According to George Soros, ``One can never be sure whether it is the expectation that corresponds to the subsequent event or the subsequent event that conforms to expectation. The segregation between thoughts and events that prevails in natural science is simply missing.” In this context, I remain uncertain of my convictions over the interim simply because events have turned against them.

Yet as prudent investors we do not fight the tape. In the invaluable words of legendary trader Jesse Livermore ``There is only one side of the market, and it is not the Bull side or the Bear side, but the right side.” We have to remain flexible, in view of these circumstances.

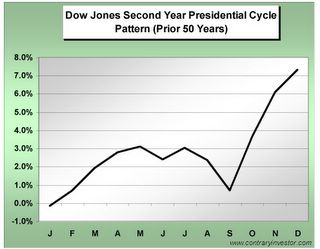

Figure 3: Contraryinvestors.com: Second Year Presidential Cycle Pattern

The tape tells us that momentum favors the bulls at present for reasons aside from the fallacious “lower inflation expectations" most possibly based on several factors such as seasonality; a switch from the weakest to the strongest period of the year, the underlying year end strength of the second year of the Presidential cycle (see Figure 3), ``the end of the fiscal year for mutual funds and other institutional investors on Oct. 31 ends selling by funds anxious to take a tax loss to offset the year's profits and sends institutional money flowing back into the market and measures of short-selling on the New York Stock Exchange and the Nasdaq have reached multiyear highs (a seven-year high in the case of the New York Stock Exchange), so there are still lots of skeptics out there to be convinced.” according to analyst Jim Jubak.

Of course, the supposed government interventions to prop up the markets for political goals could be another short-term booster, which could translate to a run until at least November.

Lastly, I think the most important factor which underpins the entire bullish psyche today is premised on inflationary biases whether through manipulation (alleged government intervention in several fronts of the market) or through Soro’s “expectation that corresponds to the subsequent event” (financial markets ties the hand of a reluctant Fed and succeed to force them to further loosen up the speculative landscape) or through remediation of one bubble to another (shift from equities to housing back to equities?).

As I wrote to a special client, “the inflation genie is what inspires the market to resume its climb upwards regardless of the risks of greater-than-expected slowdown. It's simply called addiction, from which the Fed and the incumbent politicians would be all too willing to accommodate for the primordial purpose of power retention.”

As a last piece of advice; trade only amounts you are willing to risk and importantly MIND YOUR STOPS!

TailPieces

One of my favorite analyst at Morgan Stanley covering the Asian markets, Mr. Andy Xie was reported to have recently resigned due to a controversial email he sent internally but have leaked outside and allegedly caused embarrassment to the firm which led to his rush departure.

FinanceAsia quotes the alleged intriguing derogatory comment on Singapore from Mr. Xie, ``Actually, Singapore’s success came mainly from being the money laundering centre for corrupt Indonesian businessmen and government officials. Indonesia has no money. So Singapore isn’t doing well. To sustain its economy, Singapore is building casinos to attract corrupt money from China.”

Two important quotes come into my mind, one, never to judge a book by its cover and second, from novelist Honore de Balzac, Behind every great fortune there is a crime. Just a food for thought though.

No comments:

Post a Comment