The world has never been so awash in speculative finance, ensuring aberrant market behavior. Never has the global leveraged speculating community been as colossal and powerful. Egregious Treasury “basis trade” leveraging drives unprecedented overall hedge fund leverage. Household (loving dip buying) market participation is unparalleled, with the proliferation of online accounts, options trading, and herd-like speculation creating extraordinary market-moving power—Doug Noland

In this issue

Behind the Retail Surge:

Dissecting the PSE’s 2024 Investor Profile Amid Heightened Volatility and

Economic Strain

I. Introduction: A

Record-Breaking Year for Retail Accounts

II. The Retail Activity

Paradox; The Real Drivers Behind the Surge: A PSEi 30 Bull Market?

III. Institutional

Dominance, Trading Concentration and Market Manipulation

IV. Concentration Risks: National

Team, Other Financial Corporations and Total Financial Resources

V. 2024’s Economic Operating

Conditions, Financial Distress and Unintended Consequences

VI. The Savings Illusion

and the Generational Shifts: Herding Among Youth, Decline Among Seniors

VII. The Digital Divide in

Brokerage: Traditional Brokers Under Pressure

VIII. Conclusion: A Mirage of Growth

Behind the Retail Surge: Dissecting the PSE’s 2024 Investor Profile Amid Heightened Volatility and Economic Strain

What’s really driving the surge in Philippine retail investors? A closer look reveals economic desperation, distortion, and deepening divides beneath the surface of stock market optimism

I. Introduction: A Record-Breaking Year for Retail Accounts

The PSE reported

on June 9, 2025: "The number of stock market accounts in the Philippine

Stock Exchange reached 2.86 million in 2024, up by 50.1 percent from 1.91

million in 2023. This was fueled by a 62.0 percent surge in online accounts to

2.47 million from 1.53 million. “This 50 percent jump in number of accounts is

the highest we have recorded since we started tracking the investor count

and profile in 2008. This substantial growth was made possible by the

enabling of digital platforms to connect to PSE”s trading engine, thereby

facilitating the trading by investors in the market. PSE is committed to being

true to its advocacy of promoting financial inclusion,” said PSE President and

CEO Ramon S. Monzon. “More than the numbers, what is important is that

retail investors are equipped with investment know-how to avoid investing

pitfalls. We address this need for investor education through our various

investing literacy initiatives. We also actively work with trading participants

and government and private entities to spread the word about personal finance

and stock market investing,” Mr. Monzon added." (bold added)

Figure 1

The PSE seems exhilarated by this unprecedented surge. Yet beneath the celebratory tone lies a paradox: they appear unsure why this spike occurred. Their attribution to the "enabling of digital platforms" seems insufficient, especially since such infrastructure has been in place since 2013. (Figure 1, topmost graph)

This inability to explain the surge becomes more apparent when considering their bewilderment over the depressed number of active accounts.

As the PSE acknowledged: "While growth in retail accounts has been remarkable, the real challenge is getting retail investors to participate more actively in our market as they only contribute 16 percent to total value turnover. We are optimistic that the upcoming reduction in stock transaction tax (STT) to 0.1 percent from 0.6 percent, along with the various investor education programs and upcoming pipeline of products of the Exchange, will encourage greater investor activity for the remainder of 2025," Mr. Monzon noted. (bold added)

The low contribution of retail investors to market turnover—underscores the PSE’s challenge: Understanding the essence and the development of the capital markets in line with economic freedom, rather than using it as a covert political redistribution, which drives malinvestments and inequality.

II. The Retail Activity Paradox; The Real Drivers Behind the Surge: A PSEi 30 Bull Market?

Three critical questions emerge from this phenomenon:

One, is the PSE experiencing a bull market, fueling frenzied retail participation?

Two, could the torrent of enrollment reflect symptoms of economic desperation—people seeking to plug income gaps amid stagnant living standards? Or, is this a case of instant gratification through asset speculation?

Three, has a sudden boom in savings driven retail investors into stocks?

"Is the PSE experiencing a bull market driving frenzied retail participation?"

With the PSEi 30 returning just 1.22% in 2024, the surge in new participants seems disconnected from its performance. (Figure 1, middle window)

However, breaking down this performance by quarters reveals important insights.

While Q1 2024's 7.03% increase may have been a contributing factor, Q3's phenomenal 13.4% returns likely lured the bulk of these newcomers into stocks. (Figure 1, lowest chart)

Of course, they were also likely swayed by the constant "propagandizing" or the bombardment by media and establishment "talking heads" of a "return of a bull market!"

Even more, one critical aspect highlighted by the PSE deserves

attention: retail investors "contribute 16 percent to total value

turnover." This means retail trades represent a significant minority in

the PSE’s turnover.

