Last night, European crude benchmark Brent resumed its hemorrhage and was down 1.96% while the US counterpart the WTIC bounced .18%

And the incredible stampede out of GCC stock markets continues…

(table from ASMAinfo.com)

Last night too, Saudi’s Tadawul and Dubai Financial crashed by another 7.27%. Qatar, Muscat and the Kuwait slumped by 3.51%, 2.92% and 2.08% respectively. All these adds to Sunday December 15th crash!

Once record high stocks is being dismantled at an astounding speed and stupefying rate of decline. The obverse side of every mania is a crash.

Oh by the way, Western banks have reportedly cut cash flows to Russian banks, as the Zero Hedge noted “FX brokers advised clients that any existing Ruble positions would be forcibly closed out because "western banks have stopped pricing USDRUB", over concerns of Russian capital controls.”

The article further quotes the Wall Street Journal "global banks are curtailing the flow of cash to Russian entities, a response to the ruble’s sharpest selloff since the 1998 financial crisis."

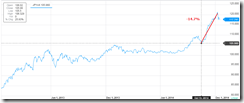

So along with plummeting oil prices and economic sanctions, the liquidity squeeze exacerbates the stunning run on Russian financial instruments. At the rate of the evolving Russian financial market turmoil, the odds of a default has been soaring as revealed by the skyrocketing CDS or the cost to insure debt as shown in the chart above.

“Curtailing the flow of cash” reveals how global liquidity is being drained. If risk assets are about liquidity, credit and confidence that the latter two generates, then the shriveling liquidity flows poses as increased structural headwinds on risk assets. If sustained then asset inflation will turn into asset deflation.

My final note

Last November, Japan export growth year on year has underperformed consensus expectations despite the crashing yen.

The USD-Yen has been up by 14.7% since the BoJ GPIF bailout of the stockmarket

Export growth fell by 4.9% and has been in a decline since November.

This is another evidence which debunks the popular mercantilist “weak currency-strong export” myth peddled by the consensus.

Also Japan’s import growth has collapsed again. It has CONTRACTED by 1.7% over the same period. The slump in imports reflects the demand conditions in the Japanese economy.

This represents the "wonders" of Abenomics--doing the same thing over and over again and expecting different results.

Additionally, Japan's imports are someone else’s exports. Japan represents the largest export market for the Philippines as of 2013. Contracting imports means marginal growth or even zero or reduced exports for the Philippines to Japan!

As I noted last weekend,

...one nation’s imports signify as some other nation’s exports. As noted above, Chinese import growth contracted in November (y-o-y), Germany’s import growth rate also CONTRACTED 3.1% month on month in October. For the Philippine bulls who sees virtually no risks, but all glory from credit fueled levitated assets, how will collapsing Chinese and German demand for imports, affect domestic exports? Do they know? In 2013, exports to China ranked third of Philippine exports with 12.4% share and Germany ranked sixth with a 4.1% share. Signs are already here, Philippine export growth rate collapsed to 2.9% in October from the stellar over 10% growth rate during the past four months, specifically 15.7% in September, 10.5% in August, 12.4% in July and 21.3% in June. Add these to the collapsing markets of the GCC, which places OFW remittances at risk. So where will demand come from? Domestic demand has already been constrained by credit overdose as revealed by investments on a downtrend, and by growth in credit and statistical economy that has been moving in opposite directions, and by consumers harassed by BSP’s invisible redistribution favoring the political and economic elites. So where will Philippine statistical growth come from? Statistical massaging? Or manna from heaven?

The world economy has been deteriorating, liquidity has been shrinking, yet domestic bulls are expecting G-R-O-W-T-H!

Pride goes before destruction, a haughty spirit before a fall (Proverbs 16:18)

Said differently, a fool and his money are soon parted.

No comments:

Post a Comment