``There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”-Ludwig Von Mises

Taking the insulated prism of the Phisix without considering global fund flow dynamics into our markets lends to serious misdiagnosis, something so prevalent in today’s media, whose penchant is to oversimplify, in describing today’s activities.

Foreign money flows are at the margins LARGELY responsible for the appreciating Peso, surging domestic sovereign instruments and rampaging equity prices.

This globalization of cross-border portfolio flows could be seen even in the US, which has capitalized heavily on global flow dynamics to fund its debt-driven asset-dependent economy as depicted in Figure 3, courtesy of Yardeni.com.

Taking the insulated prism of the Phisix without considering global fund flow dynamics into our markets lends to serious misdiagnosis, something so prevalent in today’s media, whose penchant is to oversimplify, in describing today’s activities.

Foreign money flows are at the margins LARGELY responsible for the appreciating Peso, surging domestic sovereign instruments and rampaging equity prices.

This globalization of cross-border portfolio flows could be seen even in the US, which has capitalized heavily on global flow dynamics to fund its debt-driven asset-dependent economy as depicted in Figure 3, courtesy of Yardeni.com.

Figure 3: Yardeni.com: Flow of Funds: Foreign Capital Flows in the US (upper pane) Financing Its Trade Deficit (lower pane)

Therefore understanding the mechanics of money flux by overseas investors or institutions has been the locus of our analysis.

I noted in the past that Global markets have been synchronically rising on expectations that a cooling off in the premiere consuming economy of the world would result to a more conducive financial environment for the asset markets; euphemistically, more leveraging for speculation purposes.

It is in the theatre of the absurd where we would find the investing public applauding on the expectations that record high corporate earnings will maintain its robust levels in the face of an overall cooling growth climate to justify for higher multiples.

The significant upside rally seen in the leadership of US equities, specifically the Dow Jones Industrial Averages (+12.8% year-to-date) since its July lows (+12.6%~gist of the gains came from the July 14th rally and so as the Phisix 22.27% out of the 28.93% year-to-date gains or 77% of the y-t-d advances) essentially boils down to Friday’s US GDP report as shown in Figure 4, courtesy of Northern Trust, which finally has given the major benchmark a raison d'être for a pause from its extraordinarily high adrenalin motion during the last quarter...a probable sell on News. It is in high likelihood that the Phisix will equally find a reason to correct on Monday.

I noted in the past that Global markets have been synchronically rising on expectations that a cooling off in the premiere consuming economy of the world would result to a more conducive financial environment for the asset markets; euphemistically, more leveraging for speculation purposes.

It is in the theatre of the absurd where we would find the investing public applauding on the expectations that record high corporate earnings will maintain its robust levels in the face of an overall cooling growth climate to justify for higher multiples.

The significant upside rally seen in the leadership of US equities, specifically the Dow Jones Industrial Averages (+12.8% year-to-date) since its July lows (+12.6%~gist of the gains came from the July 14th rally and so as the Phisix 22.27% out of the 28.93% year-to-date gains or 77% of the y-t-d advances) essentially boils down to Friday’s US GDP report as shown in Figure 4, courtesy of Northern Trust, which finally has given the major benchmark a raison d'être for a pause from its extraordinarily high adrenalin motion during the last quarter...a probable sell on News. It is in high likelihood that the Phisix will equally find a reason to correct on Monday.

Figure 4: Northern Trust: Declining GDP Reflects Soft Landing?

According to Asha Bangalore of Northern Trust, ``Real GDP grew at an annual rate of only 1.6% in the third quarter -- the smallest gain since the first quarter of 2003 when the economy poked along at a 1.2% clip. The U.S. economy has recorded the weakest 2-quarter growth since the two quarters ended 2003:Q1...The prospects of a quick pickup in growth in the fourth quarter are dim. Output of motor vehicles made a hefty contribution 0.7% point to real GDP growth in the third quarter.” In other words, a statistical fluke from the output of motor vehicles was responsible for giving US GDP a hefty lift, such that withholding these factors, the stated GDP figures could have been drastically weaker.

Yet with such dour outlook, the Dow and other US benchmarks fell modestly, instead of a rout.

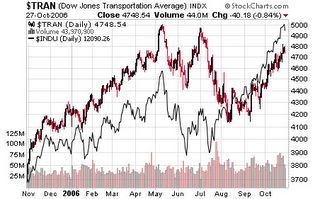

There are those who argue that in spite of the Dow Jones’ reanimated rebound, the supporting indices as the Nasdaq or the S & P 500 have not risen to surmount their previous highs as the (30-company) Dow index. Moreover, there are those who question that the resurgent Dow Jones has been limited to a select few issues whereby none of the components have broken to NEW record highs, despite the record levels attained by the major benchmark, while about half of the component issues are still trading considerably underwater (over 20% below) relative to their 2000 highs. Even some argued further, that the Dow Transports which if based on the Dow Theory has so far failed to confirm the rise of its sibling index (Figure 5), aside from arguments that the Dow’s rise has been due to its structural composition being mainly price-weighted.

