Inflation was created by the wrong monetary policy, and incorrect central bank measures may have lasting negative impacts on the economy. The first effect is evident: governments continue to crowd out the real economy, and families and businesses suffer the entire burden of rate hikes. Maybe the objective was always to increase the size of the public sector at any cost and implement a gradual nationalization of the economy—Daniel Lacalle

In this issue

PSEi 30's Weak 9-Month

and Q3 Performance Highlights GDP Decline: Symptoms of Crowding-Out and

Financial Repression

I. Clarifying Our Analytics of the PSEi 30 Data

II. 9-Month 2024 PSEi 30 Performance: Broad-based Slowdown, Sustained Dependence on Borrowing to Generate Growth

III. Dissecting the PSEi 30’s Performance by Category: Debt, Income, Revenues and Cash

IV. Analysis by Sector: Financials and Holding Firms Dominate Growth

V. Analysis by PSEi 30 Member Firms (9-Month)

VI. Conclusion: Underwhelming Performance as Symptoms of Crowding-Out Syndrome, Financial Repression, and Statist Policies

PSEi 30's Weak 9-Month and Q3 Performance Highlights GDP Decline: Symptoms of Crowding-Out and Financial Repression

The PSEi 30’s lackluster fundamental performance validated the mainstream’s unexpected decline in Q3 GDP, highlighting the persistent effects of crowding out and financial repression.

I. Clarifying Our Analytics of the PSEi 30 Data

Two factors must be explained before delving into the 9-month and third-quarter analysis of the performance of PSEi 30 constituent firms.

First, the definition of data is crucial.

-Data from the same reporting coverage provides a more accurate comparison, as it reflects the PSEi members during the relevant period. This is referred to here as 1A data.

-Data from a different reporting coverage/period results in an apples-to-oranges comparison due to two factors: periodic updates to PSEi constituents and the exclusion of past data revisions. This is referred to as 1B data.

-Aggregates may be overstated, as they include not only holding companies but also their subsidiaries.

Q3 PSEi 30’s Financial Activities: Defining the Operating Conditions

Next, it is essential to define the operating conditions of the third quarter.

Figure 1

The Philippine Q3 2024 GDP unexpectedly slipped to 5.2%, its lowest level since Q2 2023’s 4.3%, despite systemic leverage hitting an all-time high. (Figure 1, upper graph)

Public debt and bank credit expansion grew by 11.4%, marking its fastest pace since Q4 2022.

The Bangko Sentral ng Pilipinas (BSP) initiated its "easing cycle" with a 25-basis point rate cut in August, which helped fuel this growth.

Despite reaching the near all-time high employment rate, both headline and core inflation rates fell to 3.2% and 2.6%, respectively, the lowest since Q1 2022. (Figure 1, lower graph)

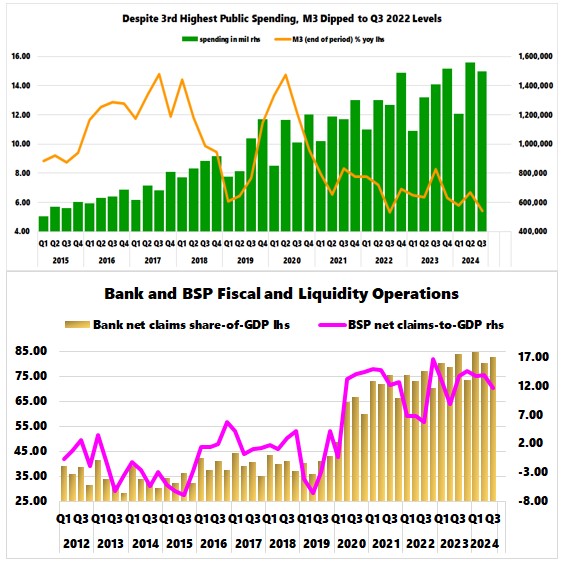

Figure 2

Marcos-nomics stimulus, channeled through its fiscal aspect, remained vibrant, with public spending growing by 6.4% in Q3, reaching its third-highest level. (Figure 2, upper image)

Once again, despite record leverage, money supply growth, measured by M3, stumbled to its lowest level since Q3 2022.

