The Bloomberg reports

The dollar is proving scarce, even after the Federal Reserve flooded the financial system with an extra $2.3 trillion, as the amount of the highest-quality assets available worldwide shrinks.

From last year’s low on July 27, the greenback has risen against all 16 of its major peers. Intercontinental Exchange Inc.’s Dollar Index surged 12 percent, higher now than when the Fed began creating dollars to buy bonds under its extraordinary stimulus measures at the end of 2008.

International investors and financial institutions that are required to own only the highest quality assets to meet investment guidelines or new regulations are finding fewer options beyond dollar-denominated assets. The U.S. is one of only five major economies with credit-default swaps on their debt trading at less than 100 basis points, meaning they are viewed as almost risk free. A year ago, eight Group-of-10 nations fit that category, data compiled by Bloomberg show.

“The pool of high-rated assets has been shrinking, not just in the euro zone but elsewhere as well,” Ian Stannard, Morgan Stanley’s head of Europe currency strategy, said in a May 22 telephone interview. “With the core of Europe shrinking, and the available assets for reserve purposes shrinking, it makes the euro zone less attractive.”

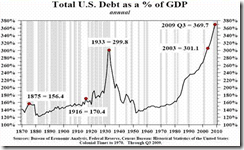

In a world where debt has been the elephant in the room, especially for major economies then it would be obvious that once there will be pressure on the claims to debts then this would mean an increased demand for the US dollar. This is because debts have been denominated in fiat currencies mostly on the US dollar. Some people may have forgotten that the world still operates on a US dollar standard.

For instance, intra-region bank run in the Eurozone will likely extrapolate to higher demand for the ex-euro currencies, mainly the US dollar

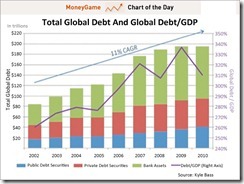

From Kyle Bass/Business Insider

This means that anxieties over a shrinking pool of “high-rated assets” has also been misguided, because much of these so-called high-rated assets revolve around the problems which we are seeing today: DEBT!!!

In short, what has been discerned by the mainstream as risk-free or safe assets epitomizes nothing short of a grand myth, founded on the belief that government edicts can defeat or are superior to the laws of economics.

Yet the US dollar has not been immune to debt, except that current instances reveal that the locus of market distresses have mainly been from ex-US dollar assets or economies, particularly the EU and China.

And since current predicament has been about debt deleveraging where central bankers have been fire fighting these with intensive money printing, then the pendulum of volatility swings from either asset deflation to asset inflation—or the boom bust cycles.

As one would note, gold has mostly moved in the opposite direction of the US dollar index. The euro has the largest weighting (about 58%) in the US dollar basket.

This simply debunks the flawed idea that gold is a deflation hedge under a paper currency system.

And as Professor Lawrence H. White aptly points out on an essay over monetary reforms,

We should not expect a spontaneous mass switchover to gold, or to Swiss francs, as long as dollar inflation remains low. The dollar has an incumbency advantage due to the network property of a monetary standard. The greater the number of people who are plugged into the dollar network, ready to buy or sell using dollars, the more useful using dollars is to you.

Where the US dollar continues to surge amidst staggering gold prices, then this only means central banking actions have been momentarily overwhelmed by apprehensions over debt mostly via political stalemates, whether in the EU or in China.

Yet we should not discount that central bankers to likely step on the inflation gas to save the current political institutions based on welfare-warfare state, central banking and the political clients—the banking sector.

Prices of commodities will now serve as crucial indicators as to the conditions of monetary inflation-debt deflation tug of war.

The Risk ON Risk OFF conditions may not last, we may morph into a stagflationary landscape.

No comments:

Post a Comment