You may recall the case of Harvard professors Ken Rogoff and Carmen Reinhart who wrote the seminal work: “This Time is Different: Eight Centuries of Financial Folly”.The book highlighted dozens of shocking historical patterns where once powerful nations accumulated too much debt and entered into terminal decline.Spain, for example, defaulted on its debt six times between 1500 and 1800, then another seven times in the 19th century alone.France defaulted on its debt EIGHT times between 1500 and 1800, including on the eve of the French Revolution in 1788. And Greece has defaulted five times since 1800.The premise of their book was very simple: debt is bad. And when nations rack up too much of it, they get into serious trouble.This message was not terribly convenient for governments that have racked up unprecedented levels of debt. So critics found some calculation errors in their Excel formulas, and the two professors were very publicly discredited.Afterwards, it was as if the entire idea of debt being bad simply vanished.Not to worry, though, the IMF has now stepped up with a work of its own to fill the void.And surprise, surprise, their new paper “[does] not identify any clear debt threshold above which medium-term growth prospects are dramatically compromised.”Translation: Keep racking up that debt, boys and girls, it’s nothing but smooth sailing ahead.But that’s not all. They go much further, suggesting that once a nation reaches VERY HIGH levels of debt, there is even LESS of a correlation between debt and growth.Clearly this is the problem for Europe and the US: $17 trillion? Pish posh. The economy will really be on fire once the debt hits $20 trillion.There’s just one minor caveat. The IMF admits that they had to invent a completely different method to arrive to their conclusions, and that “caution should be used in the interpretation of our empirical results.”But such details are not important.What is important is that the economic high priests have proven once and for all that there are absolutely no consequences for countries who are deeply in debt.And rather than pontificate what these people are smoking, we should all fall in line with unquestionable belief and devotion to their supreme wisdom.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, February 19, 2014

The IMF Hearts Debt

Tuesday, October 01, 2013

How Sustainable is Thailand’s Welfare and Debt Economic Model?

Thailand is discovering that putting the populist genie back in the bottle is harder than letting it out.Since introducing a multi-billion dollar subsidy for the country’s rice farmers in 2011, the country has seen a plethora of other special interest groups demand handouts of their own. Among them, rubber planters this month staged running battles with riot police in southern Thailand in their bid to secure higher minimum prices for their harvests.Now the country’s corn farmers are getting in on the act, last week blocking roads in northern Thailand, and raising questions among economists over whether Prime Minister Yingluck Shinawatra’s government will be able to roll back the scale of its handouts – and what the consequences might be if it doesn’t.Central bank governor Prasarn Trairatvorakul warned an investor conference last week that populist subsidies “add to micro-level risks by making households undisciplined and addicted to ‘easy’ money, while also adding to macro-level risks by stretching fiscal resources without enhancing competitiveness in any meaningful way.”

The subsidies are adding to the government’s budget, which already is bloated by a rubber subsidy and spending of 700 billion baht, or $22 billion, to support rice farmers since Ms. Yingluck was elected – an amount equal to 6% of Thailand’s gross domestic product last year.

Ms. Yingluck’s government has defended the subsidies as a way of supporting the growth of a strong consumer economy in rural Thailand, the heartland of the ruling Puea Thai, or For Thais, Party.But the subsidies also are threatening to disrupt Thailand’s economy at a time when global investors are concerned about rising public and private debt levels in many emerging markets. Huge subsidies in countries like Thailand, Indonesia and India have added to government debt burdens – an important reason why investors have turned cold on these nations stocks and currencies this year.

At the same time, the government’s goal of raising living standards and consumer spending in rural areas appears to be having unintended consequences.Some farmers are using the promise of guaranteed future incomes as a basis for borrowing more money. Thailand’s total household debt is now pushing close to 80% of GDP, with a third of the lending provided by government-run institutions such as the Bank for Agriculture and Agricultural Cooperatives and the Government Housing Bank, which aren’t subject to regulatory control by the central bank.

A tax rebate scheme for first-time car buyers that was designed to stimulate production in Thailand’s auto sector, which was badly hit by severe flooding in 2011, also has raised debt to levels that have worried some analysts.Consultancy IHS Global estimates that 10% of Thais who took out loans under the program have either defaulted on payments or unwound the borrowings, creating a glut of second-hand cars.

