Has rising markets really reduced risks in the economy?

I see the mainstream, including so called experts and industry people, use their emotions or talk their interests rather than assess risks objectively or be candid to their constituencies. They generally talk of a risk free world even as the markets undergo bouts of excessive volatility.

I have noted earlier how San Miguel Corporation’s business model has radically been altered into a virtual debt financed hedge fund, which arbitrages on industries that have been heavily politicized or regulated[1],

San Miguel’s new business model allows political outsiders to get into these economic concessions through Mr. Ang’s political intermediations which it legitimately conducts via “asset trading”. SMC’s competitive moat, thus, has been in the political connections sphere.

I came across San Miguel’s cash flow statements and was surprised by a cash flow statement discovery.

A post Keynesian economist Hyman Minsky introduced what he calls as Ponzi finance[2].

For Ponzi units, the cash flows from operations are not sufficient to fulfill either the repayment of principle or the interest due on outstanding debts by their cash flows from operations. Such units can sell assets or borrow. Borrowing to pay interest or selling assets to pay interest (and even dividends) on common stock lowers the equity of a unit, even as it increases liabilities and the prior commitment of future incomes. A unit that Ponzi finances lowers the margin of safety that it offers the holders of its debts.

When any entity with insufficient funds from operations borrows money and or sells assets to finance existing liabilities, such is called Ponzi financing.

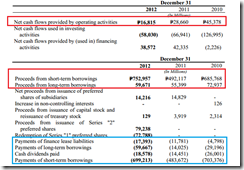

As of the 1st semester of 2012[3], San Miguel’s generated 10.8 billion pesos excess cash from operations (upper red rectangle).

The company used 53.73 billion pesos to acquire new assets. The company paid for existing liabilities of short term 440.443 billion pesos, long term 60.043 billion pesos and finance lease liabilities 9.414 billion pesos. Total payments to these (short, long term and finance lease) liabilities amounted to 509.9 billion pesos (lower red rectangle).

The company also paid dividends of 9.363 billion pesos to controlling and non-controlling shareholders (green rectangle).

So given the inadequate 10.8 billion of free cash from operations, how did SMC go about paying off the massive 509.9 billion pesos debt? By borrowing money. SMC raised 539.975 billion pesos in short term and long term borrowings.

Cash from SMC operations has not been sufficient to pay for existing principal and interest on debt. It has resorted to borrowing money to pay for existing debt as well as sales of assets, e.g. Meralco. The company also uses borrowed money to pay for dividends and acquisitions. San Miguel’s operations seem to fit Minsky’s definition of Ponzi finance.

And this has not just been a 2013 dynamic, SMC’s recourse of borrowing to pay for existing debt has been the new model since 2010, based on the 2012 annual report[4] (p 36-37).

In the August 2013 Investor’s Briefing presentation[5] the company disclosed interest bearing debt of 424.5 billion pesos and noted that net debt to 12-month rolling ebitda (earnings before interest, taxes, depreciation and amortization) at 3.64x and total assets at 1,129.6 billion.

But net debt to EBITDA or earnings or other data seems really meaningless because as shown above SMC’s financing operation has been primarily debt IN and debt OUT.

And one would wonder how much of those 1.129 trillion pesos assets have been attached as lien to creditors and how much of these assets have been priced under the current inflationary boom environment.

In other words, supposedly huge assets may mask a firm’s vulnerability from overexposure to debt.

Yet according to the SMC’s June report, interest rate breakdown for peso denominated local liabilities “range from 1.9% to 4.2% and 0.5% to 4.3% as of June 30, 2013 and December 31, 2012, respectively. Meanwhile for foreign denominated liabilities “discount rates used for foreign currency-denominated loans range from 0.3% to 2.5% and 0.2% to 0.8% as of June 30, 2013 and December 31, 2012, respectively.”[6]

This implies how SMC has been heavily dependent on central banking FED-BSP subsidies.

60.66% of San Miguel’s long term liabilities (p 15) have been denominated in foreign currency. This means a substantial segment of SMC’s loan portfolio have been exposed to currency risk.

Also 46.17% of SMC long term debt has been in floating rates which means the company has material exposure to interest rate risk.

SMC's huge loan portfolio by itself seems vulnerable to credit risk where any loss of confidence from existing creditors may trigger refusal to rollover debt or deny the company access to new debt that may lead to a credit event.

I am talking about risk here and am not forecasting for this to occur.

Yet both SMC’s currency and interest rate variables depends on a Risk ON environment (strong peso, low interest rates, sustained inflation of asset prices) from which a sustained radical change in any one of the 3 factors can lead to increased risk of a credit event.

And proof of such vulnerability has been the 10.2 billion pesos loss incurred during the first semester reportedly due to foreign exchange losses[7]. My suspicion is that the May-June meltdown has mostly been responsible for this.

SMC has not disclosed the breakdown of the Finance lease liabilities which accounts for the other big portion of the 400+ billion loans. This seems a red flag.

What appears to be a Ponzi financing scheme embraced by SMC indeed “lowers the equity of a unit” and likewise “lowers the margin of safety that it offers the holders of its debts” as noted by Mr. Minsky.

While San Miguel looks like a fragile company highly sensitive to changing conditions, what matters for me is the risk of a contagion; particularly the companies, banks and entities whom are creditors to SMC’s 400+ billion loans.

While 400+ billion pesos seems like a drop in a bucket in a system flushed presently with 5.7 trillion pesos of liquidity, the domino effect from a potential SMC credit event may in a snap of finger—the bang moment—turn abundance into scarcity.

And it has also been wonder how the domestic market continues to aggressively bid up on listed banking and financial firms as if the system’s loan portfolio will remain immaculate given the massive accumulation of systemic debt, as SMC conditions reveal, and on what also seems as an underlying assumption that prices of securities are bound to rise forever.

Sure markets may continue to rise, but should there be more fragile firms like SMC out there, and once conditions change to drastically impair their financial conditions, rising markets may extrapolate to a bigger fall.

[1] See Phisix: The Myth of the Consumer ‘Dream’ Economy July 20, 2013

[2] Hyman P. Minsky The Financial Instability Hypothesis The Jerome Levy Economics Institute of Bard College

[3] San Miguel Corporation Quarterly report (SEC 17-Q) for the period June 30, 2013

[4] San Miguel Corporation Annual Report 2012

[5] San Miguel Corporation Investor’s Briefing of San Miguel Group August 12, 2013

[6] San Miguel Corporation June report 2013 p. 32

Long-term Debt, Finance Lease Liabilities and Other Noncurrent Liabilities. The fair value of interest-bearing fixed-rate loans is based on the discounted value of expected future cash flows using the applicable market rates for similar types of instruments as of reporting date. Discount rates used for Philippine peso-denominated loans range from 1.9% to 4.2% and 0.5% to 4.3% as of June 30, 2013 and December 31, 2012, respectively. The discount rates used for foreign currency-denominated loans range from 0.3% to 2.5% and 0.2% to 0.8% as of June 30, 2013 and December 31, 2012, respectively. The carrying amounts of floating rate loans with quarterly interest rate repricing approximate their fair values. P.30

[7] Manila Standard SMC registers P10.2-b loss August 13, 2013

No comments:

Post a Comment