Rental markets appear to be the next phase of the broadening property inspired boom sponsored by the US Federal Reserve

The Wall Street Journal reports

Apartment landlords continued to impose hefty rent increases as 2012 drew to a close, although there are some early indications they could be losing their leverage with tenants.The average nationwide monthly apartment rent was $1,048 in the fourth quarter, up 0.6% from the third quarter and up 3.8% from a year earlier, according to a report set to be released Tuesday by real-estate research firm Reis Inc. The year-over-year increase was the largest since 2007 and a sign that landlords still have the upper hand they regained in 2010.The nation's apartment vacancy rate, which has declined since hitting 8%in the aftermath of the financial crisis, fell to 4.5% from 4.7% in the third quarter. The rate is the lowest since 2001's third quarter.

Despite the team Bernanke's aggressive policies, US Consumer Price inflation (CPI) rates have been modest…until now.

Chart from Tradingeconomics.com

This is not to suggest of the absence of inflation, but rather that given today’s financialization (dominance of the financial industry over the real economy), most of the flows from central bank’s monetary inflation has been absorbed by the asset markets, which has brought about boom bust cycles, in spite of the moderate CPI figures.

The other factor is that much of the money created have stashed by the banking system with the US Federal Reserve

chart from St. Louis Federal Reserve

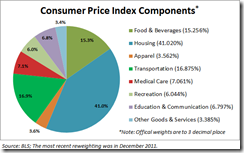

But all these may change soon. Rising rental prices will likely spillover to the US CPI basket considering that housing represents the largest share.

Chart from Doug Short’s Advisor Perspectives

As the US Bureau of Labor Statistics notes

Shelter, the service that housing units provide their occupants, is a major part of the CPI market basket—the goods and services that people need for day-to-day living. Two CPI indexes, Owners’ equivalent rent of primary residence (OER) and Rent of primary residence (Rent), measure the change in the shelter cost consumers receive from their primary residences.Housing units are not in the CPI market basket. Like most other economic series, the CPI views housing units as capital (or investment) goods and not as consumption items. Spending to purchase and improve houses and other housing units is investment and not consumption. Shelter, the service the housing units provide, is the relevant consumption item for the CPI. The cost of shelter for renteroccupied housing is rent. For an owner-occupied unit, the cost of shelter is the implicit rent that owner occupants would have to pay if they were renting their homes.

In other words, if the US CPI index will begin to register higher CPI because of higher rents, then both Fed policies and the current environment of low interest rates may be jeopardized. This is assuming the constancy of the current methodology (or is premised on the assumption that US government won't change the way the CPI has been calculated)

US 10 year treasuries (TNX) appear to be signaling this.

Bernanke's FED seems boxed into a corner.

No comments:

Post a Comment