It was an active period for fiscal and liquidity operations by the banking system and the BSP. As a ratio to GDP, banks' net claims on the central government (NCoCG) reached the third-highest level on record, while the BSP's counterpart dipped to its lowest level since Q3 2022—but still near Q4 2022 record. (Figure 2, lower diagram)

In contrast to the establishment’s "restrictive" narrative, Q3 indicated loose financial conditions, which were further bolstered by the BSP’s rate cut and sustained increases in systemic leverage, supported by BSP and bank liquidity, as well as fiscal operations.

The notion that the BSP’s easing would provide support to the economy not only failed to materialize; consumption fell, as evidenced by the declining trend in the Consumer Price Index (CPI) and the money supply—ironically occurring despite strong liquidity injections.

II. 9-Month 2024 PSEi 30 Performance: Broad-based Slowdown, Sustained Dependence on Borrowing to Generate Growth

These macroeconomic conditions were reflected in the 9-month Key Performance Indicators (KPIs) of the PSEi 30 (1A):

Figure 3

One. The aggregate non-financial debt increased by Php 208 billion, marking the lowest increase since 2020. This figure excludes borrowings of the three largest banks (Figure 3, topmost table)

Two. The cumulative net income growth of Php 47.17 billion was also the smallest since 2021.

Three. Revenue expansion, totaling Php 395 billion, was the second lowest since 2021.

Four. The PSEi 30’s cash reserves shrank by Php 5.27 billion for the second consecutive year, but at a more minimal scale compared to last year.

These figures indicate that all segments exhibited a slowdown, with net income experiencing the most pronounced decline.

There’s more.

Because the non-financial debt-to-net income ratio in 2024 represented the second highest level since 2022, it indicates that corporations borrowed more to generate income (Php 4.4 debt for every peso of net income). (Figure 3, middle graph)

Additionally, they borrowed to address their liquidity shortfall.

However, this data understates the full picture, as it excludes the borrowings of the three largest banks. These banks reported an increase of Php 491 billion in bills payments alone!

III. Dissecting the PSEi 30’s Performance by Category: Debt, Income, Revenues and Cash

Nota Bene: While we rely on the accuracy of these reports, it is worth noting the potential for discrepancies. Past instances, such as PLDT’s 4-year "budget overrun," demonstrate that reporting errors often go overlooked or ignored by both the PSE and government agencies.

Such regulatory lapses could create conditions that encourage misreporting, exemplifying the moral hazard syndrome.

We suspect that some companies may be understating the extent of their leverage by reclassifying it under other liability categories

Debt: In nominal terms, non-financial debt rose by 3.9%, increasing from Php 5.31 trillion to Php 5.52 trillion. This resulted in a slower debt-to-NGDP ratio, which declined from 30.8% in 2023 to 29.25% in 2024 (1B). Again, this excludes bank debt. (Figure 3, lowest window)

Net Income: Published net income expanded by 7.2%, rising from Php 691.2 billion to a record Php 740.93 billion. However, this represented the lowest growth rate since 2021.

Revenues: Despite historic increases in systemic leverage, near full employment and the third-largest public spending on record, revenue grew by an unimpressive 9.4%, reaching a record Php 5.265 trillion.

This also translates to a PSEi 30 revenue-to-NGDP share of 27.9%—the second highest after 2022—indicating that these elite firms contribute more than a quarter of the estimated Nominal GDP. If we include all 284 listed firms, this figure would likely account for approximately two-fifths of NGDP.

This manifests the trickle-down structure of the Philippine political economy, where the prevailing approach prioritizes consolidating wealth and power among politically connected entities through centralization, rather than fostering genuine "inclusiveness" via grassroots entrepreneurship (such as SMEs) or a bottom-up framework.

