``In the modern world, science and society often interact in a perverse way. We live in a technological society, and technology causes political problems. The politicians and the public expect science to provide answers to the problems. Scientific experts are paid and encouraged to provide answers. The public does not have much use for a scientist who says, "Sorry, but we don't know". The public prefers to listen to scientists who give confident answers to questions and make confident predictions of what will happen as a result of human activities. So it happens that the experts who talk publicly about politically contentious questions tend to speak more clearly than they think. They make confident predictions about the future, and end up believing their own predictions. Their predictions become dogmas which they do not question. The public is led to believe that the fashionable scientific dogmas are true, and it may sometimes happen that they are wrong. That is why heretics who question the dogmas are needed." - Freeman Dyson "The Need for Heretics"

People often confuse cheerleading for predictions.

Most mistakenly think that they are seeking for the “right” answers on specific dilemmas when in fact they are only latently searching for confirmations on particularly predetermined perspectives.

When we watch a sports game and take sides with one of the protagonists, we don’t “predict” the outcome, rather we “cheerlead” or desire that our handpicked team wins or accomplishes a particular goal, regardless of extraneous ‘analysis’. Faith precedes the rational.

So whether we apply this way of thinking into sports or into analyzing financial markets or the economy or the political spectrum; faith based preferences represent no more than our inherent biases that should not be confused with objective predictions or opinions or studies.

Causality versus Superstition

Yet everyone has their innate way of seeking for answers for real life activities, as Ludwig von Mises wrote[1] in his magnum opus,

There are for man only two principles available for a mental grasp of reality, namely, those of teleology and causality. What cannot be brought under either of these categories is absolutely hidden to the human mind. An event not open to an interpretation by one of these two principles is for man inconceivable and mysterious. Change can be conceived as the outcome either of the operation of mechanistic causality or of purposeful behavior; for the human mind there is no third way available. It is true, as has already been mentioned, that teleology can be viewed as a variety of causality.

And faith based analysis are mostly anchored on teleology or the doctrine or the belief that holds purpose and design as a part of or are apparent in nature[2].

Where people cannot ascertain or relate with the cause and effects of a phenomenon, they submit to the teleological interpretation usually by attributing these to some mysterious, cosmic or mystical forces.

As Professor Mises described[3], ``They invented deities and devils to whose purposeful action certain phenomena were ascribed. A god emitted lightning and thunder. Another god, angry about some acts of men, killed the offenders by shooting arrows. A witch's evil eye made women barren and cows dry.”

There seems little difference even in the modern world.

In making predictions, the same phenomenon seems to take effect: Where most people can’t ascertain valid causal linkages, they frequently ascribe to various mental heuristics and or use sloppy reasoning (logical fallacies)—and this applies even to institutional analysts or professionals. Have you ever wondered why the mainstream ‘experts’ had largely missed out on anticipating the occurrence of the last crisis? Mainstream economists had even been implicitly chastised by the Queen of England[4] for failure to predict and stop the crisis!

Yet since predictions are basically interpretations of current and past events which are extrapolated into the future, prediction essentially deals with methodology.

So whether it is about prophecy—via water divining, astrology, numerology, fortune telling, interpretation of dreams, and many other forms of divination or about prediction science—statistical probabilities, mathematical equations and models, computer simulated models[5] or the physici[6] or the search mechanistic explanations, the methodology for prediction matters.

Of course as stated above, objective predictions and biased faith based predictions can be distinguished.

Objective predictions are mostly premised on the methods that generate potential outcomes or using the ‘means to establish potential ends’. Whereas cheerleading or biased or analysis are mostly ‘cart before the horse’ reasoning or selectively choosing theories or facts to retrofit into a desired outcome.

As stated above, in cheerleading, analysis serves to cosmetically embellish or improve on the seeming cogency of the issue. To put bluntly, analysis acts only as a façade.

Critical Changes Occur At The Margin

Let me further state that mainstream predictions are largely mistaken for their idée fixe on current events, whose key players or factors they see as the main driving factors, which impels them to bypass the several other critical variables that affect the ongoing changes.

