Back to my JGB-Japan debt crisis watch.

The actions today of both JGBs and the Nikkei can be described as intense rollercoaster rides.

Though, the JGBs have been more benign.

The intraday trend of the JGB 10 and 30 year yields surged during the early part of the session but traded vastly lower as the day matured.

The lukewarm reception to today’s 30-year auction supposedly served as the impetus for today’s across the yield curve JGB rebound.

From Reuters:

Japanese government bond prices gained on Thursday as bargain-hunting emerged after some anxiety over how a 30-year bond auction would fare and as Tokyo stocks buckled, dropping to a two-month low…JGBs also extended gains on relief that the results of a 600 billion yen ($6 billion), 30-year JGB auction, turned out to be tepid, but was not as disastrous as some had feared.

The report doesn’t say if the BoJ participated in today’s JGB auction by the Ministry of Finance or of the role played by the BoJ in lifting the JGB market.

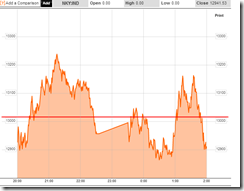

Yet while JGBs rallied, Japan’s equity benchmark, the Nikkei swung wildly between steep gains to sharp loses several times in the session as shown by the intraday chart.

The bears finally ruled as the Nikkei closed “modestly” lower compared to the scale of recent “crashes”.

Today’s loss brings the Nikkei near the technical definition of a bear market: the 20% loss threshold.

From another Reuters report:

The Nikkei dropped 0.9 percent to 12,904.02, its lowest close since April 5. Trading was volatile with the index rising as high as 13,238.53 earlier.Should the Nikkei fall to 12,754, or down 20 percent from the 5-1/2 year high reached on May 23, it will have entered a bear market.

Bifurcating signals from the JGBs and the Nikkei exhibits the continuing high risk environment.

No comments:

Post a Comment