For the Economist the answer seems to be a yes

WHEN the going gets tough, investors buy two assets: gold and the Swiss franc. Gold's all-time peak in real terms was in 1980 when inflationary fears were particularly intense. That followed a long period of Swiss-franc strength in the 1970s, which forced the government to impose negative interest rates in a bid to dissuade foreigners from opening bank accounts in the currency. With investors now worried about European sovereign debt and the crisis over the American debt ceiling, it is not surprising that both assets are popular again. Gold has been hitting nominal highs, while the Swiss franc has reached a record in real trade-weighted terms (ie, against the country’s trading partners). The Swiss have both a fiscal and a current-account surplus, a low inflation rate and a relatively low debt-to-GDP ratio.

The Swiss Franc-gold correlation seems to be playing out a cycle.

In the two decades of the gold bear market during the early 80s until the late 90s, the Franc (CHF) has substantially outperformed gold. The middle green circle highlights this phenomenon by exhibiting the widest variance.

However, the recent rally in gold prices has been closing this gap, as shown by the gold ellipse on the right.

In the early 70s we saw a similar gap-closing dynamic by gold. This eventually culminated with gold topping out in the early 80s (red oblong-left).

It can be argued that based on the above chart, where in the stretch of 4 decades the Franc (CHF) has predominated gold, the Swiss currency has indeed been a ‘better’ safehaven option.

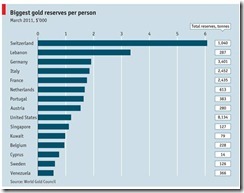

And a major additional reason, which the Economist above didn’t cite, is that Switzerland has the largest gold reserves per person (shown below)

Chart from the Economist

In short, the strength of the Franc can partly be attributed to its gold reserves.

Nonetheless, it is unclear if history would repeat or rhyme.

Given that the Swiss Central Bank has shown to be equally susceptible to inflating their currency, as recently prompted for by the Greece crisis, and like any nation operating on the central bank system, I am doubtful of the Franc-gold correlation “returning to the mean”.

This would depend entirely on monetary politics or how the Swiss Central Bank -government would respond to the unfolding events

The gap-closing trend by gold relative to the Franc, as indicated above, can be seen more clearly in this 3 year chart from stockcharts.com.

Bottom line: Since I am leery of central banking whom are prone or inclined to use their vaunted weapon (of money printing), I’d stick to gold.

Post Script:

The Philippine Peso seems no match to the Franc. (chart from Yahoo finance)

This just exhibits how relatively more inflationary the Peso (undergirded by obnoxious Philippine politics) has been.

No comments:

Post a Comment