``Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat”-Sun Tzu

WAY past the self imposed $300 billion and October deadline, the US Federal Reserve continues to load up on long dated US treasuries this week.

Notably the amount of purchases has doubled to $ 7 billion from last week’s $2.8 billion. These Quantitative Easing activities have coincided with a new watermark high among global equity benchmarks (see figure 2).

Importantly, US Treasury purchases by the US Federal Reserve which commenced in the week of March 18th of this year, has nearly been concomitant with the March 6th lows of the US stock market.

Figure 2: Stockcharts.com and Cleveland Fed: Inflection Points Coincide With QE

Figure 2: Stockcharts.com and Cleveland Fed: Inflection Points Coincide With QE

This posits that after the US markets set a floor in March of this year (vertical blue line left window), the subsequent long dated Treasury purchases (light green arrow left window) by the US central bank combined with the earlier and larger purchases of agency debts have been tightly correlated with the revitalized actions in global stock markets which has likewise been reflected on the inverse price movement of the US dollar Index! (see figure 2)

Evidence and logical argument tells us that this has been more than just a tight correlation but one of causational influence.

So while the “desperately looking for normal” camp continues to pattern their analytics to the conventional economic sphere to predict for a “normalization”, the movements in the markets have increasingly been detached from the underlying motions in the real economy. And the evolving events have repeatedly and derisively contravened such expectations.

For instance, unemployment rates have soared to 10.2% in October (yahoo Finance) with the growling bear camp predicting unemployment rates to reach 12-13% (WSJ Blog) yet US markets continue to crescendo.

And such blatant disparity between surging stocks and improving but tepid economic growth activities has left the mainstream deeply discombobulated.

US Government’s Primary Political Goal: Save The Banking System

Two principal reasons for such confusion:

One, imprisoned by walls of conventionalism, this camp obstinately refuses to acknowledge and or reckon with the political objectives of the incumbent political leadership and their respective bureaucratic authorities, and their consequent actions or measures thereof.

This camp also refuses to digest or internalize on the reality that political objectives have NOT been primarily directed at rehabilitating unemployment, output gaps (excess capacity), idle resources or economic growth, which appears to be secondary, but on the PRESERVATION of the banking system!

The morbid fear out of a massive wave of near simultaneous banking closures or banking collapse (ala the Great Depression) that would lead an eventual systemic deflation has prompted the US Federal Reserve to engage in a massive and unprecedented scale of operations to buttress its banking system.

And it is for this reason that the Federal Reserve has reconfigured bank earnings from its traditional “deposit and lend” operating model, in the face of a disinclined market hobbled by over indebtedness, to a “bank as trader” model.

The Fed has engaged in a massive manipulation of market conditions to the benefit of the “Too Big To Fail” Banks in order to attain such goals [see our expanded explanation in 5 Reasons Why The Recent Market Slump Is Not What Mainstream Expects].

A recovery in earnings is sine qua non to ensure the industry’s survivability and so far the financial sector appears to have positively responded to the Fed’s programs in terms of ameliorating the industry’s balance sheets via earnings growth (See figure 3)

Figure 3: Bespoke Invest: The Financial Sector’s Explosive Earnings Recovery

Figure 3: Bespoke Invest: The Financial Sector’s Explosive Earnings Recovery

The bank as trader model has singlehandedly turbocharged the earnings of the S & P 500 despite a broad based sectoral decline in the third quarter on a year on year basis (left column). This is a concrete evidence of the outcome of state capitalism, where political officialdom selects the beneficiaries of its actions.

Meanwhile elevated stock prices appear to have somewhat reanimated the animal spirits that seem to have filtered into the earnings expectations of some sectors as the Technology and Materials in the 4th quarter.

To quote Bespoke Investment, ``The Financial sector is currently expected to see growth of 133.8% in Q4 '09 versus Q4 '08. This high estimate in the Financial sector helps put estimates for the entire S&P 500 at +65.2% in the fourth quarter. Ex-Financials, the S&P 500 is expected to see Q4 earnings actually decline by 7.6%. Technology is expected to see growth of 21.5% in Q4, while estimates for the Materials sector are currently at 97.5%.”

As you can see stock prices have been on an overdrive while earnings have only gradually begun to recover, except for the Financial sector. This unique market-real economy divergence has long been prompting bears to call for a reversion to the mean. Unfortunately for them the market continues to scathingly defy their convictions.

Following The Money Trail Analytics

Moreover, the “desperately seeking normal camp” which mainly sees current policies as a “one size fits all” remedial approach to both the banking sector and the US economy is a highly misguided diagnostic.