Figure 2

According to PSE infographics, retail active accounts represented 23.1% of total accounts and 24.5% of online accounts, totaling 660,714 retail accounts. The massive influx of new participants helped boost the active account ratio from an all-time low of 17.5% in 2023 to 23.1% in 2024. (Figure 2, topmost and middle images)

Our underlying assumption is that the data reflects the ratio of active to total accounts, rather than the proportion of active accounts relative to total market turnover.

As further proof of the PSE's lackadaisical activities, gross volume turnover rose by just 1.37% in 2024—the second lowest peso level since at least 2014. (Figure 2, lowest diagram)

III. Institutional Dominance, Trading Concentration and Market Manipulation

Figure 3

This raises a striking question about the remaining 84% share of total turnover. The answer lies with institutional investors—both local and foreign. Foreign money accounted for 48.8% of gross turnover, with foreigners selling local equities worth Php 25.253 billion in 2024. (Figure 3, topmost chart)

Foreign investors represented 36% of active online activities, though the distribution between retail and institutional foreign activities remains unspecified.

The data reveals a staggering concentration of trading activities in 2024:

- The top 10 brokers accounted for a daily average of 58.9% of mainboard turnover. (Figure 3, middle window)

- The top 10 and 20 most actively traded issues averaged 64% and 83% respectively, and

- The Sy Group (among the top 3 of the five biggest market capitalizations) averaged 21.19% of market activity.

The scale of concentrated activities also elucidates evidence of "coordinated price actions," such as the post-lunch recess "afternoon delight" and the 5-minute pre-closing "float pumps-and-dumps"—as demonstrated by some of the major activities in 2025. (Figure 3, lowest charts)

Basically, the PSEi 30 has been "propped up" or

"cushioned" by local institutional investors.

Figure 4

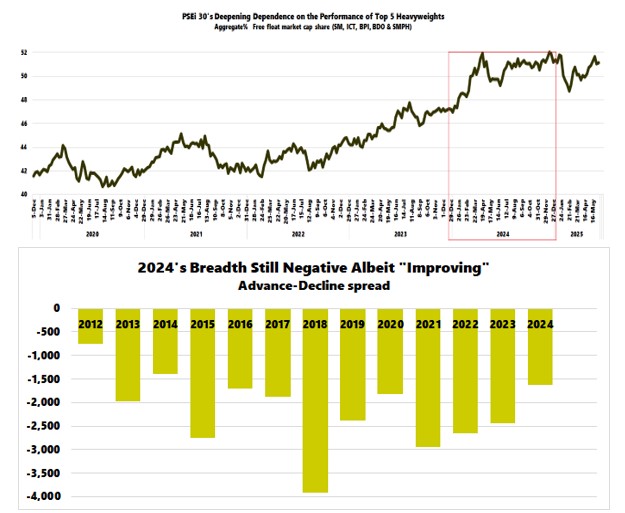

As a result, the share of the top five free-float heavyweights reached its highest level at 52% in December and averaged 50.3% in 2024—meaning their free-float share accounted for more than half of the index. SM, ICT, BDO, BPI, and SMPH delivered returns of 3.01%, 56.04%, 10.34%, 17.54%, and -23.6%, respectively, resulting in an average return of 12.76% in 2024—a clear sign of divergence from the rest of the PSEi 30. (Figure 4, upper pane)

Furthermore, given that the aggregate advance-decline spread was generally negative, albeit better than in 2023, this shows why novice "traders" morphed into "investors." Or, the negative spread signifies that losses dominated the overall performance of listed firms at the PSE—a continuing trend since 2013. (Figure 4, lower visual)

With the PSEi returning 1.22% in 2024, the asymmetric performance reinforces the massive divergence between the PSEi 30 and the broader PSE universe.

Put simply, the synchronized and mostly coordinated pumps and dumps of the top five—or even the top ten—have fundamentally kept the PSEi 30 from a free fall.

IV. Concentration

Risks: National Team, Other Financial Corporations and Total Financial Resources

Figure 5

It is no coincidence that the ebbs and flows of the domestic private sector claims of Other Financial Corporations (OFCs) have dovetailed with the PSEi 30 level. (Figure 5, upper graph)

In short, OFCs appear to have played a very substantial role in propping up the PSEi 30.

Could they be part of the local version of the "national team" aimed at supporting price levels of the PSEi 30?

It is also not a coincidence that banks have been deepening their hold on the nation’s total financial resources (assets), a trend that further reveals the depth of systemic concentration risks.

Although the growth of Total Financial Resources has been slowing from its July 2024 peak of 11.23% to 5.06% in April 2025, the share of Philippine banks and universal banks in the total has been drifting at all-time highs of 82.64% and 77.08%, respectively. (Figure 5, middle diagram)

Could all these actions have been designed to keep asset prices or "collateral values" afloat to stave off risks of credit deflation, which would imperil the banking system?

