Popular wisdom holds that a weak currency translates to export growth.

Let us see how this has worked out in Japan after MORE than a year since the implementation of PM Shinzo Abe's eponymous Abenomics or bold policies consisting of “three arrows” of doubling of the monetary base, fiscal stimulus and economic growth “strategies”.

This is a sequel to my first post last November.

From the Wall Street Journal:

Japan's run of monthly trade deficits reached the two-year mark in June as exports fell while imports increased, reinforcing the view that the deficits are here to stay for the once powerful exporter nation.The continuing weakness of exports has raised concern among policy makers as they could hamper Prime Minister Shinzo Abe's efforts to stamp out 15 years of deflation. Mr. Abe's administration and the Bank of Japan had taken the view that a weaker yen would spur export growth, but the gains so far have been smaller than expected, tempering hopes that sales overseas would help power the economy.Symbolizing Japan's export woes is a 6.8% on-year fall in auto exports to the U.S., following May's 18% plunge. The decline came despite robust demand for new vehicles in the U.S. and a stellar showing among Japanese brands there. The fact this isn't reflected in the auto export figures illustrates the impact of moves by Japanese auto makers to produce in local markets rather than export from Japan—a trend seen throughout Japan's manufacturing sector.

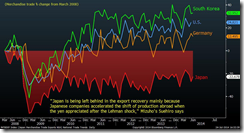

Again after more than a year of ABENOMICS, what can be seen has been a short term 9 month y-o-y based boost in export growth followed by the opposite—8 months of slowing trend, underpinned by two successive months of slump (chart from Zero Hedge)

It would signify a mistake to attribute global economic picture to her underperformance because her developed market contemporaries has been outperforming.

As the Bloomberg explains: The CHART OF THE DAY shows the value of Japan’s exports is 23 percent below a March 2008 peak, even as those of South Korea, the U.S. and Germany have grown. The yen has lost 16 percent in value against the dollar since Prime Minister Shinzo Abe took office in December 2012. That hasn’t been enough to spur growth in outbound shipments.

The Yen’s devaluation can be seen from Bloomberg’s 3 year USD JPY chart

And falling exports relative to imports has led to sustained trade deficits for Japan…

…from the same WSJ article: (chart above from tradingeconomics.com)

Japan's merchandise trade deficit came to ¥822.2 billion ($8.1 billion) in June, the finance ministry data released on Thursday showed. That compared with a ¥684.7 billion deficit expected by economists surveyed by The Wall Street Journal and the Nikkei.While the size of the monthly shortfall in trade was slightly smaller than in preceding months, when it hovered around ¥1 trillion, few policy makers expect the trade balance to turn around soon, given the weak global economy, the eroding competitiveness of Japan-based production facilities, and greater reliance on imported fossil fuels following the March 2011 nuclear accident in Fukushima.

Why has these been so?

First because of price distortions engendered by inflationism disrupts economic calculation. As I recently wrote (bold original), It’s a wonder how the Japanese economy can function normally when the government destabilizes money and consequently the pricing system, and equally undermines the economic calculation or the business climate with massive interventions

Secondly, whatever supposed temporary advantages brought about by devaluation will be offset by price inflation.

Austrian economist Patrick Barron explains:

Monetary debasement does NOT result in an economic recovery, because no nation can force another to pay for its recovery. Monetary debasement transfers wealth within an economy by subsidizing exports at the expense of the entire economy, but this effect is delayed as the new money works it way from first receivers of the new money to later receivers. The BOJ gives more yen to buyers using dollars, euros, and other currencies, as the article states, but this is nothing more than a gift to foreigners that is funneled through exporters. Because exporters are the first receivers of the new money, they buy resources at existing prices and make large profits. As you state, exporters have seen a surge in their share prices, but this is exactly what one should expect when government taxes all to give to the few. Eventually the monetary debasement raises all costs and this initial benefit to exporters vanishes. Then the country is left with a depleted capital base and a higher price level. What a great policy!

Of course, political redistribution of resources leads to misallocation of resources, this can be seen via a stock market bubble.

At the end of the day, the beneficiaries of arbitrary policies are the politicians and their cronies, which comes at the expense of the general public

No comments:

Post a Comment