``There's no way all this debt can ever be paid off or even carried by stable economic systems. Forget that. This debt must be carried, handled, by ever increasing amounts of paper. That alone is a basis for perma-inflation. Maybe we've got a new word here -- "permaflation." Richard Russell of the Dow Theory Letters

ACTIVITIES in the global financial markets, as well as in the domestic markets, have shown some semblance of abatement from the recent intense selling pressures although indications are, in my point of view, that the probabilities of risks are still far greater than potential returns hence maintain my hands-off stance at the moment until signs of a clearer trend emerges.

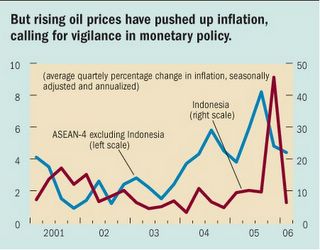

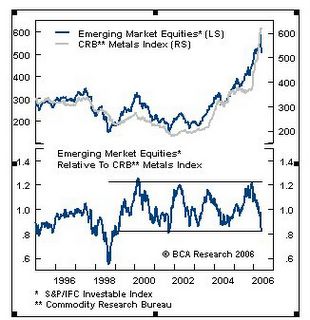

Most of the present activities had been blamed towards the inflation ‘bugbear’ when as previously discussed, inflationary pressures have long been embedded into the world’s financial and economic landscape, whose transmission mechanism have been mostly been manifested through the rising variegated asset classes, which has eventually transfused into prices of essential goods and services.

Various keynote institutional analysts have labeled the present gyrations in the in the financial markets mostly as phraseological “risk premia repricing” or “rising risk aversion” or “normalization of risk factors”. In short, euphemisms for a fundamental change in market sentiment. Where global financial markets appeared to have factored in or assumed lesser degree of risks or adopted a high degree of complacency in the projecting the immediate past for pricing present trends, the precipitate alteration of directional paths underscores this shift of psychological outlook.

For instance, the US S & P 500 VIX index ($VIX), shown in Figure 1, or a market volatility indicator calculated by measuring option activities and is used as a gauge for investor sentiment has moseyed along for a great deal of time at near record low levels which means that investors in the US equity markets, particularly the S & P 500, have been rather “self-indulgent”.

Figure 1 S & P VIX Index Breakout

The recent breakout of the sentiment indicator is a reason to be cautious, according Ivan D. Martchev of Global View Points (emphasis mine),

``But while short-term market timing models all call for a dead-cat bounce, longer-term indicators suggest there’s much more potential for the selling to continue. The rapid selling in the Nasdaq 100, even after badly underperforming in 2006, is an indication that institutional investors have decided to get serious about playing defense. That's not going to change in a matter of days or even weeks.

``The S&P 500 Volatility Index (VIX) rose well above its October 2005 spike. This is the first time “the fear gauge” has risen above any major spike in its precipitous decline during the past three years. The index is clearly bottoming, carving higher lows after having declined as low as 9.88 in July 2005. This is very different behavior than what we’re used to. And given how depressed the VIX is, it can rise a long way from here.

Oooh...what a ghastly perspective in terms of technical outlook. Yet, this is what I have been saying long ago, to lift anew a great quote from the late economics professor Hyman Minsky, “Stability is unstable” or that the appearance of stability could be a breeding ground for complacency ergo future instability.

US Epicenter of Global Market Volatilities

Morgan Stanley’s Chief economist, Stephen Roach suggests that the hubbub in today’s financial markets has been an oddity, not been event driven, and could have been due to self-implosion due to excess speculation, quoting Mr. Roach from his Risk Bubble article (emphasis mine)

``It is on a par with the big reversals of the past. What is particularly interesting is that this outbreak of risk aversion has occurred in the absence of a financial crisis and in the absence of a major shift in the underlying fundamentals of the global economy...Absent the "pin" — normally thought to be an interest rate spike — investors have no fear of bubbles. Yet, this imagery is actually quite misleading. Yale Professor Robert Shiller has long stressed the tendency of asset bubbles to implode under their own weight (see Irrational Exuberance, second edition, 2005). In other words, it doesn’t always take that unpredictable "bolt from the blue" to send overvalued assets crashing back down to earth. To stretch the image a bit further, if the weakest portion of the bubble’s membrane fails, damage can quickly spread to the rest of the asset class.”

Since markets supposedly function as “future discounting mechanisms”, it should follow that in spite of the absence of the proverbial “pin”, these perturbations could be portentous of an impending dislocation rather than be reactive to one, in contrast to Mr. Roach’s opinion. Instead of being an outright effect, it could be construed as being ‘symptomatic’ to an underlying cause.

I have stated in my recent past outlooks that the markets could be adducing to a US centric-world economic growth slowdown or corollary to the belated effects of the coordinated tightening by Global central banks and to even the resonant calls on the ramifications of the present curtailment of the YEN carry trade arbitrage.

