``Lenin is said to have declared that the best way to destroy the Capitalistic System was to debauch the currency. . . Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million can diagnose." John Maynard Keynes, The Economic Consequences of the Peace, 1920, pg 235.

As anticipated, Wall Street took the US Federal Reserve’s hiatus from its 2 year endeavor to normalize money policies as a reason to markdown equity prices, on the premise of a “slowdown-hurts-earnings” excuse, alongside with it, the Philippine Composite Index, which has closely tracked the movements of the US equity markets. The bizarre part came with Friday’s US strong retail sales figures, which had been imputed as a potential fulcrum for future Fed action on raising borrowing costs, as a reason to sell. Sell on Good news, Buy on negative news...this is today’s Wall Street mantra.

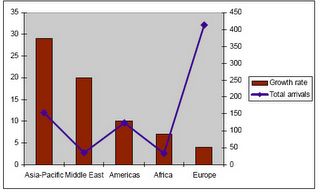

While the Phisix trailed Wall Street, this has not been the case with most emerging markets for last week. To wit, our ASEAN neighbors performed energetically on the broad financial markets, namely currencies, bonds and equities, which equally reflected the advances in other emerging markets of other regions, as shown in Figure 1.

Figure 1: Stockcharts.com: JP Morgan Emerging Market Index (black-red) JP Morgan Emerging Market Debt Fund (black)

Advances in bond prices (declining yields) have outperformed equities of late, as the chart above shows. These activities suggest that investors have been factoring in a slowdown in world economic growth. For the week, as the Phisix fell (-.89%), ASEAN markets were mostly on the upside, particularly Vietnam (+1.83%), Thailand (+.73%), Indonesia (+.92%) and Malaysia (+.46%).

In the light of moderating inflation indices, ASEAN central banks have either cut rate (Indonesia for the third time in four session for this year) or kept rates at unchanged (Philippines, Thailand and Malaysia) to spur economic growth. The “focus” on growth have led to an ardent rally in the region’s currencies as the Thai baht raced to a six year on a 1.3% jump to THB 37.26 over the week, while the Philippine Peso surged by .5% to a four month high at PHP 51.25, the Indonesian rupiah edged higher by .2% to 9,075, while Malaysia’s ringgit remained unchanged.

As of August 8th, according to Bloomberg’s Yumi Kuramitsu and Jake Lee, ``The Indonesian currency has gained 8.1 percent this year, with the Thai baht rising 8.8 percent and the Philippine peso strengthening 3.4 percent over the same period.”

Figure2: Bloomberg: Relative Performances; Indonesia (orange), Phisix (blue), Thailand (green), Malaysia (light blue)

As shown in Figure 2: rising regional currencies has mostly been reflected in buoyant equity benchmarks (except Thailand) led by Indonesia (returns on a year-on- year basis), followed by the Phisix, Thailand and Malaysia. Following May’s dramatic selloff, the above equity benchmarks have been trading below May’s peak.

At the margins, I have noted in the past that the rising peso has been inspired or set by foreign portfolio flows buttressed by OFW remittances and trade receipts.

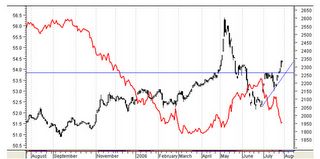

Figure3: Ascending Phisix (Red candle) on the backdrop of a falling US dollar/rising Peso (black candle)

As shown in Figure 3, the rising Peso has preceded a rally in local equities, manifesting a remarkable correlation, and should be further boosted as the Peso firms on the backstop of a prospective relaxation of monetary policies by global central banks and loose liquidity environment.

On the other hand, widely followed BCA Research admonishes that A Fed pause will do emerging equities more harm than expected (emphasis mine),

``A Fed pause typically does not help emerging market (EM) equities...EM equities have rebounded about 15% in the past two months, following the deep correction in May. There could be more upside in the near term in response to the Fed’s rate pause this week, but history suggests EM stocks will likely struggle if the Fed tightening cycle is over. EM stocks are growth sensitive and tend to advance when the Fed is hiking interest rates because the latter reflects improving U.S. economic conditions. While the structural story for EM stocks remains positive, the developing slowdown in the U.S. is a powerful headwind, especially since Chinese policymakers are also trying to cool their commodity-intensive economy. Bottom line: we recommend a neutral stance on EM stocks in global equity portfolios.”

It is rather odd where BCA views positive prospects on US stocks and bonds amidst the dour outlook they have publishing of late, yet maintains a neutral stance on emerging equities to which, according to them, is anchored to US economic conditions.

