The Economist writes,

Cross-border bank lending to Asia’s developing economies has been shrinking recently. European banks in particular have been retrenching as they seek to meet new capital targets. That may prompt many borrowers to turn instead to the capital markets--as they did during the last financial crisis. European bank lending to emerging Asia fell by over a fifth in the year to March 2009. In response, firms in these countries issued a flurry of bonds: over $240 billion in 2009, compared with $122 billion the year before. Asia's growing bond-markets may provide a useful "spare tire" in a region that still mostly bounces along on bank lending.

One would note from the above that declining cross border bank lending (mainly from Europe and the US) seem to impact AAA securities the most.

On the right window, since 2009 we can see a surge in BBB and BB and below rated securities. In my view, such lending dynamics seem consistent with the negative real rates environment. And my impression is that the recent decline in corporate bond activities may reverse soon, as negative real rates will likely reinvigorate lending activities. But the complexion of Asia's credit market will change.

I would further add that attributing Asia’s growing bond markets to a “spare tire” underappreciates the real dynamic.

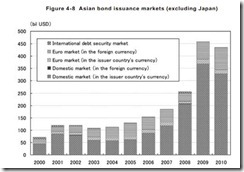

The following charts from Asian Development Bank

In reality, since 1997 Asia’s bond markets have been exploding. Although government securities remain dominant, corporate and financial institutions have been grabbing a bigger piece of the outstanding regional bond market pie.

To further add, the gist of the growth in the region’s bond issuance has been in the domestic markets (local currency). This means that (domestic) savings have increasingly been funneled into the local economy through corporate and financial bonds.

Despite the risk of a ballooning bubble, the good news is that Asia’s capital markets seem to be rapidly developing. The bond and equity markets will provide meaningful competition to the banking system in terms of intermediating savings into investments.

Yet if such an explosive growth trend will continue, Asia will eventually give Europe and the US the proverbial run for one’s money.

No comments:

Post a Comment