Stock markets must rise forever. That’s what stock market operators wanted to demonstrate…

…and so the almost regular routine of “managing” of the index.

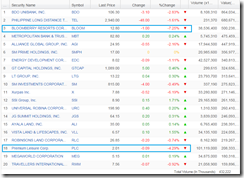

Tuesday (left) and Wednesday’s (right) sessions reveal of marking the close again.

Tuesday headed towards an almost neutral close but operators decided to bring the Phisix nearer to the all time highs.

Wednesday had the Phisix on a steady intraday decline only to be offset by the same underhanded tactic.

Breadth for those days had been negative: On Tuesday declining issues led advancing issues by 91-83 and on Wednesday the spread widened decidedly in favor of declining issues 105-68

In other words, during the last two days the Phisix wanted to correct, but operators would have none of it. The show, for them, must go on.

Operators also seem to have an innovative approach to ensure that project Phisix 7,400 would be met: They would do the push the index gradually with the aim of attaining 7,400 incrementally or to bring 7,400 within a striking distance for a major move to ensure a decisive breakthrough.

Well it appears that such plans have been foiled again (for now). But this won’t stop them from trying.

The Phisix posted a

hefty . 83% decline today…apparently by the same methods operators used to

administer project Phisix 7,400. Sellers poured the brunt of the

liquidation during the session’s end (charts from technistock)

In short, the markets, which had been wanting to profit take, prevailed.

And it’s odd that in groping for an explanation, media and their favorite experts jumped the gun on Typhoon Ruby as responsible for today’s action

The idea is that the coming Typhoon might cause devastation as to hamper G-R-O-W-T-H, thereby affecting stocks.

Didn't G-R-O-W-T-H just turned lower in 3Q even without a Typhoon? Then why does the Phisix continue to rise? What's the relationship between G-R-O-W-T-H and stock pricing?

Yet claims that Typhoons move stocks have been proven as unfounded.

While there had been knee jerk reactions, market’s typical response have been based on the dominant trend.

As I wrote before: This means that natural disasters have mostly been a non-event, especially today when stock price movement have become highly sensitive to central bank policies.

In short, when markets have been trending upwards, typhoons hardly pose an obstacle!

And based on mainstream logic, given that the property sector closed in the positive, then the property sector may even benefit from the typhoon!

Among the major issues, BDO (+2.83%) and PLDT (+1.61%) led the decline.

If we apply mainstream’s logic then bank rivals Metrobank which closed positive ( +.24) and BPI which was unchanged today means that maybe BDO only will be materially affected by the Typhoon!

Meanwhile, since PLDT rival Globe Telecoms was also .46% up today this possibly entails that Typhoon Ruby will hurt PLDT to the benefit of Globe!

That’s mainstream logic for you, supposedly expert opinion based on available bias and post hoc assertions.

But here is the most interesting part: casino operators Bloomberry, PLC and Melco Crown dived 7.55%, 4.29% and 2.39% respectively (the former two I emphasized with light blue rectangles that had been among the most traded issues today).

Such crash has also been because of Typhoon Ruby? Melco’s City of Dream have reportedly been slated to have a soft opening on December 14, that would be a few days past the Typhoon.

Yet I offer a different explanation…

Foreigners stampeded out of casino stocks. Why? Because foreigners sense that since Macau’s casino stocks had been smashed yesterday there is a risk of contagion!

Yet such contagion will serve as the mainstream's black swan.

No comments:

Post a Comment