Monday, March 18, 2013

More Signs of Global Pandemic of Bubbles

Households worldwide have boosted their borrowing since the 1970s and in some countries, such as the United States and Australia, the total amount now exceeds that of companies, the Bank for International Settlements (BIS) said, introducing a new public database for total credit in 40 countries…In addition to the growth of household borrowing, the data shows how credit has substantially outgrown economic growth in nearly all countries.In the 1950s, total credit was around 50 percent of Gross Domestic Product in many advanced economies and then grew over the next 20-30 years and started to top 100 percent in the 1960s and 1970s. By the late 1980s, credit boomed in some countries, such as the United States and the United Kingdom.Other countries, like Germany and Canada, saw modest credit growth while Ireland is the extreme case: In 1995 it had a credit-to-GDP ratio of around 100 percent. Fifteen years later, the ratio peaked at 317 percent and hasn’t dropped much since.The explosion of credit with accompanying boom-bust episodes is hardly limited to advanced economies. In Thailand, for example, private sector borrowing rose from 12 percent of GDP in 1958 to 75 percent 30 years later, BIS said.“A rapid expansion in credit then followed that ended in the 1997 Asian crisis. Thailand’s credit-to-GDP ratio nearly halved over the subsequent 13 years, but started to increase again from 2010 onwards,” BIS said.In general, emerging economies have tracked advanced economies in increasing the level of household credit. In the 1990s, when data are first collected for emerging economies, household borrowing made up 10-20 percent of total credit. Now, it has risen to 30-60 percent, corresponding to the current levels of many advanced economies.

Global debt by households, governments and non-financial enterprises has mushroomed by some $30 trillion since 2007, but governments in advanced economies are not taking advantage of the flood of cheap money to carry out necessary structural reforms that will pay off over time, warned the BIS…“Combining households, non-financial enterprises and government since 2007, global debt has risen a combined $30 trillion dollars, or roughly 40 percent of global GDP, “ Cecchetti told journalists in connection with the publication of BIS’ March quarterly review.

“One reason to be sceptical about the efficacy of further monetary or fiscal easing is that debt levels are very high and continue to rise,” he said, adding: “It is telling that as asset prices are rallying and firms are issuing more debt, investment in the major advanced economies is not picking up."Regardless of economic or political persuasion, it is clear that economic growth is driven by investment and this is financed through borrowing, either by governments or the private sector.But households are overburdened, firms are hoarding cash, and governments have reached their borrowing limits. No one wants to borrow more, nor should they, Cechetti said.With monetary and fiscal policies reaching their limits, Cecchetti appealed to policy makers to get busy with structural reform, such as addressing the time bomb in the pension and healthcare systems and reducing barriers to the reallocation of capital or workers across sectors.

Emerging East Asia’s local currency bond markets continued to expand in 2012, signaling ongoing investor interest in the region’s fast-growing economies but also raising the risk of asset price bubbles, said the Asian Development Bank’s (ADB) latest Asia Bond Monitor…By the end of 2012, emerging East Asia had $6.5 trillion in outstanding local currency bonds versus $5.7 trillion at the end of 2011. That marked a quarterly increase of 3.0% and an annual increase of 12.1% in local currency terms. The corporate markets, though smaller than the government bond markets, drove the increase, growing 6.2% on quarter and 18.6% on year to $2.3 trillion.Emerging East Asia is defined as the People’s Republic of China (PRC); Hong Kong, China; Indonesia; the Republic of Korea; Malaysia; the Philippines; Singapore; Thailand; and Viet Nam.