For instance, in the advent of the 20th century the mainstream hardly predicted the US to supplant Britain as the world’s economic and military power.

On the other hand, hardly anyone had also seen how Argentina, one of the most prosperous nations then, degenerated into a third world country or an emerging market economy[7] as her economy was gutted by protectionism and rampant cronyism.

In the same context, when Japan became the world’s economic and financial cynosure in the 1980s, there had been little notice of how China would emerge as an economic power a decade forward. And some of the geopolitical angst then had been focused on Japan’s resurgent economy, which turned out to be an illusion.

And now that China has gotten into everyone’s radar screen, political talking points and political correctness have been transfixed towards China, as if China holds the world by the jugular.

While I do not discount the growing importance of the role of China, I see the excessive focus on her as missing out the other important variables at work.

And today, the same people (mostly the politically blind) who claim to know what should be ‘morally’ good for the world, are the same people whom has constantly misread the future.

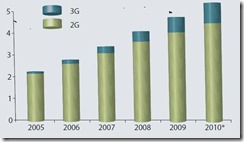

Of course these people, who presume to hold the moral high ground, have not seen or predicted the explosion of mobile telecoms technology (see figure 1) and how it has substantially affected and altered people’s lives.

Figure 1 ITU[8]: The Rise of 3G

How big an impact of the rapid progress and evolution in the telecom world to the real economy?

This from the ITU, (bold highlights mine)

-By the end of 2010, there will be an estimated 5.3 billion mobile cellular subscriptions worldwide, including 940 million subscriptions to 3G services.

- Access to mobile networks is now available to 90% of the world population and 80% of the population living in rural areas.

- People are moving rapidly from 2G to 3G platforms, in both developed and developing countries.

-In 2010, 143 countries were offering 3G services commercially, compared to 95 in 2007.

- Towards 4G: a number of countries have started to offer services at even higher broadband speeds, moving to next generation wireless platforms – they include Sweden, Norway, Ukraine and the United States.

Question: Have these so-called experts and the political ideologues seen how the explosion of technological innovation in various fields, such as the telecoms, has transformed or revolutionized the way people has conducted commerce or the how these changes has influenced the political playing field or how 86% of the world’s wired population has reconfigured their lifestyles based on these new instrument and platforms? The simple answer is HARDLY.

Du jour politics have largely obscured the contribution of technology in today’s current developments. In other words, while substantial changes has been happening at the margins, the mainstream tunnels in on what is quite evident (trading patterns misconstrued as imbalances, debt as impeding growth).

Of course from the hindsight, everything has not only been fait accompli but looks linear or deterministic such that we simplistically presume to know how history is made, which has been used by many to make flimsy and tenuous arguments.

History is mostly narrated from the lens of a single observation, rather than taken into consideration the underlying conditions and the alternative options which had been available at the time that had led to such an outcome.

As Nassim Taleb explains[9] along the lines of assailing teleology,

``While we know that history flows forward, it is difficult to realize that we envision it backward…Our minds are not quite designed to understand how the world works, but, rather, to get out of trouble rapidly and have progeny.”

Legg Mason’s Michael J. Mauboussin[10] sees the importance of critical points (or changes at the margin) in identifying trends,

``Many complex systems, including markets, have critical points where small incremental condition changes lead to large-scale effects. Researchers in both the physical and social sciences have known about these critical points for a long time; so much so that terms like phase transition and tipping point have slipped into our day-to-day language. Still, critical points throw a monkey wrench into our mostly linear cause-and-effect thinking.

Bottom line: In a world of complex systems, predictions should be anchored on the ongoing changes at the margins that could snowball into a major trend than to excessively fixate on popular issues frequently regurgitated by media and their phalanx of experts with terrible batting averages in terms of prediction.

