There has been an explosion of IPOs in emerging markets, particularly in Asia.

According to Globe and Mail (graph included)

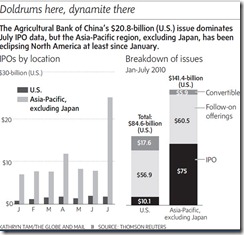

Globally, July IPOs totalled $30.5-billion (U.S.), according to Thomson Reuters, the highest value since November, 2007. The Asia-Pacific region benefited most from the boom, buoyed by Agricultural Bank of China Ltd.’s $20.8-billion IPO. Not only did AgBank garner strong demand, the offering was ultimately upsized.

Since January, the Asia-Pacific region, excluding Japan, has raised almost $136-billion (U.S.) in IPOs and follow-on offerings, according to Thomson Reuters, while the United States has raised $67-billion. Investors can only wonder why North America has been so tepid while Asia is so hot.

Exploding IPOs, for me, are symptoms of brewing euphoria, which are mostly in response to policies. The rate of increases provides significant clues to the transitioning phases of a bubble cycle. See earlier discussion What Agricultural Bank of China’s IPO Should Imply For Asian Financial Markets

The issue of concern here isn’t a liquidity drain. For every buyer there will always be a seller. Thus, liquidity (money) is transferred from buyer to seller.

The issue is here is euphoria, artificially bolstered demand from policy impetus that forces the public to (decrease savings) increase risk appetite and chase yields, thereby distorting relative price levels of financial securities, the fostering malinvestments (in the real economy) and the attendant speculative orgies.

The primary reasons why Asia outperforms or has gained significant traction from such policies as earlier stated here has been because of huge savings, less systemic leverage, and a largely unimpaired banking system.

Of course, many real economic reasons provide for the other “rationalization”. Think regionalization, urbanization, wealth transfer etc... But they are secondary forces.

Importantly, in a world of globalization, global funds tend to seek out the best performers, which is emblematic of the ‘bandwagon effect’, as Templeton’s Mark Mobius writes,

In general, institutional pension funds’ exposure to the emerging markets asset class averages around 3% to 8% of their portfolios. From a pure market capitalization perspective I think that they are severely underweight in the asset class, as emerging markets stocks account for more than 30% of the world’s total market capitalization. We anticipate seeing some shift of institutional allocations to this asset class. Consequently, we believe institutional investors could fuel further demand for emerging markets equities.

...and that there would be numerous carry trade or arbitrage opportunities, from the fast emerging divergent monetary policies which could be channelled from currencies to bonds and could find its way to these IPOs and fuel more of this bubble like phenomenon.

I don’t think that Asia’s IPOs has reached a scale of bubble proportions to the point of implosion. Not yet anyway. Perhaps we could still be far off. But these constitute one of the many signs that we are headed in that direction.

P.S. As per the Philippines an IPO boom has yet to materialize.

No comments:

Post a Comment