For the fourth consecutive day China’s stocks has tumbled significantly.

The Shanghai index, down by 2.04% today, posted the least degree of losses, relative to other national equity benchmarks.

The bulk of today's losses occurred during the near end of the session.

The successive 4 day retrenchment essentially wipes out about three quarters of the January-February’s gains accumulated in a span of about a month. Such has been signs of what I call “volatility in both directions with a downside bias” signifying how fear has greater amplitude than greed.

Recent equity market declines including that of today have been imputed to “speculation a weaker property market and falling yuan will curb corporate earnings”

Reports further say that the Chinese government via the PBOC has been 'guiding' the yuan lower according to both Wall Street Journal and the Bloomberg. Part of this guidance may have been executed via a reported draining of liquidity

This from Forextv.com

The People's Bank of China drained more cash from the banking system on Tuesday as rates continued to suggest that borrowers are having no trouble accessing liquidity.The bank drained CNY100 billion via 14-day repos, following on from last week's net removal of CNY108 billion. The PBOC's CNY48 billion drain last Tuesday was the first in eight months and appeared to be in response to January's record CNY2.58 trillion in credit creation.

The claim that borrowers are “having no trouble accessing liquidity” looks supported or confirmed by the collapsing 7 day repo rates and material drops in short term (overnight to one month) Shibor rates.

[As a side note, it seems strange to see the 7 day repo rates fall to pre-June turmoil levels when other indicators have not been consistent with these as shown below]

But concerns over credit issues seems little changed, when seen from the Shibor rates of 6 months and up which remains high.

In addition, yields of 10 year Chinese treasuries has still been adrift at near recent highs

The same concerns can be seen in 5 year CDS spreads, where despite the recent pullback seem to be ascending again.

So while PBoC action may have mollified the liquidity predicament of the credit markets, these seem as temporary.

Yet the US dollar rallied strongly against the yuan today…

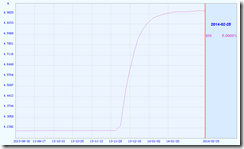

The USD-Chinese yuan has spiked during the last two weeks.

So I am doubtful of the claims that current developments has entirely been a PBoC engineered decline in the yuan that subsequently is being reflected on the stock markets.

Last December, holdings of US Treasuries by Chinese entities, largely official and partly non-official, posted “the biggest one-month drop in two years” according to the CNN.

But since Chinese forex reserves swelled to a record $3.82 trillion last December it looks as if that these entities held on to the US dollar cash proceeds from the UST sales. Incidentally over the same period, the Chinese selling of USTs has coincided with yields of 10 year US notes climbing to the 3% level.

But what if the same entities, with particular emphasis to the government, continues to sell USTs, but instead of holding to US dollar cash proceeds, sold these to the markets? If so, then such actions will be revealed as declines in her record forex reserves for January and also these should effectively extrapolate into 'tightening'.

But where it gets interesting is, could it be that US dollars being supplied to the Chinese financial markets have been used to fund outflows?

In other words, I suspect that the drastic fall in stocks and the yuan and elevated concerns over credit risks may have been prompting for an 'unseen' incipient “capital flight”, where such activities could have been camouflaged by the PBoC’s reported draining.

And if my suspicion has validity, then it won’t be far fetched that such growing episodes of minor tremors could serve as prelude to a major eruption or the Black Swan event.

No comments:

Post a Comment