What a celebration for the re-elected President.

From Bloomberg,

Stocks tumbled as Obama’s re-election set up a showdown with the Republican-controlled House over the budget, with the so-called fiscal cliff of more than $600 billion in tax increases and spending cuts slated to start in January unless Congress acts before then.The Standard & Poor’s 500 Index (SPX) lost the most since June, tumbling 2.4 percent to close at 1,394.53. The retreat wiped out roughly $370 billion in market value from U.S. equities, according to data compiled by Bloomberg.

Don’t worry, for the Obama apologists the US Federal Reserve will ride to the rescue.

A day ago, Federal Reserve Bank of San Francisco President John Williams said that he expected the revitalized asset purchasing program or QE 30 (forever) to reach $600 billion into next year.

After yesterday’s elections, the ante seems to have been upped, where many expects the Fed’s program to exceed $1 trillion (I have been saying that both the FED and the ECB will be buying over $2 trillion)

From the same Bloomberg article,

A fiscal boost to the economy is probably off the table as President Barack Obama negotiates tax increases and spending cuts with leaders of a Democratic-controlled Senate and a House of Representatives led by Republicans, Edelstein said. That may leave only the Fed in the position of trying to boost the economy, and its third round of quantitative easing may extend through next year and climb past $1 trillion, said economists at JPMorgan Chase & Co. and Pierpont Securities LLC.

Supposedly political gridlock is there to blame, but this is simply a smokescreen for what in reality has been President Obama’s anti-business policies, which have only increased the risk profile and the cost of doing business and which will be reflected on higher hurdle rate for investors and entrepreneurs.

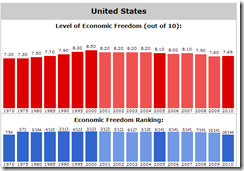

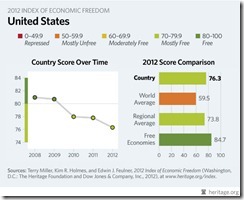

Economic freedom in the US has been on a marked decline.

From Fraser Institute: US ranking fell to 18th in 2010

From Heritage Foundation: US fell to 10th place in the 2012 index

The distinguished Professor and author Thomas Sowell elaborates,

The media misconception today is that what we need to speed up economic recovery is to end gridlock in Washington and have bipartisan intervention in the economy. However plausible that may sound, it is contradicted repeatedly by history.Unemployment was never in double digits in any of the twelve months following the stock-market crash of 1929. Only after politicians started intervening did unemployment reach double digits — and it stayed there throughout the rest of the 1930s.There is nothing mysterious about an economy’s recovering on its own. Employers usually have incentives to employ and workers have incentives to look for jobs. Lenders have incentives to lend and borrowers have incentives to borrow — if politicians do not create needless complications and uncertainties.The Obama administration is in its glory creating complications and uncertainties for business, ranging from runaway regulations to the unknowable future costs of Obamacare and taxes. Record amounts of idle cash held by businesses and financial institutions are a monument to the counterproductive effects of Barack Obama’s anti-business policies and rhetoric. That idle money could create lots of jobs — net jobs — if politics did not make it risky to invest.

So President Obama’s increasing reliance on the FED (most likely on Bernanke) will only lead to more volatile markets.

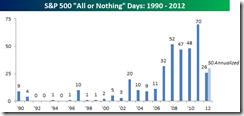

And volatile days have been a common feature since 2007.

The Bespoke Invest notes of the increasing “All or Nothing days” or advance decline breadth index “where the net daily A/D reading in the S&P 500 exceeds plus or minus 400”.

In other words, since the FED began intervening in the markets, stock market movements either floated or sank in tides. Such tidal motion is a symptom of the monetary policy influenced inflation (boom)-deflation (bust) volatilities.

Finally, Sovereign Man’s Simon Black succinctly illuminates on what to expect from the extension of Obama’s presidency

One point that I absolutely must make is this– after December 31st,- Income tax rates are going up- Capital gains rates are going up- Rates on dividends are going up- Estate and gift tax exclusions are going down. Dramatically.

Eventually the US government will run out of savings or wealth generators to tax and a crisis will emerge. And the US will default on its obligations.

Perhaps the markets has signaled what the great libertarian H. L Mencken wrote [A Little Book in C major (1916); later published in A Mencken Crestomathy (1949)].

Democracy is the theory that the common people know what they want, and deserve to get it good and hard.

No comments:

Post a Comment