimism, fear, and a passive relationship with money. A poverty thinker aligns beliefs, attitudes, expectations, goals and behaviors toward unrealistic levels of scarcity, fear, and loss. It diminishes our financial and personal self-esteem and decreases confidence in handling money. Such messages can cause us to distort how we perceive an event and explain why we react irrationally. Almost everyone, including highly wealthy people, is a victim of poverty thinking to a certain degree.

Prosperity and poverty thinking are two important concepts for understanding the psychology of money. Studying various spending personalities and behavioral patterns provide us with an awareness for making smarter financial decisions of our own. Because the mind takes precedence over our actions, to think and feel more prosperous creates new opportunities for experiencing financial freedom.

World Equities: Knockin’ on Heavens Door or Facing Hell?

``The game is always changing and evolving, and it pays to pay attention to new theories. The bottom line is to always be open-minded, to try and improve the way you do things." -Brian Cashman (GM, NY Yankees)

Figure 3: Phisix: Knockin’ on Heaven’s Door?

Of course with the momentum going in one’s favor, would one even care to listen to what may derail it? As we have previously noted, the average investors normally extrapolate the immediate past as the likely path of the future.

I’d like to point out to you that the ongoing activities in the US Treasuries market have not been singing hallelujahs as the consensus have it. In fact, if one looks at the present activities, the rapid decline of the 10 year bond yields point towards, expectations by bond investors of an ‘accelerated’ mark down in the US economic growth cycle and inflation expectations as shown in figure 4.

Figure 4: Stockcharts.com: Bond Yields Suggests Big Slowdown Ahead

Figure 5: Stockcharts.com: Knockin’ on Heavens Door or Facing Hell?

If these

On the other hand, if the prospective slowdown in the

Thai Coup: Hardly A Ripple

``The coup has also highlighted some of the fragility inherent in Thailand's social fabric: so very much of the nation's unity and order rests on the shoulders of one remarkable man, His Majesty, the King.”-Andrew T. Foster, Director of Research, Portfolio Manager, Matthews International Capital Management, LLC

One major distinguishing factor that has so far contributed to the triumph of the changeover has been that the military group, who were seen adorned with yellow ribbons meant to demonstrate their loyalty to

Many pundits have thrown their opinions as to the possible repercussions. A surprisingly big number of analysts, mostly from foreign institutions-gleaned through Bloomberg’s interviews, have said that this opportunity could signify a “screaming buy” given that the present political impasse would be disentangled given the makeover. Some like those from Morgan Stanley downgraded their Thai outlook.

In the past I have noted that domestic volatility have markedly ebbed as global markets have slowly integrated...

Figure 1. Yahoo: US/THB; stockcharts.com

To give it a more balanced perspective, Asian currencies have been largely down led by

For as long as the Thai incident would remain contained, orderly and peaceful, we are unlikely to see a contagion effect towards other the ASEAN nations which I view as rather low impact low probability event. In contrast to the Asian Financial Crisis in 1997, where structural infirmities such as pegged currencies, massive deficits and mountain loads of external or dollar denominated debts gave way to simultaneous capital flight, today’s ASEAN economies appeared to have learned from the past and have adopted a more flexible stance.

As for General Sonthi Boonyaratkalin leader of the coup, like the JRR Tolkien masterpiece the Lord of the Rings, we will see if he will be consumed by the power he arrogated upon himself (what I call “personality based politics”) or indeed stay loyal to the cause of the King and permit for a transition government. By the way, coup has been a way of life for the Thais; this has been the 18th during the past 60 years for the Land of the Smiles!

Finally, I’d like to make a short comment on the observations of a very high profile contemporary, who made a ‘rationalization’ that Thursday’s decline at the Phisix had been due to the Thai coup. Our expert analyst simply parroted what the average investor would have thought. However, being an analyst, I guess I’d be responsible enough to point out that in spite of the impression of so-called “foreign-investors-pulling-out-of-ASEAN” due to the Thai development, internal market data showed that foreign buying heavily supported the Phisix in nominal and in broad market terms, which simply belies this claim. Further, Ayala insiders or the Zobel group represented by MERMAC sold 6.9% or Php 10.56 billion worth of AC shares to a foreign group on a special block sale also during that fateful day. So listen to your high profile analyst, who is after all, not after the truth, but for publicity (smiles!).

