Rising stock markets and PMI surveys has mainly been used as basis by the consensus to posit for a so-called European economy recovery which I have been a big skeptic of.

In questioning the mainstream premises, I pointed to several evidences.

Just how will a recovery occur when countries like France have been strangulating commerce with exorbitant taxes? In Greece, economic stagnation has prompted for a call for coup by army reservists. Also Europe’s car sales plunged in August.

Sanguine PMI surveys departed with bleak actual industrial output in July. Industrial production based on the chart from Eurostat turned lower as of August while September output has deteriorated further.

Importantly why would the ECB cut rates if the recovery has been for real?

Well it appears that, as I suspected, the Eurozone’s statistical recovery has been gasping for dear air.

From Bloomberg

The euro area’s recovery came close to a halt in the third quarter as German growth slowed, France’s economy unexpectedly shrank and Italy extended its record-long recession.Gross domestic product in the 17-nation euro area rose 0.1 percent in the three months through September, cooling from a 0.3 percent expansion in the second quarter, the European Union’s statistics office in Luxembourg said today. That’s in line with the median forecast in a Bloomberg News survey of 41 economists. Growth in Germany, the region’s largest economy, eased to 0.3 percent from 0.7 percent.The slowdown comes as the currency bloc struggles with the legacy of a debt crisis now in its fifth year and just after it emerged from its longest-ever recession in the second quarter. Unemployment (UMRTEMU) stands at a record 12.2 percent and inflation slowed to the lowest level in four years in October, leading the European Central Bank to cut its benchmark rate to a record low last week.

I would call this growth dynamic, in stock market lingo, a fading dead cat's bounce.

Nevertheless for the Eurozone’s stock market speculators it’s been a “don’t worry, be happy” ambiance as the German Dax hit fresh landmark highs, while the French CAC and the Eurozone Stoxx 50 has passed 2010 highs.

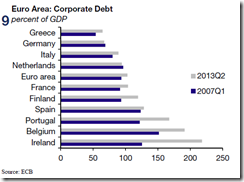

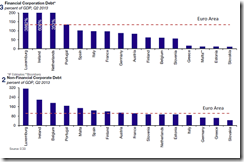

And as the Eurozone’s stock markets swiftly race forward, corporate debt in both financial and nonfinancial sector has similarly been ballooning.

Media will continue to spin the Eurozone’s parallel universe with fables

No comments:

Post a Comment