The fact that the US has spent more and provided gargantuan guarantees for its banking system than for the economy conspicuously reveals of its political priorities.

As we previously quoted a Bloomberg report, `` The U.S. has lent, spent or guaranteed $11.6 trillion to bolster banks and fight the longest recession in 70 years, according to data compiled by Bloomberg. That’s a 9.4 percent decline since March 31, when Bloomberg last calculated the total at $12.8 trillion.”

For the real economy only $132.5 billion or roughly 17% of the $787 US fiscal stimulus have been spent as of November 10th (recovery.gov)

Yet what seems obvious based on evidence hasn’t been given an appropriate weighting. Instead, experts have opted to selectively choose or data mine facts based on a preferred conclusion.

On our part analysis based on “follow the money trail” has been more effective.

And the money trail tells us that political reality translates to inflation as having been the chosen recourse to salvage the US dollar standard system pillared by the US banking system. The economy, despite the official pronouncements, is a secondary concern.

For as long as economic strains poses as threat to the survival of its banking system, the US political leadership will err on the side of an inflation risk and public sector credit risk than with the risk posed by deflation from a banking collapse. Hence, the sustained QE purchases on long dated treasuries, in spite of the self declared deadline and equally the sustained guarantees on the market mechanism conditioned by the US Federal Reserves that would allow the earnings of the banking system to recover.

This renders talks of “exit strategies” as mainly some sort of communication signaling ruse-meaning central bankers feign interest aimed at controlling the surge in asset prices. As we have been repeatedly saying, economic ideology and recent policy triumphalism has boosted the confidence of policymakers to undertake policies in the same direction. Any proposed “tightening” changes will likely be conservative.

Yet, in contrast to mainstream expectations, QE or “money printed from thin air” buying of US treasuries and US agency debt instruments from private institutions, have been flowing into commodities and equity markets and has likewise exerted pressure on the US dollar-giving a semblance of a US dollar carry.

Nonetheless misreading effects as a cause would seem like a sign of incomprehension or outright denial as a result of either economic ideological zealotry or blind spot biases.

The Folly Of Money’s Neutrality

The second reason for such confusion is the widespread or popular fallacious wisdom of the neutrality of money.

Conventionalism treats money has having a minor impact on its purchasing power or in the economy as transmitted by such inflationist policies. This is the reason why the mainstream can’t seem to reconcile on the dynamics behind rising asset prices and the divergence seen in the real economy.

Professor Mr. Ludwig von Mises explains the flaw in populist wisdom (bold emphasis mine), ``It is a popular fallacy to believe that perfect money should be neutral and endowed with unchanging purchasing power, and that the goal of monetary policy should be to realize this perfect money. It is easy to understand this idea as a reaction against the still-more-popular postulates of the inflationists. But it is an excessive reaction, it is in itself confused and contradictory, and it has worked havoc because it was strengthened by an inveterate error inherent in the thought of many philosophers and economists.”

``These thinkers are misled by the widespread belief that a state of rest is more perfect than one of movement. Their idea of perfection implies that no more perfect state can be thought of and consequently that every change would impair it. The best that can be said of a motion is that it is directed toward the attainment of a state of perfection in which there is rest because every further movement would lead into a less perfect state.”

In short, economic activity is seen as fundamentally independent from money supply growth.

Furthermore, asset prices have been deemed to operate on the premise of ‘efficient’ market price signaling brought about by disparate entrepreneurial assessments, estimates and evaluation. This is hardly true today.

And such perceptions of market efficiency will unlikely reflect on the same performances of yesteryears, as global governments have taken to the center stage in the propping up of financial markets.

The Periphery As Global Economic Locomotive

A recent rundown on the performance of global stock markets can be seen in Global Stock Market Performance Update: BRICs Firmly In Command. What seems obvious is the relativity or the variability of performances from the collective pace of global reflationary activities.

Major emerging markets have monstrously been outperforming developed economies equities for several crucial reasons: a largely unimpaired banking system, low systemic leverage and high savings, from which monetary and fiscal policies seem to have generated a visible efficacy-read my lips-seminal bubbles.

This also means that the transmission mechanism of inflation has been segueing from the core (developed economies) to the periphery (emerging markets) -where the periphery is now expected to lift the economic conditions of the core.

The recent crisis has triggered the reshuffling economic might. China’s economy offset the economic losses from developed economies as shown in figure 4.

