To my valued email subscribers, only a max of 3 blog post a day is sent to you. I posted 5 today so the other 2 won’t get reflected on your mailbox. Nonetheless here they are

Back to the regular programming.

The Wall Street Journal reports

The economy grew at a solid pace during the third quarter, driven by an uptick in military spending and a drop in imports, showing the U.S. on relatively firm footing as worries mount about a global slowdown.Gross domestic product, the broadest measure of goods and services produced across the economy, expanded at a 3.5% annual rate from July through September, the Commerce Department said Thursday.The quarter showed broad-based improvement in the U.S. economy. Business investment grew steadily. Exports showed resilience against a backdrop of slowing global growth. Government outlays, which had dragged on growth for four years, enjoyed a large boost from military spending alongside a brightening budget picture in cities and states.

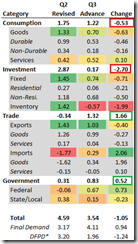

The table above from Bespoke invest exhibits the breakdown of the US GDP.

Notably there has been a broad based weakening of investments aside from signs of slack from consumers despite record stock markets.

What has really perked the advanced estimated 3Q numbers has been trade and government.

Additionally the marginal growth in imports, consumption slack and negative inventories hardly suggests of buoyant domestic activities.

And if to reckon from the frame of Fixed Investments (FI) and consumer consumption (PCE), Alhambra Partner’s Jeffrey Snider at the David Stockman’s Contra Corner has equally been unimpressed.

In the latest quarter, PCE and FI accounted for only 1.96% growth, for an average of just 2.0% in 2014. Over those same three quarters, GDP has averaged just 2.34% meaning that the more volatile swings, especially from Q1 to Q2, have largely been meaningless. What is left is an economic foundation stuck somewhere between recession and growth, but never achieving fully either one or the other (yet).

This leaves exports as the bright spot. But with China-Europe-Japan and emerging markets struggling, it is doubtful for international trade to remain robust. Add to this the economic sanctions on Russia.

Aside from trade, defense spending has been the other major booster for US 3Q GDP.

According to Marketwatch.com (bold mine)

The 16% spike in defense spending was driven mainly by higher outlays on services to support military members instead of purchases of tanks, fighter jets and ships.Outlays on services jumped nearly 17%, with most of the gains coming in a trio of categories known as personnel, weapons and installation support. The military also spent a bit more on ammo, missiles and oil.Spending on major weapons actually fell slightly.Although the third-quarter increase was unusually large, defense spending is notoriously volatile and often lumpy. And spending on military services appears to have a pronounced tendency to increase sharply in the July-to-September period.Sometimes a big increase is merely catchup after several quarters of weak outlays. Military outlays, for instance, rose a meager 0.9% rate in the second quarter after falling by a 4% rate in the first quarter and dropping 11.4% in the 2013 fourth quarter.

So thanks to the war against ISIS US 3Q GDP growth has been ‘growing at a solid pace’. This also implies that the bureaucracy and military contractors had been the major beneficiaries of the supposed 'solid pace' of 3Q growth as most the economy struggled (add to this of course Wall Street).

But of course, government spending whose resources used or consumed comes at the expense of the productive agents of the economy either through coercive transfer and or through opportunity costs…means that the supposed ‘solid pace’ of statistical G-R-O-W-T-H won’t be sustainable if the private sector won’t pick up.

US 3Q GDP like the Philippine 2Q GDP are wonderful examples of the variances between statistical G-R-O-W-T-H and real economic growth (by real I mean private sector growth excluding government).

No comments:

Post a Comment