Yet with such dour outlook, the Dow and other US benchmarks fell modestly, instead of a rout.

There are those who argue that in spite of the Dow Jones’ reanimated rebound, the supporting indices as the Nasdaq or the S & P 500 have not risen to surmount their previous highs as the (30-company) Dow index. Moreover, there are those who question that the resurgent Dow Jones has been limited to a select few issues whereby none of the components have broken to NEW record highs, despite the record levels attained by the major benchmark, while about half of the component issues are still trading considerably underwater (over 20% below) relative to their 2000 highs. Even some argued further, that the Dow Transports which if based on the Dow Theory has so far failed to confirm the rise of its sibling index (Figure 5), aside from arguments that the Dow’s rise has been due to its structural composition being mainly price-weighted.

Figure 5: Stockcharts.com: Dow Theory Non-Confirmation? Dow Transports (red candle), DJIA (black line)

While these views have my sympathy, I think that most of these observations are in a state of denial considering that Dow Jones Industrial Average (DJIA) has actually led if not inspired all other benchmark higher, despite their below record performances including that of world indices.

Even if such actions were borne out of surreptitious intervening activities of the Plunge Protection Team, or Executive Order 12631-Working Group of Financial Markets, a supposedly covert US government body led by the US Federal Reserve with purported ``goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence”, my point is global markets have chimed. They can manipulate one or two markets but for a whole spectrum of markets around the world would be close to impossible. Besides, manipulative activities have short-term effects and the likelihood is that the present underlying efficacies will erode over the long run, if indeed downright cooked.

Yes, the Dow and other key US benchmarks are likewise in strenuously overbought conditions and may retrench as they find an opportunity to do so, but my point is unless we see a genuine divergence, or moving in the opposite direction in contrast to the DJIA, by one or some or a combination of the other indices, to wit, the Nasdaq, the S & P 500, the NYSE, Russell indices or the Dow Transports, et. al., it would be impractical to dismiss outright the actions transpiring in the US equity markets as a nonevent.

Even if such actions were borne out of surreptitious intervening activities of the Plunge Protection Team, or Executive Order 12631-Working Group of Financial Markets, a supposedly covert US government body led by the US Federal Reserve with purported ``goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence”, my point is global markets have chimed. They can manipulate one or two markets but for a whole spectrum of markets around the world would be close to impossible. Besides, manipulative activities have short-term effects and the likelihood is that the present underlying efficacies will erode over the long run, if indeed downright cooked.

Yes, the Dow and other key US benchmarks are likewise in strenuously overbought conditions and may retrench as they find an opportunity to do so, but my point is unless we see a genuine divergence, or moving in the opposite direction in contrast to the DJIA, by one or some or a combination of the other indices, to wit, the Nasdaq, the S & P 500, the NYSE, Russell indices or the Dow Transports, et. al., it would be impractical to dismiss outright the actions transpiring in the US equity markets as a nonevent.

Figure 6: Stockcharts.com Bullish signals from Gold

In addition, if one vets on the intermarket activities, only POLITICAL “INFLATION” associated commodities, particularly Gold (see Figure 6) and Energy commodities appears to be under pressure, despite the “significant” moderation seen in the US economy. Now with US elections coming in early November any incentive to “manipulate” these markets or any other markets may eventually wean.

In essence, mainstream economists and pundits will argue about the technicalities of the opposing potential directions of inflation (as measured in goods) in the backdrop of a supposed cooling of world economic growth led by the US, yet we are seeing a rebound in most asset prices globally, which is quite ironic. The US economy may have slowed during the third quarter, but obviously friendly and loose credit conditions have softened the impact of such slowdown. Will these conditions continue?

Since I think that today’s markets have been mainly liquidity and liquidity “expectations” driven, any furthering or reversal of these conditions will lead or dictate upon the directions of the world financial markets, be it in bonds, currencies, commodities or the equities or our own Phisix.

As liquidity conditions remain lax, and bountiful credit intermediation persists, and importantly, expectations of such conditions to remain in place; excess money will be finding a home in assets, notwithstanding a slowdown.

In essence, mainstream economists and pundits will argue about the technicalities of the opposing potential directions of inflation (as measured in goods) in the backdrop of a supposed cooling of world economic growth led by the US, yet we are seeing a rebound in most asset prices globally, which is quite ironic. The US economy may have slowed during the third quarter, but obviously friendly and loose credit conditions have softened the impact of such slowdown. Will these conditions continue?

Since I think that today’s markets have been mainly liquidity and liquidity “expectations” driven, any furthering or reversal of these conditions will lead or dictate upon the directions of the world financial markets, be it in bonds, currencies, commodities or the equities or our own Phisix.

As liquidity conditions remain lax, and bountiful credit intermediation persists, and importantly, expectations of such conditions to remain in place; excess money will be finding a home in assets, notwithstanding a slowdown.

No comments:

Post a Comment