Empirical evidences appear to bear me out:

One, US Fed Chief Bernanke sees a housing slowdown, recently CNN Money quotes Mr. Bernanke, ``It looks to be a very orderly and moderate kind of cooling at this point.” In addition, you have Former Fed Chair Alan Greenspan echoing the same concerns that ``housing boom is over”, although noting that there is ``no evidence home prices are going to collapse.''

Of course, would it be sensible for present or past officials to prognosticate for a “collapse” as to likely trigger a financial panic? The answer is quite obvious. Yet given the law of unintended consequences, what the financial markets could be telling us at present is something we don’t naturally want to hear....a possible risk of a BUST!

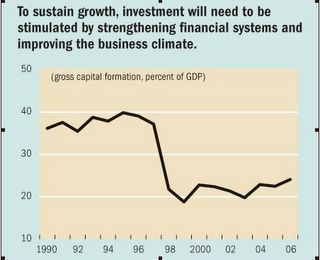

The performance of the housing market in the US has manifested of a strong correlation to the consumer spending dynamics as shown in Figure 2.

Figure 2: courtesy of John Maudlin/ BCA Research: Falling Housing and real consumer spending?

What these officials could be implying is that given the close correlation of the housing dynamics to consumer spending, the backbone of the US economy, these means that consumer spending will also backtrack (and so with Asia’s and the emerging market’s export led growth) and that the US economy would see a marked deceleration soon; as to the extent or degree of the slowdown is something that has yet to be seen.

Some analysts including the widely respected BCA Research tells us that another liquidity propelled rally, due to a possible pause by the US FED on its march to normalize interest rates, could ensue on the premise of low inflation data from the major world economies belonging to the OECD, an attendant retreat in inflation in the US due to its expected growth slowdown and possible rally in global bonds in anticipation of a slowdown of global growth. This perspective is quite convergent to the projections of Deutsche Bank which I presented last week (see Deutsche Bank: Fed’s Monetary Approaches Equals Different Outcomes).

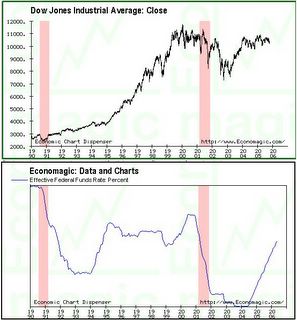

However in stark contrast, John P. Hussman, Ph.D. of the Hussman funds argue against such rose colored glass expectations (emphasis mine), ``It doesn't help to argue that the Fed will stop tightening soon, because the end of a tightening cycle has historically been followed by below-average returns for about 18 months.”

Yet, all these polemics come in the perspective of the possibility a Fed pause. However, during the Federal Open Market Committee Meeting last May 10, its minutes manifested discussions of the possibilities of even raising by 50 basis points!!! Which means while the apparent consensus have been looking for a pause, incidental probabilities dictate that a 50 basis points increase could be the axiomatic “elephant in the room”!

Now the question remains, will the Fed take its pause or will it raise rates to “quell inflation” or in camouflage, defend the embattled US dollar (my long held view)? If the latter, by how much?

Falling US Dollar Leads to Stagflation?

Figure 3 Discordant Signals Falling US dollar Falling US Treasury yields (courtesy of stockcharts.com)

A falling currency is seen as “stimulative” and “inflationary”, yet as of last week, the US dollar trade weighted index appears to be rolling over, as seen in Figure 3, apparently looking towards a test to its recently marked lows (emitting inflationary signals). On the other hand, US Treasury 10 year benchmark yields (black line) appear to have broken down from its peak, signifying either a “sharp slowdown in inflationary expectations” and or an “economic growth slowdown” or both.

Figure 4 US Dollar Index St Louis Model Breaks down! (courtesy of contraryinvestor.com)

The St. Louis Federal Reserve’s methodology in computing for its US dollar trade weighted index is more representative of the country’s trading patterns than the New York’s Board of Trade (NYBOT) model, according to contraryinvestors.com (emphasis mine)...

``The bottom line is that approximately 2/3rd's of the US Dollar Index is keyed off of Euro area currencies. And unbelievably enough, the USD Index does not contain any relative currency weighting at all to key trading partners such as Mexico and many Asian countries such as Korea, Thailand, Taiwan, Singapore, Hong Kong, etc. It just so happens that the St. Louis Fed does calculate an alternative trade weighted dollar index that is much more representative of the true US trade situation globally, importantly inclusive of Mexico, China and many Asian currencies...Unlike the widely quoted, largely Euro area currency driven US Dollar Index, the St. Louis trade weighted dollar index has now broken below the late 2004 and early 2005 lows. It's telling us that it's a good bet the headline US Dollar Index follows. If indeed this comes to pass, we have to believe the consensus will be taken a bit aback in terms of heightened inflationary concerns.”