Investors have been putting their money to work in emerging East Asia since the early 1990s, but the flows have picked up pace in recent years because of low interest rates and slow or negative economic growth in developed economies while emerging East Asia has enjoyed high growth rates and appreciating currencies.Investment is increasingly coming from overseas, with foreign ownership in most emerging East Asia local currency bond markets increasing in the second half of 2012. In Indonesia, for example, overseas investors held 33% of outstanding government bonds at the end 2012, while foreign holdings of Malaysian government bonds had reached 28.5% of the total at the end of September 2012.The fastest-growing bond market in emerging East Asia in 2012 was Viet Nam, 42.7% bigger than at end 2011, largely due to the rapid expansion in the country’s government bond market. The Philippine and Malaysian markets grew 20.5% and 19.9% respectively, while India’s market expanded by a strong 24.3% to $1.0 trillion. Japan still has the largest market in Asia at $11.7 trillion, followed by the PRC at $3.8 trillion.Governments in emerging East Asia are increasingly opting to sell longer-dated bonds – another sign of strong market confidence in the economies of the region – which is making them more resilient to possible volatile capital flows. This is particularly the case in Indonesia and the Philippines. Maturities tend to be shorter in the corporate bond markets of the region.

Friday, February 17, 2012

Shale Gas Won’t Boost the US Dollar

At the Financial Times, managing director of foreign exchange strategy at UBS Mansoor Mohi-uddin says that Shale Gas will be instrumental in shifting the trade balance of the US that should translate to a stronger US dollar.

The future of the dollar is more likely to be determined in the shale gas and oilfields of Dakota and Texas than in the sovereign wealth funds of Asia and the Middle East. This is because striking new technological developments are set to transform America’s energy supplies, significantly improving the US balance of payments and the long-term outlook for the greenback.

The US’s current account deficit has been a longstanding drag on the dollar. At the height of the credit boom in 2006, it reached $800bn or 6 per cent of gross domestic product. Though the deficit has halved as the credit crunch has lowered imports, it still stands at 3 per cent of GDP, largely because the US, like the eurozone, Japan, China and India, remains a major energy importer, with annual net foreign oil purchases of $300bn a year. As the US economy slowly recovers, the International Monetary Fund expects the US current account deficit to start rising again. That would lead to foreign central banks accumulating greater reserves of dollars.

But such straight-line forecasts are likely to be challenged as the US’s shale gas and “tight oil” reserves are commercially exploited over the next few years. The US has vast reserves of shale gas but, until recently, energy companies were unable to tap the gas trapped in shale rock. Now, through hydraulic fracturing or ‘fracking’, US reserves of economically available gas supplies have started to rise sharply.

While I am in accord that shale gas is the future of energy, a lopsided focus on energy as driving the US dollar risks a substantial diagnostic error.

Trade balances are largely influenced by policies, directly or indirectly. Policies which promotes boom bust cycles and increased government spending (or the debt culture) stimulates consumption activities at the expense of production, thus boost trade deficits. So even if shale gas may reduce US dependence on foreign energy, growth of consumption activities will expand to other sectors.

Today, the declining share of oil imports (above chart courtesy of Mark Perry) relative to consumption has hardly been a factor affecting the US trade balance—the latter which suffered a major bump from the 2008 recession or crisis (chart below tradingeconomics.com).

In short, the above only exhibits that there has been a shift taking place in import activities from oil to the other sectors.

The US dollar has hardly strengthened because of the improving oil trade balance but instead has functioned as a du jour shock absorber from the unresolved crisis from 2008 which lingers on today through the Eurozone.

And another thing, the Fed’s money printing activities relative to other central banks will drive the destiny of the US dollar more than just shale gas output. Money is never neutral.

Saturday, February 11, 2012

Understanding America’s Debt Culture

Writes The End of the American Dream

When most people think about America's debt problem, they think of the debt of the federal government. But that is only part of the story. The sad truth is that debt slavery has become a way of life for tens of millions of American families. Over the past several decades, most Americans have willingly allowed themselves to become enslaved to debt. These days, most of us are busy either going into even more debt or paying off the debt that we have accumulated in the past. When your finances are dominated by debt, it makes it really hard to ever get ahead. Incredibly, 43 percent of all American families spend more than they earn each year. Even while median household income continues to decline (now less than $50,000 a year), median household debt continues to go up. According to the Federal Reserve, median household debt in America has risen to $75,600. Many Americans spend decades caught in the trap of debt slavery. Large numbers of them never even escape at all and die in debt. It can be a lot of fun to spend lots of money and go into lots of debt, but it can be absolutely soul crushing to toil and labor for years paying off those debts while making others wealthy in the process. Hopefully this article will inspire many people to try to escape the chains of debt slavery once and for all.

