From the Wall Street Journal blog:

The biggest risk, however, isn’t Greece per se. It is the prospect of other peripheral euro members — Ireland, Spain, and Portugal — following Greece down the default path. That cascade effect has to be avoided….

The global credit authorities and financial markets have been digesting this problem for more than a year. Some participants think a default is inevitable; Greece should just do it.

Then the world can move on to an even bigger worry: whether the U.S. government will soon default on its debt.

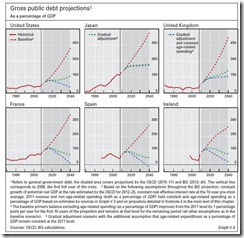

Yes, ballooning debt as a consequence of incessant government spending on the welfare state isn’t just an issue of Greece. It’s everywhere.

From the Bank of International Settlements

Sooner or later, something will occur to prevent debt from exploding: governments will adopt corrective measures on their own, or they will be forced to act as sovereign risk premia reach unbearable levels.

And this is only from the facet of government liabilities, which does not include the banking system

This bring us to the admonitions of the great Ludwig von Mises

The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. The boom comes to an end as soon as additional quantities of fiduciary media are no longer thrown upon the loan market. But it could not last forever even if inflation and credit expansion were to go on endlessly. It would then encounter the barriers which prevent the boundless expansion of circulation credit. It would lead to the crack-up boom and the breakdown of the whole monetary system.

Governments will default, either by massive inflation or by the far better option-deflation.

And that’s why the events in Greece is a prelude to the next monumental chain of government-and-banking debt crisis.

We are approaching the Mises moment.

No comments:

Post a Comment