The fabulous guys at Gavekal at today's blog post “China Slowing is Evident Everywhere Except GDP” shows how China’s GDP has been egregiously inconsistent with other economic activities.

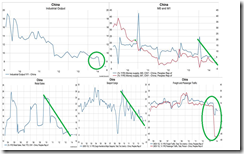

While loans continue to bulge (upper left window), (consumer and producer) inflation rates have topped out (upper right window). The likely rational for this is “debt in debt out”. Current borrowings, instead of financing expansion, are being made to offset earlier acquired liabilities.

China’s record reserve assets seems to have peaked.

FDI’s have markedly slowed to reflect on diminishing investments.

The slowdown in inflation rates can be seen by the decline in money supply growth rates (upper right window) which reinforces the Debt IN Debt OUT dynamic.

From the production (industrial) to consumption (retail) and even to transports (seaport cargo and freight and passenger traffic), the numbers converge to suggests of a meaningful slowdown in China’s economic activities in contrast to the headline growth numbers..

But like the Philippines, statistical G-R-O-W-T-H for the Chinese government has many important political implications, e.g. forestall financial instability, social unrest, justify supposed anti-corruption activities (really a purge of the political opposition) et.al.

And G-R-O-W-T-H should justify rising stocks to give the impression that “all is well” in the overleveraged plagued Chinese political economy.

"All is well" really means stealth QE, as well as, managing stock market activities by intervening in the IPO market.

All these have really been designed to buy time.

Nonetheless China’s Shanghai Composite remains one of the few national bellwethers unscathed by the current return of Risk OFF

No comments:

Post a Comment