Monday, September 18, 2006

A Brewing Financial Storm or A Wall of Worry to Climb?

``With so much complacency around and with such a high propensity to speculate in just about everything among all classes of investors, a nice crash should not entirely be ruled out.”- Dr. Marc Faber

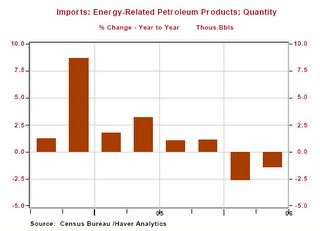

Yet evidences continue to mount in support of my concerns. Recently, I have assigned the weaknesses seen in the broad spectrum of energy prices to dampening demand in the

Figure 1: Northern Trust: Declining Energy Related Imports

Figure 2: Fullermoney.com Oil’s Countertrend risk since 2001

Analyst Barry Ritholtz echoes a similar view on the apparent corrosion of consumer demand (emphasis mine), ``In the past 16 Federal Reserve tightening cycles, there has been one true soft landing in 1994. I continue to look at that not as impossible, but as a low probability event.... My largest present concern is oil and other commodity prices. It's no coincidence that gas, oil, gold, aluminum and copper all have dropped at the same time. I read that as signs of a global slowing in demand.”

At the same time, we likewise hear parallel sentiments and warnings from the head honchos of the multilateral agency the IMF as Mr. Rodrigo Rato (Managing Director) and Mr. Raghuram Rajan (chief economist).

I watched Mr. Rajan’s interview at Bloomberg where he commented that the world economies have been growing strongly supported by emerging domestic demand. As an example, private demand has made up the bulk of

Figure 4 Yardeni.com: Moody’s Corporate spreads

Figure 5: Bank of International Settlements: Default rates and CDS markets

Figure 6: PSE and Dow Jones World Index

Governments will do anything as to achieve its short term goals usually with long term unintended consequences. When governments distort markets we know that the effect is likely to be short-term. Moreover, governments have had ignoble track records in the markets. One can just be reminded of

Foreign Funds: Rotation to the Telecoms?

In the local market, recently one sector had been a steady beneficiary of foreign portfolio inflows over the past few weeks. It appears that an ongoing rotation abroad has also found a similar trend here.

We see similar upside momentum over at the Dow Jones Emerging Market Telecoms benchmark as well as a spike in PLDT shares (lower window) traded in

Fundamentally, if one considers subscriber growth as basis for projecting revenue growth, I find that the fantastic growth clip for telecom stocks as having peaked out. However, as I have noted the hunt for yields may continue and the formerly out-of-flavor telecom issues abroad may equally find a spillover at local issues.

If the bullish momentum towards these issues continues to lead the market over the interim, one may consider surfing them.

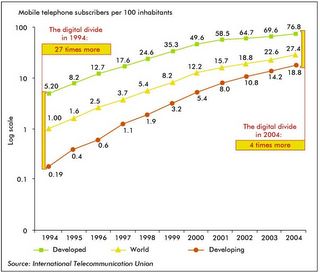

Telecoms: Closing the Digital Divide

The telecom sector is one areas of the controversial “digital divide” said to be the restricted to the realm of the “haves” over the “have-nots”. According to the International Telecommunications Union (ITU), ``Over the last 10 years, the digital divide has been shrinking in terms of numbers of fixed phone lines, mobile subscribers, and Internet users.”

Figure 8: ITU: Closing the Digital Divide

In the

Monday, September 11, 2006

Global Markets: A Financial Storm Ahead?

``A man can fail, but he isn't a failure until he blames someone else." J. Paul Getty, industrialist

Figure 3 stockcharts.com: US dollar breaks to the Upside!

According to Morgan Stanley’s Currency analyst Stephen Jen, ``Investor risk-reduction could ‘turbo-charge’ the dollar and, ironically, lead to dollar strength…we think that the dollar could actually rally in a deep recession.” In the present setting, a strong US dollar supported by rallying bonds amplifies the case of a severity of a potential hard landing.

Figure 5: stockcharts.com: WTIC Breaksdown!

Figure 6: stockcharts.com: Gold breaking down too?

However, over the long run, I remain bullish on gold even as present trends appear not to be supportive of its short-term case. Anyway, no trend goes on a straight line.

For the moment it looks like that the deflationist camp is getting ready to open the champagne bottles.