According to the World Bank, ``Thanks to China, East Asia remains the fastest growing developing region in the world. Although China’s economy accounts for less than a tenth of the global economy, the increase in China’s GDP in 2009 will offset three-fourths of the decline in G3’s GDP. This number underlies China’s markedly increased global role, but also reveals the limits to what China alone can do, because this year’s outcome was achieved through a huge monetary and fiscal stimulus that the authorities will find neither prudent nor necessary to sustain for an extended period of time. Take China out of the equation, however, and the remainder of the region is set to expand at a slower pace than the Middle East and North Africa, South Asia, and only modestly faster than Sub-Saharan Africa (Table 4). This reflects the openness of East Asia and the fast transmission of shocks through production networks serving the U.S., Japan and other global markets.” (bold highlights mine)

In short, conventionalism continues to embrace myopically a US centric world, even as global growth dynamics appears to be shifting to a very important theme: the periphery as the world’s economic growth locomotive.

In addition, conventionalism can’t seem to grasp the encompassing dynamics where government has practically been THE market. The US Government has been the market because the political authorities deem the “Too Big To Fail” segment of its banking system as indispensable to the economy or for unspecified purposes (known only to the authorities-saving friends perhaps?).

This means that when government as policy, prints money to buy assets from private institutions that owns these securities to shore up its financial sector; money from the proceeds of the sale of assets circulates in the economy or is imbued by the financial market.

Why? Because according to Professor Mises, ``Money is an element of action and consequently of change. Changes in the money relation, i.e., in the relation of the demand for and the supply of money, affect the exchange ratio between money on the one hand and the vendible commodities on the other hand. These changes do not affect at the same time and to the same extent the prices of the various commodities and services. They consequently affect the wealth of the various members of society in different ways.”

In short, inflationism is fundamentally a redistribution of wealth.

From the US perspective, since the advent of the crisis, US taxpayers have been funneling wealth into its financial sector, which is being precariously upheld by the government policies.

On a global scale, the ongoing QE process by the US government has been facilitating for capital outflows from the US. Conversely, such outflows have translated to influx into emerging markets channeled via a vastly weakening US dollar-ergo, the immense disparity in the equity performances between emerging markets and developed economies.

So while we may not have seen generalized inflation yet, what we are seeing today has been a colossal flow of money into assets or “asset inflation” mostly in terms of rising prices of stock markets and possibly in real estate markets of some emerging economies aside from commodity inflation.

Myths and Fallacies, Inflation A Predominant Theme For 2010

In addition the vast excess reserves held by the banking system in the developed economies, given today’s buoyant sentiment, is NOT a guarantee that the reserves won’t be converted into private sector loans (see figure 5)

Even as money supply year on year change on the Euroland has been on a decline (right window) since 2007, the loans to non-financial institutions and households have been resurgent (left window). Given the fractional reserve nature of our banking system, sustained loan growths would eventually translate to a surge in money supply growth.

Essentially, more of the continued central bank money printing activities and circulation credit from global zero interest rate regime will transpose to even more systemic inflation.

Remember, it would be a fallacious argument to read ‘deflation’ as contracting money supply in debt plagued economies and apply a different definition to emerging markets (mostly in terms of surplus capacity).

Such inconsistency makes the global deflation theme highly vulnerable or flawed.

Figure 6: World Bank: Different Structures, Different Impact

Figure 6: World Bank: Different Structures, Different Impact

As seen in figure 6, credit growth has been relatively nuanced among Asian economies and has impacted the region’s economies distinctly.

Therefore, oversimplifying inflation or deflation without fully understanding the fundamental individual political economic constructs of each nation would seem nebulous.

Moreover, it is likewise another fallacious argument to predicate the “containment” of inflation on lofty bond prices alone. As earlier discussed, applied to the US, US treasuries have been one of the key markets supported and manipulated by the US government aimed at bolstering its banking system.

Where price controls can create temporary conditions favorable to policymakers, imbalances from market distortions are fostered from within that would eventually unravel once the system can’t absorb more of these at the margins.

Yet, to assume that current market conditions accurately paint today’s economic environment would be a monumental folly. To be sure, this view critically fails to contrast on the political dynamics from economic metrics.

Moreover, this view seems like a perilous miscomprehension on the operating dynamics of inflation. Inflation does not just randomly pop up where central banks can do a whack-a-mole. Inflation is a political process that operates and is manifested on the markets in stages. [see What Global Financial Markets Seem To Be Telling Us]

Hence, market action is conditional on the direction of global government policies where so far political authorities have been predisposed towards the global reflation context.

This, in essence, also suggests that inflation, as expressed in mainstream definition as higher consumer prices, will likely surprise to the upside and will be a key theme for 2010.

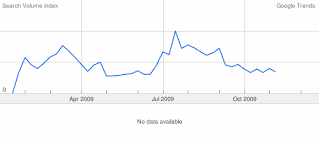

And even in Google search trends

And even in Google search trends