A short note on the government shutdown, debt ceiling and Obamacare issue which for me has been nothing more than histrionics

Officials of the US treasury[1] and the IMF[2] warns that should there be no increase in the debt ceiling there will crippling effects on economy and financial markets.

While such threats may turn out to be true, it hasn’t been for now

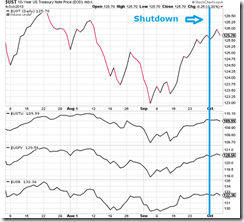

Figure 10 US Treasury in the face of the US Government Shutdown

I believe that the bond markets in combination with other markets will determine if such threats are for real.

If there will be a threat of default then markets will be selling bonds first. So far this hasn’t been the case, as US treasury prices (falling yields) has rallied across the curve. Prices of 10 year notes, 2 year (USTU), 5 year (USFV) and 30 year (USB) has mostly rallied from the government shutdown.

Again if the threat of default is real, then we should expect a reversal from the above. Prices fall yields rise. And because political uncertainty will haunt the bond markets this is likely to spillover to the equity markets. So bonds and stocks are likely to drop as US credit default swaps and volatility indices soar. We will see a risk OFF phase if this becomes a reality.

And so with the US dollar to remain pressured as investors are likely to scamper for alternative foreign currency reserve alternatives. I believe that gold will remain mixed until a resolution on this matter occurs.

But unless we see the above scenario, all the politicking amounts to stoking fear as a conventional ploy of the politics of control. In the moving words of the great libertarian H. L. Mencken[3]

Civilization, in fact, grows more and more maudlin and hysterical; especially under democracy it tends to degenerate into a mere combat of crazes; the whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, most of them imaginary. Wars are no longer waged by the will of superior men, capable of judging dispassionately and intelligently the causes behind them and the effects flowing out of them. They are now begun by first throwing a mob into a panic; they are ended only when it has spent its ferine fury. Here the effect of civilization has been to reduce the noblest of the arts, once the repository of an exalted etiquette and the chosen avocation of the very best men of the race, to the level of a riot of peasants.

[1] Marketwatch.com Treasury warns of dire consequences of default October 3,2013

[2] BBC.co.uk IMF head warns US debt crisis threatens world economy October 3,2013

[3] H. L. Mencken 13. Women and the Emotions IN DEFENSE OF WOMEN gutenburg.org

No comments:

Post a Comment