If contraryinvestor.com is right about their projections of a continued downdraft of the US dollar then what may strike as the UNSEEN variable could be a “stagflationary” environment, or characterized by low/stagnant growth and high inflation (a scenario we discussed since 2003)!

The Curtailment of the Yen Carry Trade: Getting A Larger Audience

Second, is that the backstop of the synchronized global rate hikes has possibly prompted for the retrenchment of the Yen Carry trade arbitrage.

I noted that the economic recovery prospects in Japan has reduced its need to flood its banking system with excess cash/reserves and thereby go about restoring normalcy to its monetary policies by lifting its easy money policies such as the QE Quantitative Easing and eventually the ZIRP Zero Interest Rate Policies (see last week’s Jim Jubak/Gavekal: Yen Carry Tumult and Apr 24 to 28 edition, Improving Your Portfolio Returns by Seeing the Unseen).

Where global investors used to lever funds from an almost zero interest yielding yen to arbitrage investments in diverse asset classes, such as US treasuries, emerging market debts and or equities or even commodities, the prospects of normalizing Japan’s monetary policy effectively lowers the economic incentive to straddle between the yield differentials between currencies, where the arbitrage opportunity lies.

It has been widely suspected that the recent selloffs in the global financial markets had been linked to the liquidity crunch or deleveraging brought about by Japan’s move to tighten its money policies. ``The unwinding of yen-carry trades exacerbated sell-offs that started with a slide in the U.S. dollar and falling commodity prices.” notes Bloomberg Asian analyst William Pesek Jr.

Mr. Pesek further observes that ``What makes the yen-carry trade so worrisome -- and easy to dismiss as a potential problem for markets -- is that no one really knows how big it is. It's not like the BOJ has credible intelligence on how many companies, hedge funds or mutual funds borrowed in yen -- or how much -- and put the money into assets elsewhere.”

Well, Gavekal Research whom has done a persnickety work tracking down yen capital flows has estimated that about US$1.8 trillion worth of Japanese capital found its way into the global financial markets in sundry assets, mostly to US treasuries. This is equivalent to around 15% of US GDP or 3% of US assets.

In other words, with the previous massive capital outflow from Japan’s residents plus a heavily yen denominated leveraged global financial community, any drastic moves to imbue or absorb back excess reserves or raise rates could further unsettle and destabilize the global financial markets.

With the Japanese governments’ apparent acknowledgement of the global market’s fallout, which had been “aggravated” from its pronounced reversal from its present “anti-deflation” policies, it has pumped back a record 1.5 trillion yen into the money markets last May 29th. This action suggests that Japan’s government, cognizant of the probable negative repercussions posed to the global financial markets, may go slow in its attempt to restore normalcy with its monetary policies.

This simply shows that the world markets will have to adjust and learn to live with the newfangled risk environment posed by Japan’s recovery, in the mellifluous words of Bloomberg’s Mr. Pesek, ``The world has anxiously awaited Japan's recovery, and its arrival is good news for Asia. Yet there's a catch: As Japan raises its interest rates, it may export higher borrowing costs everywhere else.”

Until then, the likelihood is that markets would remain volatile while it adjusts to present realities.

Philippine Assets: Vulnerable to Liquidity Crunch

What has all these got to do with Philippine financial markets? Almost everything.

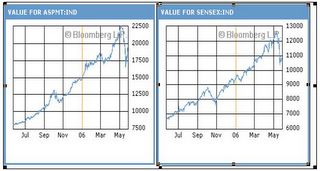

For the Phisix, which has been predominantly backstopped by foreign buying since 2003, question is how much of these portfolio investments have been levered to the Yen carry arbitrage or through various channels intermediated by the hedge fund dominated highly sophisticated leveraged/credit system.

The massive conflated sellout in almost the entire spectrum of asset classes simply validates my analysis that today’s markets have been largely macro driven brought about by the technology enabled financial market integration and increased globalization.

Figure 5: stockcharts.com Phisix and JP Morgan Fleming Emerging Markets

Once a similitude of a liquidity crunch occurs, as in the recent case, our asset class despite being a nominal laggard compared to its neighbors or its peers, would likely reflect the same degree of activity but of a more subdued intensity. As an illustration, the Phisix in red candlestick closely tracking (peaks and troughs-have been almost as one) the movements of the JP Morgan Emerging Market Index...

Need I say more?

Figure 6: IMF Growing Domestic Investor Holdership of RoPs (%)

And of the bond markets, despite the improving percentage of ownership of RoPs by domestic investors ($10 billion), mostly by banks (81%), insurance and pension companies (14%), foreign money still dominates ownership of the $28 billion outstanding, according to the IMF. Given the above, the likelihood is that the dynamics in the bond markets despite its fundamental differences may somewhat reflect that of the Phisix.