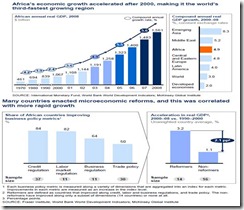

Here is more evidence on the evolving paradigm shifts at the margins from which the mainstream has vastly ignored (see figure 2)

Figure 2: McKinsey Global Institute[11]: Economic Freedom Spurs Growth In Africa

People today see the growing role of emerging markets in the global economy for mostly the wrong reasons: they have overlooked the role of economic freedom as fuel to economic growth.

As the McKinsey illustration shows, as many nations in Africa have undertaken vital reforms in the direction of economic freedom, trade exposure has been bolstered and vibrant economic growth has followed.

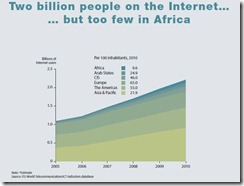

And how has progress in technology coped with the ongoing reforms in Africa? (see figure 3)

Figure 3: ITU: Africans Online Likely To Catch Up

Mobile penetration level is reportedly at an estimated 41% at the end of the 2010 compared with the global average of 76%, whereas only 21% are online compared to 71% in developed economies.

According to ITU[12], ``By the end of 2010, Internet user penetration in Africa will reach 9.6%, far behind both the world average (30%) and the developing country average (21%).”

Since Africa has lagged the world in terms of economic development, the recent economic reforms has translated to a catch up role even in the realm of connectivity. Nonetheless a promising room for growth for industries.

Yet these are examples of “changes at the margins”…important changes that may be gradual but could play a substantial role in shaping the future.

Conclusion

In conclusion:

-We should not confuse predictions with that of cheerleading or biased analyses that are influenced or shaped by political or economic dogma.

For views ossified by such biases, hardly any amount of valid or worthwhile reasoning will be sufficient to apostatize a recalcitrant ‘faith’ based outlook. It’s like debating religion which is usually a futile exercise that would only lead to strained personal relationships.

Instead, people with such biases ought to put money where their mouth is. For instance, if they believe that the world is on path to a meltdown then they should just ‘short’ the markets or the economy/-ies or just run to the hills for cover. Let convictions be parlayed into monetary votes than unduly spread political canard. Some use their ivory tower positions to spread miasma.

-Many cheerleaders look for ‘expert’ opinion only either to CONFIRM their biases or to get ENTERTAINED. If they are not pleased with what they read about, they scrounge for opinions that match with their biases.

-The framework of any forms of predictions depends on methodology. Applying the wrong method would likely bring about misdiagnosis, and consequently misguided conclusions and erroneous predictions. Being accurate then, will account for as a product of lady luck or provident coincidence, rather than having their analysis to conform with actual or the “run of mill” developments[13].

-Quality predictions avoid biases, particularly generalizations predicated on limited sample/s, data mining and selective use of theories and facts in order to justify a preconceived conclusion. Prediction analysis should consider objectively, the broader picture, aside from the micro developments that incorporates interpretation from sound theory, which are supported by evidences.

-The most important changes or ‘critical points’ are happening at the margins, something which most predictions don’t discover until they become major trends.

[1] Mises, Ludwig von Human Action: Chapter 1. Acting Man: The Alter Ego, Mises.org

[3] Mises Ludwig von, Theory and History Positivism and Behaviorism, Chapter 11, Mises.org

[4] Guardian.co.uk This is how we let the credit crunch happen, Ma'am ... July 26, 2009

[5] Wikipedia.org, Prediction

[6] Lilburne, J. Grayson Prelude to Natural Philosophy, Mises Blog, March 17, 2010

[7] Glaeser Edward L. What Happened to Argentina?, New York Times Blog, October 6, 2009

[8] Itu.int The Rise of 3G, The World In 2010, ICT Facts and Figures

[9] Taleb, Nassim Nicolas Fooled By Randomness, Random House Trade, p.56

[10] Mauboussin Michael J. Fat Tails and Nonlinearity, Legg Mason Capital, December 20, 2007

[11] McKinsey Global Institute: Lions On The Move The Progress and Potentials of the African Economies, June 2010

[12] Itu.int, Op cit. P.4

[13] See Distinguishing Luck From Skills In The Financial Markets, September 19, 2010

No comments:

Post a Comment