V. 2024’s Economic Operating Conditions, Financial Distress and Unintended Consequences

"Could the torrent of enrollment reflect symptoms of economic desperation?"

Let us also not forget the operating conditions in 2024. The BSP initiated its easing cycle in the second half of 2024 (rate cuts and RRR cut), while public spending rose to a record high.

The unintended consequences of the PSEi 30's 'Potemkin village' effect extend beyond price distortions—overvaluing capital goods and fostering spillover effects through excess capacity and malinvestments. More importantly, it redistributes wealth through zero-sum transactions, where institutions sell holdings at elevated prices while naive retail participants are 'left holding the bag.'

Once again, downside volatility has 'emasculated' these neophytes, transforming their initial short-term trading positions into long-term or 'buy-and-hold investments.' More precisely, their failed attempts to generate short-term income resulted in a 'trading freeze.'

That is to say, many novice traders were drawn in by the pursuit of short-term yield—whether to compensate for insufficient income, recover lost purchasing power, or escape excessive debt—by engaging in stocks, a true 'Hail Mary Pass!'

It is no surprise that this period aligned with milestone highs in sentiment-driven surveys on self-rated poverty and hunger incidences.

In essence, many newcomers likely perceived the PSE not as a structured investment market but as a high-stakes gamble—a 'lottery ticket' or a 'casino' offering a chance to escape financial hardship.

VI. The Savings Illusion and the Generational Shifts: Herding Among Youth, Decline Among Seniors

Using the Philippine banking system's deposit liabilities

and cash balances as proxies, the answer is definitively no. In 2024, despite

record-high bank credit expansion, bank deposit

liabilities reported their lowest growth rate of 7.04% since 2012, while

PSE volume increased by only 1.4%. (Figure 5, lowest chart)

Figure 6

Next, bank cash and due balances fell to their lowest level since 2018, wiping out the historic liquidity injections by the BSP during the pandemic recession in 2020. (Figure 6, topmost pane)

Circling back to retail accounts, distributed by generations, the accounts with the biggest gains emerged from Gen Y and Gen Z, posting 48.8% and 26.5% growth in 2024, respectively. (Figure 6, middle image)

This category hints that with likely insufficient income, these age groups could have fallen prey to the ‘herding effects’ of the PSEi 30's Q1 and Q3 upside volatility.

In contrast, seniors' growth fell sharply from 14.8% in 2023 to 7.3% in 2024. Seniors, likely with the most savings, topped in 2023, but they accounted for the least growth (3.7%) in online accounts in 2024.

VII. The Digital Divide in Brokerage: Traditional Brokers Under Pressure

The surge in online accounts, representing 86.42% of total accounts, has reduced traditional brick-and-mortar accounts to just 13.58%. However, non-online brokers still represent the vast majority of trading participants.

According to PSE's 2024 infographics, there were 121 active trading participants, but only 37 offered online accounts—meaning 30% of brokers accounted for the bulk of total turnover. (Figure 6, lowest graph)

This implies that brick-and-mortar brokers are fighting for a rapidly dwindling share of PSE volume, making many vulnerable to sustained low-volume conditions and an extension of the prevailing bear market.

VIII. Conclusion: A Mirage of Growth

The Philippine Stock Exchange's reported surge in new accounts in 2024, while seemingly a triumph of financial inclusion and capital market deepening, masks a more complex and potentially troubling reality.

Our analysis suggests that this growth isn't primarily a result of a robust bull market or a sudden boom in savings. Instead, it reflects heightened volatility, a concentrated market, and a populace grappling with economic hardship.

The significant disconnect between the dramatic increase in accounts and the persistently low level of active participation—coupled with the overwhelming dominance of institutional investors—paints a picture of a market, where retail investors, particularly younger generations, may be making a "Hail Mary Pass" amid limited economic opportunities.

The “Potemkin village” nature of the PSEi 30’s performance—propped up by institutional activities and circumstantial signs of coordinated activity—raises deeper concerns: price distortions, misallocated capital, and the quiet transfer of wealth from uninformed and gullible retail players to more sophisticated institutions.

Moving forward, it’s no longer enough for the PSE to simply lower transaction taxes, launch new products, or expand investor education programs.

What’s truly needed is a political economy that fosters real economic freedom—grounded in long-term thinking or lower time preference—so savers can build genuine wealth by channeling their capital into productive enterprise and transparent capital markets.

Above all, capital markets must operate with integrity: free from manipulation, insulated from rigged dynamics, and designed to protect—not exploit—retail investors from becoming cannon fodder in a system tilted toward institutional dominance.

___

References

Doug Noland, Uncertainty Squared, June 7, 2025, Credit Bubble Bulletin

Philippine Stock

Exchange, Stock market accounts breach 2M mark, June 9, 2025 pse.com.ph