If the US bond markets are to continually rebound on the backdrop of a moderation economic growth (read: soft landing) and subdued inflation outlook, this indicates further loosening of the money policies ahead. As indicated last week, benchmark treasuries have mostly led Fed policies rather than the other way around.

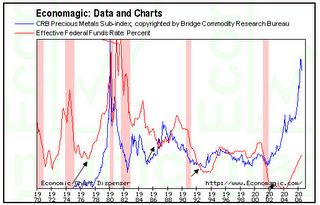

Inflation as gauged by the activities in the bond markets appears to be indicative of a prospective meaningful reduction as shown in Figure 4.

According to the Bureau of Public Debt, TIPS or Treasury Inflation Protected Securities ``are securities whose principal is tied to the Consumer Price Index. With Inflation the principal increases. With deflation, it decreases.” In short, TIPS are sovereign debt instruments with yields computed based on activities of the Consumer Price Index as a measure of inflation.

Based on the yield differentials of long and short dated TIPS instruments, the bond market appears to be looking at deflationary conditions, according to the Gavekal Research team, ``The short dated bond, indexed on the short term cost of money has seen its yield move from 0% in 2003 to 3% today. Meanwhile, the long dated TIPS has been range trading between 1.5% and 3% since 2002, and we are basically smack in the middle of that trading range today. More interestingly, the difference between the two is almost at an all time high. So, in other words, the US bond market is positioning itself for deflation rather than for inflation. While, a few months ago, bond markets were by and large saying that inflation was a threat, this message has now reversed. This is an important development.”

Again, should the bond markets persist to manifest on the trends indicated by BCA and Gavekal corroborated by either economic data or significant deterioration in the equity markets then one can expect the US Federal Reserve to act on relaxing or reversing its present course to “stimulate” or “reflate” both the financial and economic settings.

Loose money and credit policies equate to abundant liquidity which is highly conducive for the leveraged speculative community. Under such circumstances, one should expect the indispensable participation of financial management entities (hedge, mutual, institutional funds, et. al.) to further adopt yield chasing strategies or finding returns in excess of cash or funding costs, even to the farthest and remotest corner of the most unstable areas of this world, as had been during the past three years.

My point is liquidity or the present inflationary biases, as manifested in the realm of global finance in its myriad forms, such as massive trade imbalances, explosive growth of structured finance or ubiquitous credit boom, frenzied worldwide M&As, petro revenue liquidity et. al. , has driven economic growth on a macro framework rather than the other way around, and would continue to do so unless interdicted by a financial accident. In the same context, we find that these inflationary biases would likely be channeled into various asset classes as we are witnessing today.

In the appearance of coordinated tightening by global central banks led by the US Federal Reserve, liquidity has apparently been persistently accommodative allowing for intermittent rallies as seen in diverse markets and asset classes geographically.

Although there could be indeed signs of softening of inflation expectations, yet on the premise where global central banks would like to be seen as “successfully managing” the financial system, they are likely to err on the side of tolerating inflationary biases than to allow deflationary forces to overwhelm and render their policies as inutile.

Who among the bureaucrats would like to be perceived as being ineffective or inept? You can just imagine how its Japanese counterparts threw every known textbook response from adopting Keynesians measures of massive deficit spending to the monetarist approach of slashing rates to Zero or flooding central banks with cash to stave off a deflating bubble in the 90s only to fail miserably. Japan’s failed policies could be freshly ingrained in the minds of every member of the US Federal Reserves.

Moreover, you have the present war policies, an extended military exposure worldwide, massive defense and homeland security spending, humongous future liabilities concentrated in welfare entitlement programs as medicare and healthcare and foreign holdings of US bonds. Likewise globally, trend towards increased globalization and the deflationary shocks from the emerging market crises, the tech bubble bust, China’s accession to the WTO and Japan’s banking reforms, which have previously contained the effects of inflation, has permitted central banks around the world to adopt loose money policies too. ``As the effects of these unique factors pass, the inflationary effect of the excess money supply is becoming apparent” notes Andy Xie of Morgan Stanley.

At the end of the day, Central banking is all about inflation. According to analyst Puru Saxena (emphasis mine), ``You must understand that the central banks don't raise interest-rates to fight inflation. After all, the modern-day central banking system IS inflation! Central banks raise or lower interest-rates in order to manage the public's inflation fears or expectations. During such times when the public wakes up to the inflation problem and starts losing faith in the world's paper currencies (present scenario), central banks raise interest-rates to show that they're fighting inflation. Interest-rates are pulled up in an effort to restore confidence in the world's currencies as a higher yield makes currencies more attractive. On the other hand, when the public's inflation fears are under control and confidence in the monetary system is high, central banks lower interest-rates to create even more inflation!”