More evidences of the tightening embrace by the Chinese government of “I recognize the addiction problem but a withdrawal syndrome would even be more cataclysmic” where existing debt problems will be solved by more encouraging acquisition of more debt!

The PBOC has reportedly signaled easing restrictions on banking system’s deposit requirements to encourage more credit activities.

China's central bank is allowing banks to lend more out of their deposits as the world's second-largest economy struggles to gain momentum, according to banking officials with knowledge of the matter.At a closed-door meeting on Wednesday, officials at the People's Bank of China told representatives from two dozen banks and other financial firms that the central bank will soon relax a major restraint on banks' abilities to make loans, according to the banking officials. The move would essentially allow them to include more money in their deposit base, giving them more room to lend…Analysts estimate the move is roughly equivalent to injecting 1.5 trillion yuan--or about $242 billion--into the banking system. PBOC officials didn't respond to requests for comment.

Unlike her counterparts who attempt to project transparency in policy communication, the PBOC has undertaken monetary stimulus via the stealth measures

From Bloomberg: (bold mine)

Contrary to the Federal Reserve’s forward guidance, the Bank of England’s increased transparency and a Group of 20 Nations vow to clearly communicate policies, China has added liquidity by stealth at least four times in the past four months. One proxy it has been using is China Development BankCorp., the nation’s biggest policy lender.Balancing the need to buoy an economy set for its slowest full-year expansion since 1990 and efforts to contain a debt pile that’s almost doubled in six years, China’s leaders have sought a targeted monetary path that’s deviating from advanced economy peers. Problem is, by keeping in the shadows, speculators have jumped in, pushing the stock market up over 20 percent since the PBOC’s benchmark interest rate cut on Nov. 21 in anticipation of more monetary easing…The PBOC will lower the benchmark one-year lending rate by 25 basis points to 5.35 percent in the first quarter and by another 15 basis points by the end of June, according to economists surveyed by Bloomberg from Dec. 18-23. The central bank may cut banks’ required reserve ratio by a total of 1 percentage point in the first half, the survey found.The PBOC rolled over at least part of a 500 billion yuan ($80 billion) three-month lending facility to the largest Chinese lenders last week, days after it injected 400 billion yuan via CDB, according to people familiar with the steps. Neither move, nor an offer of short-term liquidity to banks, has been officially announced.

Targeted easing means choosing winners and losers for monetary largesse by the PBOC.

And as I have been saying here stock markets have been about liquidity and credit that fuels fragile (false) confidence. The prospects of more easing compounded by the government’s IPO management has incited an orgy of speculation.

From the wall Street Journal:

Chinese stocks rose Thursday on the news of corporate-finance deregulation in otherwise quiet Asian trading as the end of the year nears.Shanghai Composite Index rose 3.4% to 3072.54, driven by financial stocks, following the announcement by China’s State Council Wednesday that it would scrap geographic restrictions for Chinese companies and commercial banks issuing yuan bonds abroad. The council also said it would make it easier for companies to offer shares, conduct mergers and acquisitions, and open branches overseas.

It could be possible that the PBOC has been channeling those loans to stock market, indirectly (bank loans to brokerages?)

Yet all these latest "easing" measures has done the opposite, it has raised interest rates based on 7 days repo moving averages.

Media has blamed this on demand for IPOs and stock market activities, but as previously explained for every security transaction represents a buyer and a seller. Money passes only from the buyer to the seller, so there should be no liquidity pressures.

Yet record high of margin trades last December 22nd of 670.6 billion yuan hardly has been indicative of liquidity strains at the stock market.

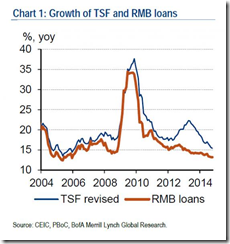

The credit crunch has been in the real economy where China’s flow of credit has been diminishing.

I believe that the stock market serves as a convenient camouflage for the monetary tightening occurring in the real economy emanating from deepening signs of debt deflation.

So like governments almost everywhere, where stock markets have been used as policy communications tools to conceal real economic problems, to buy time from a violent market clearing adjustments and to promote a spurious G-R-O-W-T-H model based on the trickle down from the “wealth effect”, the PBOC desperately pins her hope based policies that stock market boom will do the wonders of exorcising her debt woes.

No comments:

Post a Comment