Because the truth is that the American people need a wake up call. Consumer borrowing rose by another $19.3 billion in December. Right now it is sitting at a grand total of $2.5 trillion according to the Federal Reserve.

Overall, consumer debt in America has increased by a whopping 1700% since 1971.

We always criticize the federal government for going into so much debt, but we rarely criticize ourselves for our own addiction to debt.

Debt slavery is destroying millions of lives all across this country, and it is imperative that we educate the American people about the dangers of all this debt.

The following are 30 facts about debt in America that will absolutely blow your mind....

Credit Card Debt

#1 Today, 46% of all Americans carry a credit card balance from month to month.

#2 Overall, Americans are carrying a grand total of $798 billion in credit card debt.

#3 If you were alive when Jesus was born and you spent a million dollars every single day since then, you still would not have spent $798 billion by now.

#4 Right now, there are more than 600 million active credit cards in the United States.

#5 For households that have credit card debt, the average amount of credit card debt is an astounding $15,799.

#6 If you can believe it, one out of every seven Americans has at least 10 credit cards.

#7 The average interest rate on a credit card that is carrying a balance is now up to 13.10 percent.

#8 According to the credit card calculator on the Federal Reserve website, if you have a $10,000 credit card balance and you are being charged a rate of 13.10 percent and you only make the minimum payment each time, it will take you 27 years to pay it off and you will end up paying back a total of $21,271.

#9 There is one credit card company out there, First Premier, that charges interest rates of up to 49.9 percent. Amazingly, First Premier has 2.6 million customers.

Auto Loan Debt

#10 The length of auto loans in America just keeps getting longer and longer. If you can believe it, 45 percent of all new car loans being made today are for more than 6 years.

#11 Approximately 70 percent of all car purchases in the United States involve an auto loan.

#12 A subprime auto loan bubble is steadily building. Today, 45 percent of all auto loans are made to subprime borrowers. At some point that is going to be a massive problem.

Mortgage Debt

#13 Total home mortgage debt in the United States is now about 5 times larger than it was just 20 years ago.

#14 Mortgage debt as a percentage of GDP has more than tripled since 1955.

#15 According to the Mortgage Bankers Association, approximately 8 million Americans are at least one month behind on their mortgage payments.

#16 Historically, the percentage of residential mortgages in foreclosure in the United States has tended to hover between 1 and 1.5 percent. Today, it is up around 4.5 percent.

#17 According to Dylan Ratigan, 46 percent of all mortgaged properties in Florida are underwater, 50 percent of all mortgaged properties in Arizona are underwater and 63 percent of all mortgaged properties in Nevada are underwater.

#18 Overall, nearly 29 percent of all homes with a mortgage in the United States are underwater.

#19 If you can believe it, the mortgage lenders now have more equity in U.S. homes than the American people do.

Medical Debt

#20 Medical debt is a major problem for a growing number of Americans. One study discovered that approximately 41 percent of all working age Americans either have medical bill problems or are currently paying off medical debt.

#21 Sadly, the number of Americans that are protected by health insurance continues to decline. An all-time record 49.9 million Americans do not have any health insurance at all right now, and the percentage of Americans covered by employer-based health plans has fallen for 11 years in a row.

#22 But even if you do have health insurance, there is still a good chance that you could end up with huge medical debt problems. According to a report published in The American Journal of Medicine, medical bills are a major factor in more than 60 percent of the personal bankruptcies in the United States. Of those bankruptcies that were caused by medical bills, approximately 75 percent of them involved individuals that actually did have health insurance.

Student Loan Debt

#23 Total student loan debt in the United States is rapidly approaching 1 trillion dollars.

#24 If you went out right now and starting spending one dollar every single second, it would take you more than 31,000 years to spend one trillion dollars.

#25 In America today, approximately two-thirds of all college students graduate with student loan debt.

#26 The average student loan debt load is now approximately $25,000.

#27 After adjusting for inflation, U.S. college students are borrowing about twice as much money as they did a decade ago.

#28 One survey found that 23 percent of all college students actually use credit cards to pay for tuition or fees.

