The US statistical GDP has undergone major methodological revisions. The likely effect will be to temporarily 'boost' the economy.

The Zero Hedge quotes Bloomberg's Joseph Brusuelas on the changes made by the Bureau of Economic Analysis (BEA)

Changes to the national income and product accounts data will be released at the same time as the second quarter estimate of gross domestic product. The revisions go back to 1929 and include the current business cycle. They will probably show a deeper recession and modest increases in the level of growth in the current cycle that may add as much as 3 percent to the level of GDP.While growth may look more impressive, the growth path and rate of overall economic activity in recent years isn’t likely to change.Policy ImplicationsHigher GDP may support those on the Fed pushing to start tapering. While the numbers are likely to shift noticeably, the change won’t merit a surprise announcement of tapering later today.With increased data on receipts, expenditures and cash flow with respect to pensions, regulators and investors should have a better sense of what public entities have severely underfunded pensions programs. Investors should expect the potential crisis in the U.S. public pension system to play a greater role in the national economic narrative given the recent municipal bankruptcy in Detroit that includes $11.9 billion in unsecured obligations to lenders and retirees.The biggest methodological change will be the reclassification of Research and Development Expenditures as well as Intellectual Property – entertainment, literary, and artistic originals. Where previously treated as an expense, these areas will now be categorized as investments and included in the measure of GDP.

The other highlights from the revision, according to the Wall Street Journal economic blog will include:

-Dating back to 1929, the U.S. economy grew at a 3.3% annual pace, which is one-tenth of a percentage point higher than previously published estimates. From 2002 to 2012, the growth rate was 1.8%, up from a previously reported 1.6% pace.-Intellectual property, which includes research and development, entertainment and the arts, and software, grew by 13% in 1997 from the prior year, as the Internet bubble began. But by 2001 growth had slowed and only rose 0.5% from a year earlier. By 2012, the categories’ contributions to overall growth were negligible.-The BEA also tweaked how it calculates pension contributions. The agency will now consider compensation to reflect the value of the pension promises made by the employer, rather than the employer’s cash contributions to the pension fund. The new method better reflects the retirement benefits a worker earns while working and is consistent with business accounting standards, BEA said. As a result, the personal savings rate averaged 4.7%, an upward revision of one percentage point, for the period between 2002 and 2012.-In 2012, the economy expanded at a 2.8% pace versus a previous estimate of 2.2%. But that performance was wildly uneven over the course of the year, with a strong 3.7% annualized pace in the first quarter after a big upward revision, followed by two middling quarters and finally an abysmal 0.1% growth rate in the final quarter of the year. In current dollar figures the revisions added nearly $560 billion to the overall figure 2012 GDP figure of $16.2 trillion.-The great recession was less severe than previously thought, with the economy shrinking at an average annual pace of 2.9%, revised from a 3.2% contraction. The recession stretched, officially, from December 2007 through June 2009, according to the National Bureau of Economic Research, which determines the widely accepted benchmarks for U.S. business cycles.-The current recovery, while revised to show stronger growth, is still the weakest since World War II. The economy expanded at an average 2.3% annual pace between the second quarter of 2009 and the fourth quarter of 2012, compared with a previously published 2.1% pace.

The US GDP reportedly grew at a rate better than the expected during the 2nd quarter, according to Time.com

But accounting changes may have played a big part in it.

The Zero Hedge notes

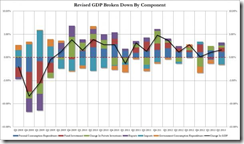

Think the pick up in Q2 GDP was due to the desired increase in end consumption? Think again. Following the full data revision, Personal Consumption as a component of GDP dropped from 1.54% in Q1 to 1.22% in Q2, offset however by an increase in fixed investment which rose from -0.23% to 0.93%. In fact, aside for Q3 and Q4 of last year, Personal consumption in the just completed quarter was the lowest goin back to Q2 2011 when PCE was 1.03%.

That's why I'd be leery of statistics since governments may manipulate them to suit their ends.

No comments:

Post a Comment