Each time government attempts to control the markets they usually end up having the opposite effect from what has been intended.

In Argentina capital controls have been implemented to stem capital flight.

From the Washington Post, (bold emphasis mine)

Argentine President Cristina Fernandez has placed strict controls on the foreign-exchange market and forced oil, gas and mining companies to keep their export earnings in the country.

The moves are designed to shore up foreign-currency reserves and discourage citizens from sending their assets abroad. But they have set off alarm bells among her critics, prompting comparisons to the heavy-handed economic tactics of Venezuelan President Hugo Chavez.

The result of which has been to accelerate capital flight. From the same article (bold highlights mine)

Until last week, the peso was depreciating at a 7 percent yearly pace, according to Boris Segura, a Latin American analyst for Nomura Securities. The peso today trades at 4.26 to the dollar; a year ago, it traded at 3.9 to the dollar.

The decline has prompted an uptick in the number of Argentines seeking to exchange pesos for dollars.

To discourage such demand, the Fernandez government on Oct. 30 began requiring people seeking to exchange pesos for any foreign currency to enter their national identification numbers into a database to show they aren’t tax scofflaws.

The government also sent 4,400 tax agents to exchange houses across the country to implement the verification system.

Meanwhile, Mrs. Fernandez is trying to keep foreign currencies in the local exchange market by requiring oil, gas and mining companies to cash in their export sales at home. The country’s central bank estimates this will keep some $3 billion in U.S. dollars in the exchange market.

Bloomberg News reported Wednesday that, as Argentina has put limits on foreign exchange purchases, nervous investors are withdrawing their money in anticipation of further controls, and Argentine dollar deposits are heading toward their first annual decline in a decade. Dollar deposits have fallen by about $300 million since the Oct. 31 decree.

“In the past, these sorts of moves have been preludes to quite severe changes to the rules of the game, such as freezes and devaluations,” said Joseph S. Tulchin of Harvard University’s Center for Latin American Studies during a phone call from Cordoba, Argentina. “That’s why this has been setting off alarm bells.”

Argentina’s statist government has been feeling the impact of their profligacy (e.g. 4,400 tax agents), local investors are finding safe haven or diverting capital elsewhere.

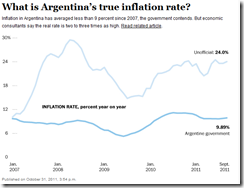

Basically, capital controls applied by the Argentine government is sister (corollary) to inflationist policies. This goes hand in hand with the censorship on reporting real inflation rates.

From another Washington Post article

Facing government sanctions, most continue to calculate their own inflation figures. But they do it quietly, their findings used mainly in private reports issued to clients, economists sanctioned by the government said in interviews.

“I feel that I am carrying out serious research and providing an alternative to the government pricing index, which is not credible,” said Bevacqua, a mathematician whose group, GB Consumer Price Index, is nonprofit.

For the first time since 2007 — when statisticians and field workers at the National Institute of Statistics and Censuses were replaced with political appointees and the official inflation rate started to fall — the once-hot-button issue of inflation in Argentina is fading from the front pages, said Victor Beker, director of the Center for Research on the New Economy at the University of Belgrano.

“What the government set out to do was to suppress alternative statistics,” Beker said. “The objective is to ensure that the consultancies stop publishing and that the official numbers become the only statistics.”

Bottom line, if the current political trends persist, Argentina, like their model Venezuela, will be hot candidates for another episode of hyperinflation, in the fullness of time.

No comments:

Post a Comment