#29 The student loan default rate has nearly doubled since 2005.

#30 Student loans made to directly to parents have increased by 75 percentsince the 2005-2006 academic year.

At this point, most Americans are up to their eyeballs in debt. According to a recent study conducted by the BlackRock Investment Institute, the ratio of household debt to personal income in the United States is now 154 percent.

Our entire economy has become based on credit.

Read the rest here

You’d hear or read of many adverse or negative imputations as “consumerism”, “not producing enough”, “spendthrift behavior”, “squanderville” and etc… from the mainstream, as if it has been the nature of Americans to be prodigal.

Lost on the real causation for the present circumstances, the politically popular theme has been to shift the blame on China for “currency manipulation” and or for financing US “profligacy”. In short, China bashing has served as a convenient political scapegoat for politicians and their allies.

Yet there have hardly been significant mainstream inquiries on what forces or variables may have influenced or motivated Americans to adapt on such consumption debt-financed based lifestyles.

In terms of government policies, a black hole emerges from mainstream thinking.

While the mainstream fixates on the moral aspects of the debt-consumption dynamics, they gloss over the effects of government policies that have vastly skewed people’s behavior to take on debts at the expense of savings and equity.

For instance, the credit fueled 2008 housing bubble has largely been policy driven. The speculative environment was entwined with debt based consumption activities.

Tax deductions on interest for corporations, and similarly for individuals—tax deductibility on mortgage interest and government subsidies on mortgages—encouraged debt take up and over-leveraging.

Another, capital regulations discouraged traditional mortgage lending and incentivized securitization, which has been abetted by the conflict of interest role played by credit rating agencies, whom ironically have been tightly regulated by the US government.

Also, public policy to promote housing or homeownership provided the moral hazard aspects via commitment by government to various housing subsidies. Thus, American’s penchant for McMansions. (My source Professor Arnold Kling: THE FINANCIAL CRISIS: MORAL FAILURE OR COGNITIVE FAILURE?)

Importantly, the zero bound interest rate policies, or formerly known as the Greenspan Put, favored debtors at the expense of savers. The Greenspan Put had also functioned as a conventional tool used against past crisis which has successfully kicked the proverbial can down the road.

Policies implemented by team Bernanke today have been NO different from the past, ergo the eponymous Bernanke Put.

Artificially suppressed interest rates thereby increases people’s time preference to consume at the expense production.

As the illustrious Ludwig von Mises explained,

The very act of gratifying a desire implies that gratification at the present instant is preferred to that at a later instant. He who consumes a nonperishable good instead of postponing consumption for an indefinite later moment thereby reveals a higher valuation of present satisfaction as compared with later satisfaction. If he were not to prefer satisfaction in a nearer period of the future to that in a remoter period, he would never consume and so satisfy wants. He would always accumulate, he would never consume and enjoy. He would not consume today, but he would not consume tomorrow either, as the morrow would confront him with the same alternative.

Thus, alternative to consumption activities from boom bust policies would be to entice short term speculation; ergo today’s speculative inflationary boom.

The ‘innovative’ and unparalleled Quantitative Easing (QE) approach also shields the banking system from having to face the harsh reality of the required market adjustments, from the massive malinvestments accumulated, brought upon by past policies.

QEs labeled as credit easing by central banks, have likewise been designed to promote debt by alleviating the conditions of the accounting books of the banking and financial industry.

In addition, America’s debt culture signifies a product of mainstream ideology

I previously wrote,

The culture of debt signifies symptoms of accrued policies shaped by the dominant economic ideology which sees spending as the key force for promoting prosperity or keeping society “permanently in a quasi-boom”.

The war against savings, which is being channeled through policy-based low interest rates (“The remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the boom to last”-General Theory) punishes savers and rewards speculative activities which benefits the wards of central banks—added profits for the banking industry cartel and expanded government spending for politicians.

Never mind the law of diminishing returns on debt to an economy

Past ephemeral successes [plus sustaining a debt based political economy] will lead global authorities towards path dependent policy choices (which is why I think that global QEs will continue)

Besides, politicians and the bureaucracy sees such policies as even more beneficial to them even if the markets suffer from the convulsions of debt overdose: people will be more captive to them which expands their control over the society.

