The Philippine Stock Exchange has endured its first boom bust cycle this new millennium. We may be segueing into the second.

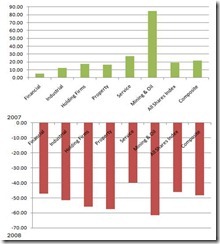

The graphs below narrate on the sectoral performances since 2007 (5 years)

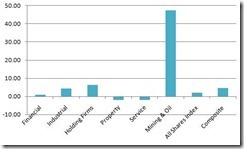

Below is the year to date performance

2011

Some observations:

The mining sector has prominently led in 2007 and 2009. So far in 2011, the mining sector continues to pull away.

The mining sector has been the worst performer in 2008. Newton’s third law of motion seems to be in play “For every action, there is an equal and opposite reaction.” Mining as the best performer becomes the worst performer during bear markets.

Outside the mining sector the best performers had been

2007: service

2008: service (least decline)

2009: industrial

2010: holding (industrial- second spot)

2011: holding (second spot)

Bottom line: Market leadership rotates. This comes even in the face of the clear outperformance of the mining sector.

If history will rhyme, 2012 may see other sectors takeover the leadership from mining. But I wouldn’t bank on this as the past 5 years does not reflect on the same conditions for 2012.

No comments:

Post a Comment