Current developments in the marketplace also suggest of the high tolerance of speculative activities or of greater risk appetite or where markets simply don’t buy earnings in the traditional sense.

Bloombery as Trendsetter

From Finance Asia[1],

Bloomberry Resorts has raised Ps8.84 billion ($209 million) from its first follow-on share issue since it listed through a reverse takeover late last year, after fixing the price just above the mid-point of the range.

The Philippine company, which is set to become the first licence holder to open an integrated casino resort in Manila’s new Entertainment City gaming hub early next year, attracted strong demand from international investors in particular and sources said the deal was multiple times covered throughout the price range. In fact, the subscription level and the quality of the book were deemed strong enough for the bookrunners to close the fully marketed deal two days early…

Bloomberry holds one of the four licences to build integrated tourism resorts in Entertainment City that were awarded in 2009, and started construction on its Solaire Manila project in July last year. Phase one, which will include 300 gaming tables, 1,200 slot machines, one 500-room hotel, seven specialty restaurants and a number of other food and beverage outlets, is scheduled to open in the first quarter of 2013.

In short, Bloombery [PSE: BLOOM] which has YET to generate cash flows has successfully raised Ps8.84 billion from local and global investors.

As of Friday’s close, BLOOM’s market capitalization surged to a surreal 87,343,301,226 which beat property giants Robinsons Land [PSE:RLC] 72,215,173,283 or SM Development Corp [PSE:SMDC] 59,757,133,523

So how was the company valued?

Again from Finance Asia,

At the final price, Bloomberry is valued at an enterprise value-to-Ebitda multiple of about 7 to 7.1 times, which puts it at a sizeable discount to all the Macau casino operators. However, even at the top of the range, the Philippine company was pitched only at an EV/Ebitda multiple of 7.8 times, which compares with a valuation range of 7.5 times to 10.4 times for the Macau players and explains why some investors were comfortable to pay the maximum price.

Ebitda or earnings before interest, tax, depreciation, and amortization[2]???

Ebitda has been the prominent financial metric used to value technology[3] companies during the height of the dot.com bubble.

This simply shows that many people hide behind numbers. Financial metrics, valid or not, have been used either as marketing instruments or as justification for buying actions.

In reality, the BLOOM case represents nothing more than a promise to build. The difference is that this promise has been backed by a prominent name, tycoon Enrique Razon.

Mr. Razon deftly capitalized on the bullish market sentiment through a “fast break play”: he bought Active Alliance at 3.3 per share[4] last February, backdoor listed BLOOM and sold part of the portion of his shares to the public at 7.5 per share for a whopping 127% gain in just THREE months!

Yet like the dot.com boom, I believe that BLOOM’s highly successful “pre-sellling” strategy (similar to pre-selling condo units) would set a trend for succeeding IPOs or secondary listings or follow on offerings.

We should not forget that the dot.com bubble was highlighted by an IPO boom[5]

Volume, Money Flows and Profit Taking

And of course, a continuing boom will likely to attract volume. The US Global Investor suggests that the recent improvements in trading volumes may attract foreigners.

The US Global Investor writes[6],

increasing trading volume in the Philippine stock exchange, explaining why the Philippine market has outperformed Asian peer’s year-to date and the last year. Morgan Stanley research shows $829 million new money has flowed into the Philippine stock market so far this year, encouraged by better macro economic indicators and strong corporate growth prospects.

Rising volumes signify effects rather than causes. The yield chasing phenomenon as consequence of easy money policies here and abroad has been driving the domestic markets and will continue to spur interest from foreigners.

As governments of developed economies continue to debase their currencies, discreet capital flight into asset markets and currencies of ASEAN economies and other emerging markets, may become an entrenched trend.

Second, what they refer to as new money could probably mean money from “new” investors. That’s because the popular concept of money “flows” in stock markets are fallacious[7].

For every peso of traded, this means that the peso exchanged from the buyer of a specific security goes to the seller of that security. So there are no money flows. Perhaps there are more “new” retail investors today as “old” investors take profits or go cash.

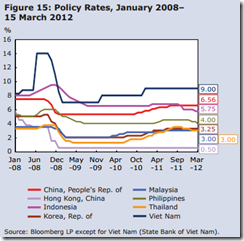

All that has been discussed above demonstrates growing symptoms of market’s response to bubble policies. Today’s record or near record lows in nominal interest rates[8] are policies designed to promote consumption (and speculation) via a negative real interest rate regime.

In a bubble cycle, systemic distortion of prices means that markets neither manifest earnings nor the real economic performance, but one of malinvestments and rampant speculations.

In predicting the continued rise of the Phisix in 2010 I wrote[9]

The point is inflationism creates an illusion of prosperity by inflating asset bubbles in domestic market such as in the Philippines or in the Asian region, which eventually would exact toll on the society. The normative outcome of any bubble bust would be high rate of unemployment, output and capital losses, political turmoil, aside from a lowered standard of living via more incidences of poverty.

That illusion is now being interpreted as real progress.

And as a final note, given the recent dramatic record run up, we should expect natural profit taking process to follow. And perhaps such profit taking will take cue from weakening commodity prices (CRB) and stock markets abroad led by the S&P 500 (SPX). This is likely to be a temporary event, or another episode where steroid propped financial market clamors to be fed with more steroids of inflationism.

Perhaps the weekend elections in the Eurozone could also spice things up.

[1] FinanceAsia.com Bloomberry re-IPO raises $209 million May 3, 2012

[2] Thismatter.com Enterprise Value

[3] Brennan Linda L. Social, Ethical and Policy Implications of Information Technology p.161 Google Books

[4] Philstar.com Razon-led Active Alliance hikes capital February 7, 2012

[5] Wiki Mises.org IPO Boom Dot-com bubble

[6] US Global Investors Do Emerging Markets Win, Place or Show in Your Portfolio? Investor Alert May 04, 2012

[7] See The Myth Of Money Flows Into The Stock Markets, April 5, 2009

[8] Asian Development Bank ASIA BOND MONITOR APRIL 2012 p.29

[9] See Why The Philippine Phisix Will Climb The Global Wall Of Worries June 7, 2010

No comments:

Post a Comment