Put differently, the cartelized political institutions made up of the triumvirate of the central bank, the welfare state and the politically privileged “too big to fail” banks represents as the major beneficiaries of a debt driven society, and thus, the incumbent political agents will continue to focus on maintaining the status quo founded on policies, laws and regulations that rewarded debts.

Sad to say, the laws of economics has been catching up with the artificiality of such political arrangement.

Saturday, April 23, 2011

The Festering Culture Of Debt

In Canada, a recent poll manifested that one-third of their residents does not have enough savings.

From Yahoo,

Nearly one-third of Canadians that responded to a recent survey backed by a major Canadian bank said they didn't have enough money to cover living expenses.

An online survey completed for TD Canada Trust (TSX:TD) also found that 54 per cent of the 1,003 people who answered said it was a real struggle or impossible to save.

The report, released Wednesday, says that 38 per cent of respondents said they had no savings and 30 per cent said they didn't have enough money for their living expenses.

In other words, a big segment of Canada’s population has been living on debt.

And the culture of debt has been a festering pandemic since Nixon Shock where the gold anchor was severed from the world’s monetary system.

As the Economist points out in the crisis year of 2008,

Throughout the 1980s and 1990s a rise in debt levels accompanied what economists called the “great moderation”, when growth was steady and unemployment and inflation remained low. No longer did Western banks have to raise rates to halt consumer booms. By the early 2000s a vast international scheme of vendor financing had been created. China and the oil exporters amassed current-account surpluses and then lent the money back to the developed world so it could keep buying their goods.

Those who cautioned against rising debt levels were dismissed as doom-mongers; after all, asset prices were rising even faster, so balance-sheets looked healthy. And with the economy buoyant, debtors could afford to meet their interest payments without defaulting. In short, it paid to borrow and it paid to lend.

Like alcohol, a debt boom tends to induce euphoria. Traders and investors saw the asset-price rises it brought with it as proof of their brilliance; central banks and governments thought that rising markets and higher tax revenues attested to the soundness of their policies.

The culture of debt signifies symptoms of accrued policies shaped by the dominant economic ideology which sees spending as the key force for promoting prosperity or keeping society “permanently in a quasi-boom”.

The war against savings, which is being channeled through policy-based low interest rates (“The remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the boom to last”-General Theory) punishes savers and rewards speculative activities which benefits the wards of central banks—added profits for the banking industry cartel and expanded government spending for politicians.

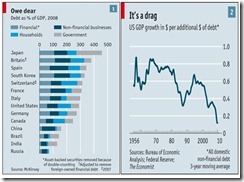

Never mind the law of diminishing returns on debt to an economy (such as in the US; see right window of the above chart).

Past ephemeral successes [plus sustaining a debt based political economy] will lead global authorities towards path dependent policy choices (which is why I think that global QEs will continue)

Besides, politicians and the bureaucracy sees such policies as even more beneficial to them even if the markets suffer from the convulsions of debt overdose: people will be more captive to them which expands their control over the society.

As Mises Institute’s President Doug French aptly points out, (bold highlights mine)

Those with no savings are more dependent on government and others when the unexpected occurs, whether it's job loss or the washing machine quits. Professor Paul Cantor reminds us in his article, "Hyperinflation and Hyperreality: Mann's 'Disorder and Early Sorrow,'" that "money is a central source of stability, continuity, and coherence in any community. Hence to tamper with the basic money supply is to tamper with a community's sense of value."

When the Fed makes saving seem futile and immediate pleasure seem rational, the world has been diabolically turned upside down. Just one step away from hyperinflation, the central banks' actions are threatening "to undermine and dissolve all sense of value in a society."

"Thus inflation serves to heighten the already frantic pace of modern life, further disorienting people and undermining whatever sense of stability they may still have," Cantor explains.

The government sponsored debt culture fundamentally erodes society’s moral fibers.

Yet most people have either not been cognizant or simply refuses to see (out of blind reverence on government) the deleterious effects of false prosperity (turning bread into stones) policies.

Nevertheless, in the fullness of time, the world will see that the emperor has no clothes.