The revolt against the US dollar regime seems underway.

The Bloomberg reports, (bold highlights mine)

Central banks that were net sellers of gold a decade ago are buying the precious metal to reduce their reliance on the dollar as a reserve currency, signaling demand that may extend a record rally in prices....

In 2010, central banks became net buyers for the first time in two decades, adding 87 metric tons in official-sector purchases by countries including Bolivia, Sri Lanka and Mauritius, according to World Gold Council data. China, with more than $3 trillion in foreign-currency reserves, plans to set up new funds to invest in precious metals, Century Weekly reported this week. Russia purchased 8 tons of gold in the first quarter...

China, which has just 1.6 percent of its reserves in gold, may invest more than $1 trillion in bullion, Pento said. “China wants to be an international player, and they need to own more gold than they currently have.”...

As of April, China was the sixth-largest official holder of gold, with 1,054.1 tons, according to World Gold Council estimates. The U.S. has the most, with 8,133.5 tons, or 74.8 percent of the nation’s currency reserves, council data show.

Central-bank buying may have the same impact on gold as the introduction of exchange-traded funds, Cuggino said. Prices have more than tripled since the SPDR Gold Trust, the biggest ETF backed by bullion, was introduced in November 2004.

Central banks in emerging markets may aim to hold 2 percent to 8 percent of their foreign-currency reserves in gold, Francisco Blanch, the head of commodities research at Bank of America Merrill Lynch in New York, said in an interview.

If emerging market central banks sustain the shift of their dollar reserve stash for gold or other metals, then this means that US government will have to increasingly rely on their resident savings or on the US Federal Reserve to finance their fiscal deficits.

Otherwise, the US economy faces the risk of higher interest rates.

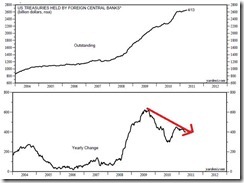

So far, while the nominal amount of US treasuries debt held by foreign central banks continue to climb; the annual rate of change has been falling since 2009. (chart courtesy of yardeni.com)

BRICs and East Asia are major holders ‘financiers’ of long term US debts. (charts above and below from Wikipedia)

Yet about 28% of US debts has been owned by foreigners. The gist of these debts has been held by the Federal Reserve and intragovernmental Holdings whose trend has risen steadily since 1997.

Higher interest rates go against the implied guiding dogma of the incumbent authorities of the US Federal Reserve which has been anchored on low interest rates (ZIRP) to perpetuate permanently ‘quasi booms’.

Also higher interest rates can severely affect the balance sheets of the overleveraged banking system which may again result to another turmoil.

According to Wikipedia,

The U.S. banking sector's short-term liabilities as of October 11, 2008 are 15% of the GDP of the United States or 43% of its national debt, and the average bank leverage ratio (assets divided by net worth) is 12 to 1.

And given that the US government has spent and exposed her taxpayers to trillions of dollars worth to protect the banking industry, I expect the Federal Reserve to see the interests of the banking sector as a continuing political priority.

So going by the elimination process, I see the conditionality as:

-if emerging market central banks continue to reduce their US dollar exposure

-if savings of US residents would turn out to be inadequate to finance government deficits

-given the path dependency and political interests (priorities) of US government and

-the US government’s refusal to pare down spending

then the US Fed seems backed into a corner with further QEs (this may not happen immediately right after QE 2.0 in June, but any signs of weakness or volatility will likely prompt the FED for the next set of QE)

And more QEs extrapolate to higher gold prices, lower dollar, possibly higher equity prices (depending on the degree of the impact of CPI inflation) and more CPI inflation...all these signifying a feedback mechanism of the inflation cycle until CPI inflation turns into a nightmare.

Alternatively, the US can cut government spending and reduce debt, but that would be an anathema or a seeming taboo for politicians.

No comments:

Post a Comment