From a recent study by McKinsey Quarterly : Debt and (Not Much) Leveraging

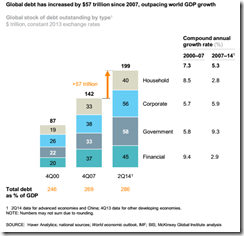

McKinsey summary: Since 2007, global debt has grown by $57 trillion, raising the ratio of debt to GDP by 17 percentage points.* Developing economies account for roughly half of the growth, and in many cases this reflects healthy financial deepening. In advanced economies, government debt has soared and private-sector deleveraging has been limited.

My comment: As for developing economies: has this been about financial deepening or about boom bust cycles?

McKinsey summary: Fueled by real estate and shadow banking, China’s total debt has quadrupled, rising from $7 trillion in 2007 to $28 trillion by mid-2014. At 282 percent of GDP, China’s debt as a share of GDP, while manageable, is larger than that of the United States or Germany.* Several factors are worrisome: half of loans are linked directly or indirectly to China’s real estate market, unregulated shadow banking accounts for nearly half of new lending, and the debt of many local governments is likely unsustainable.

My comment: How "manageable" is manageable? Comparing China's capacity with US or Germany signifies a contrast effect--depends on what is being compared. To give you an idea, per capita GDP (IMF measures 2013) of China has been estimated at $11,868 while the US and Germany has $53,001 and $43,475 respectively. If we use this in the prism of looking at the debt levels, then the US and Germany has more capability to manage debt than China has been. Again contrast effect.

Nonetheless the critical issue has been how nations today have become addicted to debt. And debt is no free lunch.

Nonetheless the critical issue has been how nations today have become addicted to debt. And debt is no free lunch.

No comments:

Post a Comment