In Canada, a recent poll manifested that one-third of their residents does not have enough savings.

From Yahoo,

Nearly one-third of Canadians that responded to a recent survey backed by a major Canadian bank said they didn't have enough money to cover living expenses.

An online survey completed for TD Canada Trust (TSX:TD) also found that 54 per cent of the 1,003 people who answered said it was a real struggle or impossible to save.

The report, released Wednesday, says that 38 per cent of respondents said they had no savings and 30 per cent said they didn't have enough money for their living expenses.

In other words, a big segment of Canada’s population has been living on debt.

And the culture of debt has been a festering pandemic since Nixon Shock where the gold anchor was severed from the world’s monetary system.

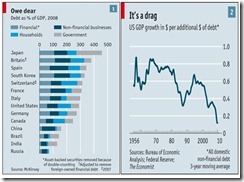

As the Economist points out in the crisis year of 2008,

Throughout the 1980s and 1990s a rise in debt levels accompanied what economists called the “great moderation”, when growth was steady and unemployment and inflation remained low. No longer did Western banks have to raise rates to halt consumer booms. By the early 2000s a vast international scheme of vendor financing had been created. China and the oil exporters amassed current-account surpluses and then lent the money back to the developed world so it could keep buying their goods.

Those who cautioned against rising debt levels were dismissed as doom-mongers; after all, asset prices were rising even faster, so balance-sheets looked healthy. And with the economy buoyant, debtors could afford to meet their interest payments without defaulting. In short, it paid to borrow and it paid to lend.

Like alcohol, a debt boom tends to induce euphoria. Traders and investors saw the asset-price rises it brought with it as proof of their brilliance; central banks and governments thought that rising markets and higher tax revenues attested to the soundness of their policies.

The culture of debt signifies symptoms of accrued policies shaped by the dominant economic ideology which sees spending as the key force for promoting prosperity or keeping society “permanently in a quasi-boom”.

The war against savings, which is being channeled through policy-based low interest rates (“The remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the boom to last”-General Theory) punishes savers and rewards speculative activities which benefits the wards of central banks—added profits for the banking industry cartel and expanded government spending for politicians.

Never mind the law of diminishing returns on debt to an economy (such as in the US; see right window of the above chart).

Past ephemeral successes [plus sustaining a debt based political economy] will lead global authorities towards path dependent policy choices (which is why I think that global QEs will continue)

Besides, politicians and the bureaucracy sees such policies as even more beneficial to them even if the markets suffer from the convulsions of debt overdose: people will be more captive to them which expands their control over the society.

As Mises Institute’s President Doug French aptly points out, (bold highlights mine)

Those with no savings are more dependent on government and others when the unexpected occurs, whether it's job loss or the washing machine quits. Professor Paul Cantor reminds us in his article, "Hyperinflation and Hyperreality: Mann's 'Disorder and Early Sorrow,'" that "money is a central source of stability, continuity, and coherence in any community. Hence to tamper with the basic money supply is to tamper with a community's sense of value."

When the Fed makes saving seem futile and immediate pleasure seem rational, the world has been diabolically turned upside down. Just one step away from hyperinflation, the central banks' actions are threatening "to undermine and dissolve all sense of value in a society."

"Thus inflation serves to heighten the already frantic pace of modern life, further disorienting people and undermining whatever sense of stability they may still have," Cantor explains.

The government sponsored debt culture fundamentally erodes society’s moral fibers.

Yet most people have either not been cognizant or simply refuses to see (out of blind reverence on government) the deleterious effects of false prosperity (turning bread into stones) policies.

Nevertheless, in the fullness of time, the world will see that the emperor has no clothes.

No comments:

Post a Comment