Lastly, the government reported a headline GDP of 5.2% based on the NGDP of 8.5%. However, revenues of the PSEi 30 grew by only 6.8% suggesting a significant overstatement of the statistical economy.

IV. Analysis by Sector: Financials and Holding Firms Dominate Growth

Figure 4

Although the holding firms sector posted the smallest percentage growth, it experienced the largest increase in debt, amounting to Php 104.21 billion, followed by the real estate sector with Php 38.62 billion. (Figure 4, upper table)

The financials and holding firm sectors recorded the highest net income growth, with increases of Php 20.327 billion and Php 13.35 billion, respectively, accounting for 43% and 28.3% of the total.

The sector with the highest revenue growth was the holding firm sector, which generated Php 196.653 billion, followed by financials with Php 86.44 billion, representing 49.8% and 22% of the total, respectively.

Meanwhile, the services sector led in cash growth, reporting an increase of Php 21.24 billion. Conversely, the industrial sector experienced the largest cash outflows.

In Q3, holding firms and financials reported the highest net incomes of Php 16.84 billion and Php 7.8 billion, respectively. (Figure 4, lower table)

These two sectors also delivered the strongest revenue growth, with increases of Php 43.36 billion and Php 25.26 billion.

In summary, during the nine-month period and in Q3, the financials and holding sectors dominated net income and revenue growth, while other sectors struggled to keep pace.

V. Analysis by PSEi 30 Member Firms (9-Month)

Figure 5

Broken down into individual categorical activities:

The top firms contributing to non-financial debt increases were San Miguel Corporation (SMC) and Ayala Corporation with increases of Php 63.9 billion and Php 57.6 billion, respectively.

Out of the 27 firms analyzed, 15 posted debt expansion during the period, with SMC accounting for 30% of the total debt growth in pesos.

In the net income growth segment of the PSEi 30, International Container Terminal Services, Inc. (ICT) and the Bank of the Philippine Islands (BPI) were the top performers with Php 9.85 billion and Php 9.441 billion, correspondingly.

On the other hand, DMCI Holdings (DMC) posted the largest decline among the eight firms that reported a decrease in net income growth.

SMC and BPI also led the revenue growth segment. Conversely, DMC reported the largest revenue decrease among the seven firms that experienced revenue declines during the period. Notably, SMC accounted for 30% of total revenue growth in peso terms.

Finally, ICT emerged as the leader in cash reserves growth, while Aboitiz Equity Ventures (AEV) headed the minority of ten issues that saw reductions in cash flows.

Once again, even among the elite firms, only a select few tend to dominate in terms of performance.

Notably, financial giants such as BPI and BDO emerged as some of the most prominent gainers, while non-consumer sectors, including ICT and SMC, led in the net income and revenue segments, respectively.

Interestingly, the underwhelming performance of consumer-focused firms like SM Investments and Ayala Corporation—arguably the most exposed to the local consumer market—highlights the underlying fragility of the sector

VI. Conclusion: Underwhelming Performance as Symptoms of Crowding-Out Syndrome, Financial Repression, and Statist Policies

The Bottom Line: Despite the "Marcos-nomics stimulus," near-record employment levels, and loose financial conditions, the conspicuous signs of weakness among the PSEi 30 member firms not only align with the GDP slowdown observed in Q3 but may also indicate much slower overall growth.

Moreover, this underbelly has exposed the firms’ increasing vulnerability to extensive leveraging.

What is particularly notable is that many of these PSEi 30 firms are linked to political projects that should have enhanced their performance.

Instead, their underwhelming performance could be indicative of the detrimental effects of the crowding-out syndrome—a phenomenon that gradually erodes economic productivity over time—compounded by financial repression and other forms of government interventions (such as the subtle shift to a war economy, increasing centralization and more).